Singapore Telecommunications Ltd - Bharti shines in earnings and dividends

14 Nov 2022

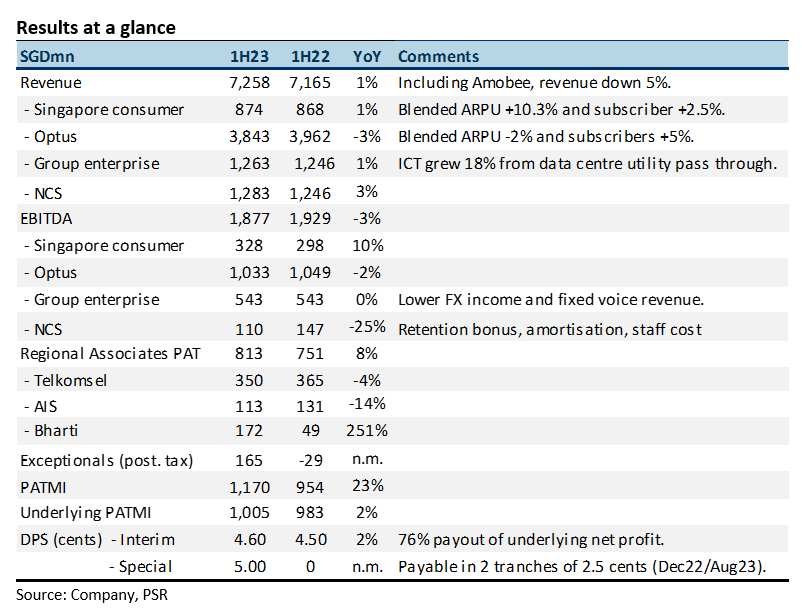

- 1H23 results were within expectations. Revenue and EBITDA were 48%/46% of our FY23e estimates. A special dividend of 5 cents was announced following the S$2.2bn proceeds from sale of Bharti stake.

- Underlying earnings rose 2% to S$1bn supported by an 8% growth in associate earnings to S$813mn led by a turnaround in Bharti. There was a large drag in earnings from NCS with EBIT down 49% to S$53mn.

- We maintain our FY23e forecast largely intact. Our ACCUMULATE and SOTP TP of $3.05 is unchanged. Singtel is transitioning to longer-term growth drivers such as data centres and IT services. Near-term earnings growth will be driven by a rebound in mobile ARPUs in India, Singapore and other associates from roaming and improving economic conditions.

The Positives

+ Strength in Singapore consumer. Singapore consumer grew EBITDA 10% YoY to S328mn. Mobile enjoyed EBITDA expansion from a 12.6% YoY rise in ARPU as roaming revenue returned with borders re-opening. Roaming is around 60% of pre-pandemic levels. Penetration of roaming has risen as compared to using SIM cards of destination countries. Revenue was impacted by a 21% decline in pay TV to S$74mn due to the cessation of EPL.

+ Turnaround in Bharti is still underway. Bharti earnings spiked more than 3-fold to S$172mn. Improvement in earnings came from the 24% YoY increase in ARPU to Rp190 (S$3.2) and 9% YoY rise in 4G mobile customers to 210.3mn.

The Negatives

– Still a work in progress for NCS. EBITDA for NCS declined 26% YoY to S$110mn. Part of the weakness was from post-acquisition charges in Australia such as staff retention and earnouts and overall higher staffing cost.

– Losses in GXS Digital bank. The digital bank associate registered a S$27mn loss in 1H23. Expectations are for break even in 2025 rather than 2027. From a banker to everyone strategy, GXS will pivot to selected segment. Loans will be targeted to mobile devices and niche small medium enterprises. The advantage of GXS is the lower customer acquisition cost by embedding GXS into Grab and Singtel apps plus tapping on both customer bases.

– Provisions in Optus. There were two provisions made on Optus – (i) goodwill impairment of S$1bn from higher WACC, lower Australian dollar and weaker economic outlook assumptions; (ii) A$140mn provision for the cyber attack based on independent review, credit monitoring services for impacted customers and replacement of customer documents. It does not include potential class action (no notification so far) and penalties from pending investigations.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU