Singapore Airlines - Stock Analyst Research

| Target Price* | SGD 5.91 |

| Recommendation | REDUCE› REDUCE |

| Market Cap* | - |

| Publication Date | 22 Feb 2024 |

*At the time of publication

Singapore Airlines - Costs escalate, yields under pressure

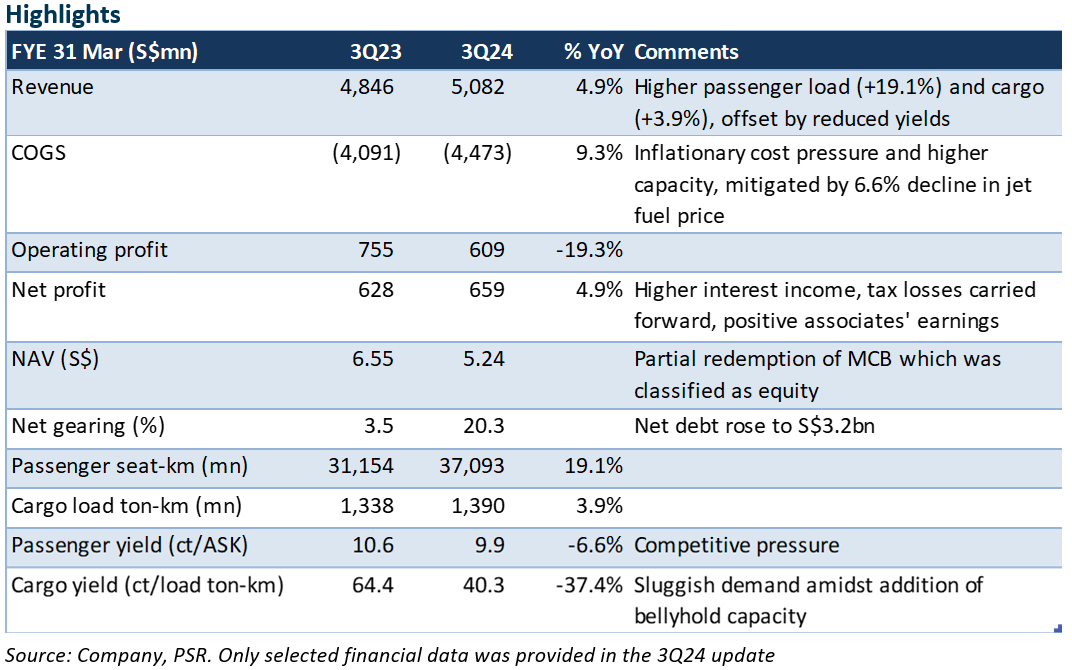

- 3Q24 operating profit fell 19.3% YoY to S$609mn, as yield decline and inflationary cost pressure (+9.3%) offset strong passenger traffic (+19.1%) and cargo load (+3.9%). Net profit was lifted (+4.9%) by positive contributions from associates, and other one-offs including higher interest income, gains from aircraft sale and carried forward tax losses.

- 9M24 net profit of S$2.1bn is above our FY24e forecast. We raise our FY24e net profit by 10.5%, as passenger load factors are coming in above our earlier assumptions. However, 4Q24e is expected to fall YoY and QoQ with mounting pressure on yields and costs.

- We maintain a REDUCE recommendation, and raise our TP to S$5.91 (prev. S$5.45) at 1x FY25e P/B, as we roll over to the new FY. This factors in a projected 31% decline in net profit for FY25e.

The Negatives

– Revenue grew slower than volume. The surge in passenger (pax) volume (+19.1% YoY) and cargo (+3.9%) was offset by lower pax yields (-6.6%) and cargo (-37.4%) due to competition. Both pax yields (9.9 cents) and cargo yield (40.3 cents) are 20% and 32% above pre-pandemic level, respectively, held up by still high load factors. If pax load factor decline in subsequent quarters, pax yield, as measured by revenue per available seat-km (RASK) could likely fall at a faster rate.

– Cost escalated. This is despite a 6.6% decline in jet fuel prices. Besides bigger capacity, cost increase was led by higher passenger cost such as inflight meals, ground handling charges and staff costs. Management expects further increase as more supply contracts are being renewed.

– Operating profit fell 19.3%. Scoot’s operating profit fell 70.5% YoY in 3Q24, after a 44.8% YoY gain in 1H24. 3Q24 load factor of 90.5% was just 1.6% point above breakeven. Operating profit at the full-service carrier fell 9.4%, hurt by lower cargo revenue.

– Net profit gain of 4.9% was due to several one-offs. Besides positive contributions from associates, net profit benefitted from several one-offs, including tax losses carried forward, the surplus on disposal of aircraft, and higher interest income, amounting to about S$155mn.

– Net debt rose to S$3.2bn (Mar 23: net cash S$5.2bn) after a partial redemption of MCBs. Net gearing was 0.2x. Book value as of the end of Dec 23 was S$5.24 per share (Mar23: S$6.68).

The Positive

– Nil

Outlook

Yields are expected to fall further as airfares continue to normalize. Airlines are expected to lower fares to fill seats as travel demand eases. On the other hand, costs are expected to rise with more flight restorations and more new airlines launching services.

Maintain REDUCE and raise TP to S$5.91, from S$5.45 previously, which is based on 1x FY25e book value, as we roll over to a new FY. We have raised our FY24e net profit estimates by 10.5% as passenger load factors are coming in above our earlier assumptions.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU