Microsoft Corporation - Stock Analyst Research

| Target Price* | 465.00 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 30 Apr 2024 |

*At the time of publication

Microsoft Corp - Azure strength fuels revenue growth

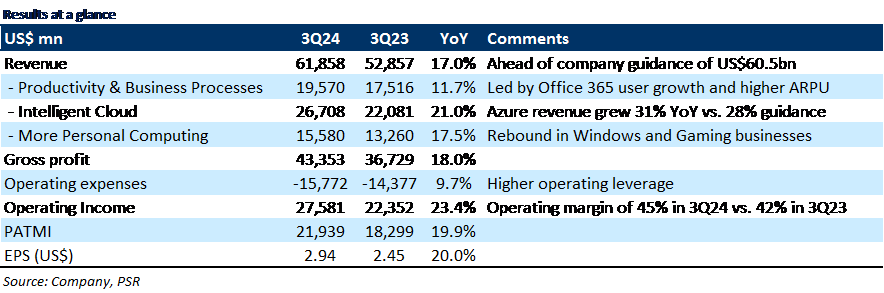

- 9M24 revenue/PATMI was in line with expectations at 74%/77% of our FY24e forecasts. 3Q24 revenue growth of 17% YoY was supported by strength in cloud computing business Azure. PATMI rose by 20% YoY to US$21.9bn due to higher operating leverage.

- For 4Q24e, Microsoft expects total revenue to grow by 14% YoY to US$64bn fueled by Azure revenue growth of 31% YoY and Office 365 Commercial revenue growth of 14% YoY. Microsoft’s implied operating margin for 4Q24e is ~42%.

- We maintain ACCUMULATE recommendation but raise our DCF target price to US$465.00 (prev. US$450.00), with an unchanged WACC of 7.2% and terminal growth rate of 4.5%. Our FY24e revenue estimates remain unchanged, while we increased our PATMI by 2% to account for lower expenses. We believe that the growing demand for large AI models could help attract customers to Microsoft’s Azure platform for storage and computing solutions.

The Positives

+ Azure revenue growth accelerates. In 3Q24, Intelligent Cloud segment revenue grew 21% YoY to US$26.7bn led by strength in cloud services. Azure revenue grew 31% YoY, beating the company’s guidance of 28% YoY growth. The significant growth was primarily driven by an increase in the size and duration of the deals as customers migrated workloads (e.g., SAP/Oracle) from on-premises to the cloud. Management noted accelerating demand for its Azure AI services, which contributed 7% points to Azure growth (vs. 6% in 2Q24). Azure AI services help enterprises create their own generative AI solutions, including the development of chatbots, summarization, and writing documents.

+ Windows and Gaming continued to rebound. In 3Q24, More Personal Computing segment revenue grew 18% YoY to US$15.6bn, 3% above the top end of company guidance. Notably, Windows OEM revenue grew by 11% YoY, beating the company’s guidance that it would be relatively flat. The growth was mainly driven by a recovery in the PC market and a shift to developed markets. Meanwhile, Gaming segment revenue grew by 51% YoY to US$5.5bn as the integration of Activision Blizzard titles like Call of Duty into Xbox Gamepass drove higher player engagement.

+ Improvement in margins. In 3Q24, the operating margin expanded by 300bps YoY to 45% despite elevated AI-related CAPEX, beating the company’s guidance of 43%. The margin improvement was mainly due to top-line upside, higher operating leverage from prudent headcount control (down 1% YoY), and lower sales-related costs. CAPEX jumped 66% YoY to US$11bn due to cloud and AI infrastructure build-out.

The Negatives

– Nil

Sea Ltd. - Growth Supported by Spending

Sea Ltd. - Growth Supported by Spending Singapore REITs Monthly: April24 - Pricing in higher-for-longer interest rates

Singapore REITs Monthly: April24 - Pricing in higher-for-longer interest rates May 17th - Things to Know Before the Opening Bell

May 17th - Things to Know Before the Opening Bell Trade of the Day - Boeing Co. (NYSE: BA)

Trade of the Day - Boeing Co. (NYSE: BA)