Microsoft Corp - Azure growth re-accelerates

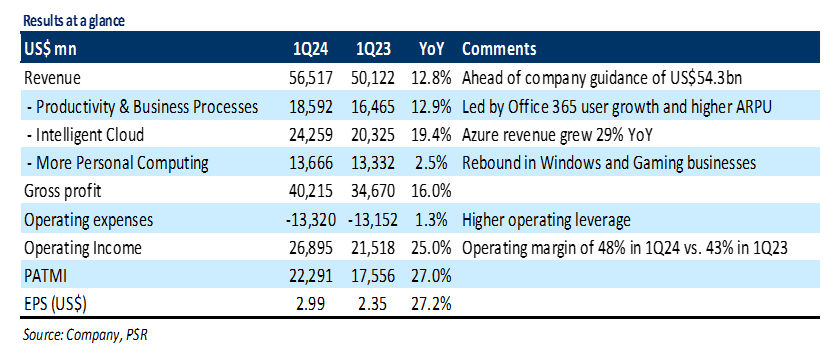

27 Oct 2023- 1Q24 revenue/PATMI was in line with expectation at 24%/26% of our FY24e forecasts. Total revenue grew 13% YoY as Azure growth re-accelerated to 29% YoY. PATMI rose by 27% YoY due to higher operating leverage.

- For 2Q24e, Microsoft expects total revenue to grow 15% YoY to US$60.9bn driven by corporate cloud-computing demand and increase in gaming revenue. Management reiterated its expectation of flat operating margins for FY24e (~42%) despite absorbing Activision Blizzard. Office 365 Copilot AI tools (US$30 per user per month) to commercially launch on Nov. 1.

- We maintain ACCUMULATE recommendation and nudge our DCF target price to US$375.00 (prev. US$372.00) using a WACC of 7.2% and terminal growth rate of 4%. Our FY24e revenue/PATMI is increased by 2%/0.4% to account for Activision acquisition and continuation of AI tailwinds. Microsoft is well-positioned to benefit from shifting workloads to the cloud, demand for its AI-enabled products, and cybersecurity upgrades.

The Positives

+ Azure revenue growth re-accelerates. Microsoft showed signs of recovery in its cloud-computing unit, with Azure revenue expanding 29% YoY. The growth came ahead of the company’s guidance of 26% YoY growth as more enterprises move to the cloud and growing contributions from AI-enabled services (3 percentage points). Management highlighted that Azure OpenAI service now has 18,000 customers compared with 11,000 last quarter (up 60% QoQ) indicating early traction for its AI services.

+ Office 365 momentum continues. Office 365 commercial revenue grew by 18% YoY led by strong growth in its users and higher average revenue per user as customers upsell to E5 license for its advanced functionalities. Paid Office 365 commercial users grew by 10% YoY to approximately 400mn driven by continued demand from small and medium businesses and frontline worker offerings. We believe that the commercial launch of Office 365 AI tools (US$30 per user per month) on Nov. 1 should enable Microsoft to maintain double-digit Office 365 growth rates.

+ Improvement in margins. In 1Q24, Microsoft reported operating margin of 48% compared with 43% in 1Q23. This was the highest over the last decade despite AI investments. The margin improvement was mainly due to top-line upside and continued focus on operational discipline (headcount down 7% YoY).

The Negatives

– Nil.

Wells Fargo & Company - NII decline hurt earnings

Wells Fargo & Company - NII decline hurt earnings Bank of America Corporation - Earnings hurt by NII and FICC

Bank of America Corporation - Earnings hurt by NII and FICC CapitaLand Investment Limited - Capital recycling picks up pace

CapitaLand Investment Limited - Capital recycling picks up pace Sheng Siong Group Ltd - Seasonal and base effect bump

Sheng Siong Group Ltd - Seasonal and base effect bump