Singapore Airlines - Restoration of capacity by competing carriers

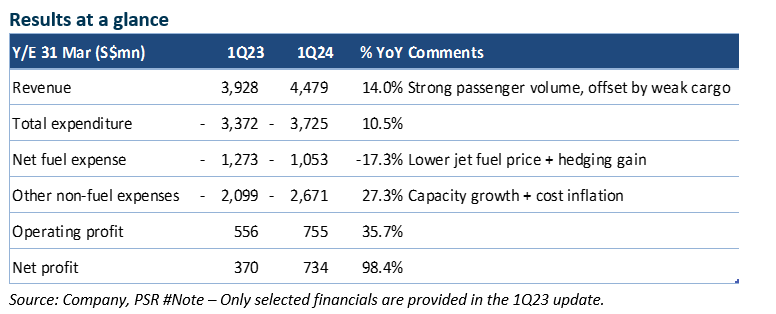

31 Jul 2023- 1Q24 net profit accounts for 42% of our FY24e estimate. We maintain our estimates as we expect yields and loads to fall in the coming quarters with more carriers restoring capacity aggressively.

- Strong passenger load (+49% YoY) driven by seasonal peak demand and re-opening in key Asian markets offset weaker cargo volume (-11.3% YoY). Other tailwinds include lower jet fuel price (-17% YoY), higher interest income (+S$144mn) and higher associates’ contributions (+S$80.9mn). We expect these tailwinds to fade.

- We maintain a REDUCE recommendation and TP of S$6.80, based on 1.1x price to book for FY24e. This is in line with historical P/B of 1.1x.

The Positives

+ Record quarter driven by high passenger load. Revenue gained 14.0% YoY, driven by strong passenger load (+49.0% YoY) that outpaced the decline in cargo loads (-11.3%). A very high passenger load factor (88.9%) sustained revenue per available seat-km (RASK) at 9.6 cents (+3.2%). Passenger yield dipped 7.7% to 10.8 cents/pkm as demand growth skewed towards low-cost carrier Scoot and lower-yielding routes.

+ A big tailwind is the lower jet fuel price (-29.6% YoY). Net fuel expense fell 17.2% in spite of the higher capacity for passenger (+32.4%) and cargo (+12.1%). It also enjoyed fuel hedging gain of S$101mn, which is not expected to recur.

+ Higher share of profits from associates of S$80.9mn. Vistara turned in a profit, due to forex gain of S$60mn. The merger with Air India could be concluded by March/April 2024 if it clears anti-trust scrutiny.

The Negative

– Cargo is a major drag. Cargo load factor fell 13.7ppt to 51.8%, negatively impacted by capacity increase (+12.1%) and weaker loads (-11.3%). Cargo yields fell 44.3% to 44.6 cents/load ton-km, but is still 50% higher than pre-Covid’s 29.7 cents/load ton-km. Besides weak global manufacturing output, air freight is losing share to lower-cost sea freight, where rates have returned to pre-pandemic level.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

May 13th - Things to Know Before the Opening Bell

May 13th - Things to Know Before the Opening Bell BRC Asia Ltd - Bountiful five years ahead

BRC Asia Ltd - Bountiful five years ahead Memiontec Holdings Ltd. - Fully integrated water infrastructure provider

Memiontec Holdings Ltd. - Fully integrated water infrastructure provider Oversea-Chinese Banking Corp Ltd - Non-interest income the growth driver

Oversea-Chinese Banking Corp Ltd - Non-interest income the growth driver