17LIVE GROUP - Stock Analyst Research

| Target Price* | 2.30 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 8 Apr 2024 |

*At the time of publication

17LIVE Group Limited - Back to growth mode

- We expect earnings growth in FY24e to be driven by a jump in virtual liver streamers, expansion in live commerce revenue and aggressive streamlining of R&D and other expenses. Monthly Active Users (MAU) will begin its recovery with a growth rate of around 10% in FY24e from new content offerings in SE Asia, product enhancements and reinvestment into marketing.

- With a net cash balance of US$102.7mn as of Dec23, inorganic growth via acquisitions can add more steamers with their accompanying users onto the platform. This network effect will further elevate the appeal of the platform to other streamers and users.

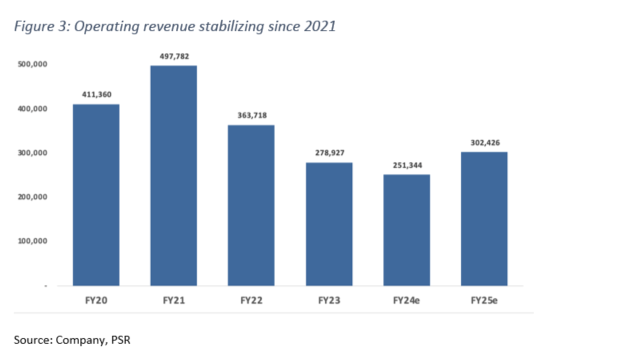

- We initiate coverage on 17LIVE with a BUY recommendation and DCF-backed TP of S$2.30 (WACC: 14.1%, g:1%). 17LIVE is further monetising its core user base and streamlining operating expenses. After declining for three years, we expect revenue to stabilize this year, and return to full-year growth in FY25e. The major drivers will be new content, live commerce sales and subscriptions, further cost reductions and inorganic growth.

Company Background

17Live Group Limited is a live streaming platform which listed on SGX on 8 Dec23 following the acquisition by Vertex Technology Acquisition Corp. Established in 2015, 17LIVE Inc (17LIVE) is a pure-play live-streaming platform with its main markets in Japan (68% revenue) and Taiwan (25%). Revenue is generated from the sale of virtual gifts and value-added services in real liver live streaming, virtual liver live (V-Liver) streaming, live commerce and audio live streaming. Its content base is wide, encompassing a range of genres including music, games, education, fashion, art, chatting and more. 17LIVE live streaming is optimized for higher engagement with users compared with other platforms (e.g. TikTok, YouTube). The streaming time or content is longer, greater interaction with users and smaller communities are formed to build deeper connections.

Investment Highlights

- Organic growth. We anticipate growth drivers in FY24e to come from its live commerce (OrderPally and HandsUp), V-Liver revenue and expansion into SEA and the US. Live commerce revenue is projected to grow by c.40% in FY24e, building on the success of gross merchandise value (GMV) growth in Taiwan (FY23: +80%YoY). Supporting GMV is the increased cross-border demand for Japanese products and a greater focus on user generated content. V-Liver growth is enjoying increased popularity and a jump in content supported by an automated virtual skin creation process. The core live streaming business’ MAU is to return to growth of c.10% from improving user retention, streamers training to provide better content and experience and new marketing initiatives.

- Inorganic growth potential. Acquisition of streamers in the US, Japan and SEA, is a strategy to onboard more MAU. From enlarging the user base and its high paying ratio of the 17LIVE platform, we believe acquisitions will be accretive.

- Margin expansion and cost optimization. Gross margins have improved from 34.7% in FY22 to 41.2% in FY23. 17LIVE has increased its focus on higher-margin businesses such as live commerce and in-app games. 17LIVE is actively enhancing its in-app ecosystem and updating operating contracts, aiming for a 10% gross margin improvement in Taiwan this year. Cost efficiency and streamlining cross-border virtual-coin purchasing are expected to boost margins further. 17LIVE is also halving R&D costs without compromising user experiences to offset higher marketing in FY24e.

Phillip Securities Research has received monetary compensation for the production of the report from the entity mentioned in the report.

Revenue and Business Model

The largest revenue segment for 17LIVE comes from the sale of virtual gifts. Revenue is recognized when streamers receive the gifts and virtual coins, which expire after one year after purchase. The monetization process begins as viewers purchase virtual gifts for their favourite streamers during live streams. Streamers can then return these virtual gifts to the platform for their salary initiating a revenue-sharing model based on a prearranged ratio.

The second segment pertains to interactive video streaming companies that generate revenue by selling user subscription plans. These plans provide users with exclusive content and privileges in exchange for a recurring fee.

In the third segment, platforms can effectively leverage their reach by offering digital advertising space to brands that match their target audience, thereby creating opportunities for targeted marketing.

The fourth source of revenue is live commerce revenue, allowing people to purchase goods. The business operates on a C2C SaaS (Software as a service) business model, where 17LIVE charges subscription fees and a percentage of GMV. Streamers can utilize the technology and facilities provided by 17LIVE to stream on any platform. Moving forward, the group aims to enhance profitability by implementing fees across all aspects of the supply chain, including logistics and payments.

The latest contributor to revenue is in-app games where customers purchase in-game virtual items to help them progress in their games. There is also a live version of game competitions where users can buy in-app items such as weapons and equipment to support the streamers.

17LIVE not only has the traditional streamers. In Sept23, the Group acquired nighty-six V-Liver IPs. Concurrently, the Group launched a dedicated division named NexuStella to oversee the management of the V-Liver business and IPs.

In FY23, revenue reached US$278.9mn (-23.3% YoY) due to declining monthly active users and average spending per user. Revenue contribution from Liver live streaming declined from 97% in FY22 to 95% in FY23. The V-Liver streaming and e-commerce industry are the growth catalyst for 17LIVE as e-commerce revenue surged by 80% YoY in FY23.

Japan is 17LIVE’s largest market and accounted for 68.2% of the total revenue in FY23. Taiwan is a more saturated market with intense competition and currently generates 25.3% of the revenue (Figure 5). Despite the effort to expand into SEA, we expect the revenue contribution to be marginal (less than 4%) in FY24. We anticipate a stable revenue mix in recent years due to the market leadership in Taiwan and Japan.

About the author

Phillip Research Team

About the author

Trade of the Day - Aztech Global Ltd (SGX: 8AZ)

Trade of the Day - Aztech Global Ltd (SGX: 8AZ) Trade of the Day - Singapore Exchange Ltd (SGX: S68)

Trade of the Day - Singapore Exchange Ltd (SGX: S68) Wells Fargo & Company - NII decline hurt earnings

Wells Fargo & Company - NII decline hurt earnings Bank of America Corporation - Earnings hurt by NII and FICC

Bank of America Corporation - Earnings hurt by NII and FICC