Referral Program Be our influencer with POEMS

Refer and Share with

Your Friends & Family.

Share your referral link

* Earn S$60 for each referral, up to a maximum of 10 new account holders

Start Inviting Your Friends & Family!

Generate your referral link now!For Referrer

Steps

Rewards

Share Your Unique Referral link

Your Friends & Family Opens a POEMS Account with SMART Park Opt-in

(Excess Fund Management)

S$10

US Stock Coupon

Your Friends & Family Funds a Minimum of S$1,000

(within 14 days of Account opening & holds it for 30 days)

S$50

Cash Credit

For Referee

Steps

Rewards

Sign Up Using the Unique Referral Link

Opt-in to SMART Park

(Excess Fund Management within 14 days)

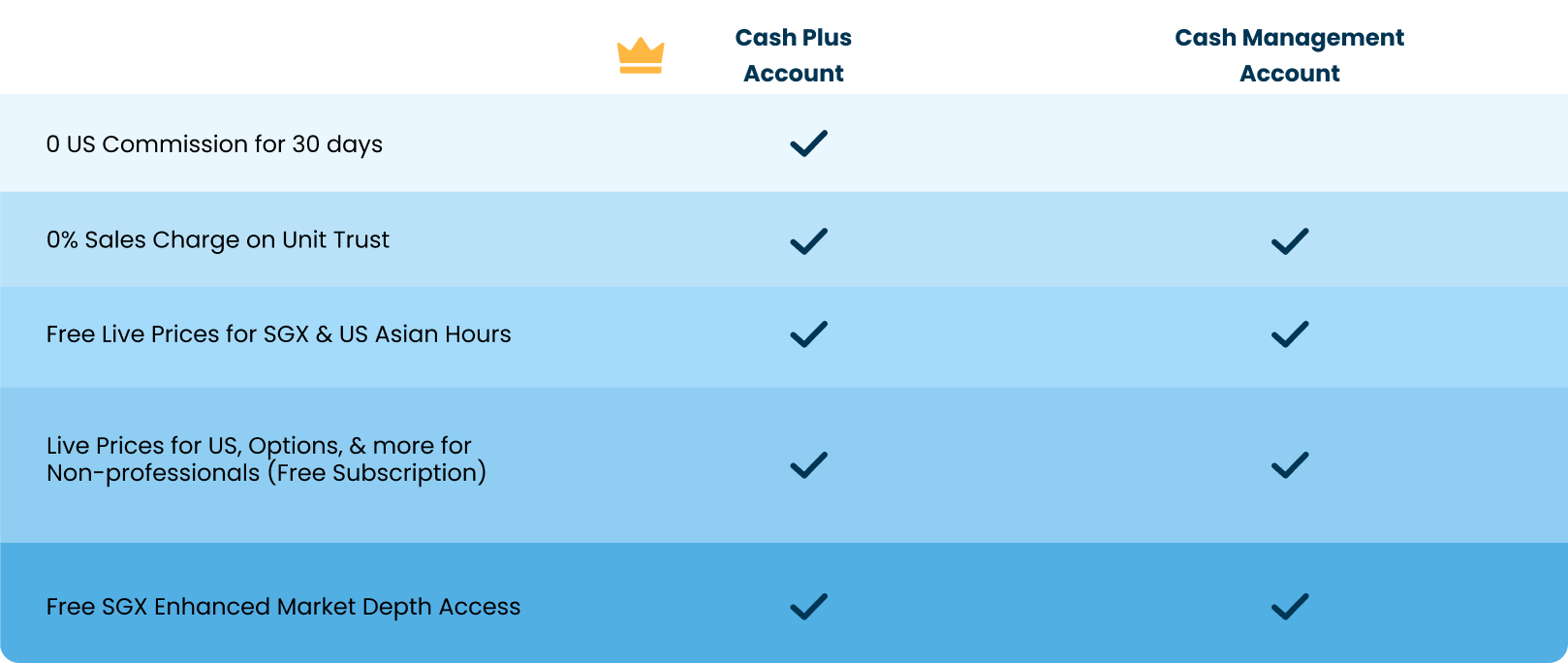

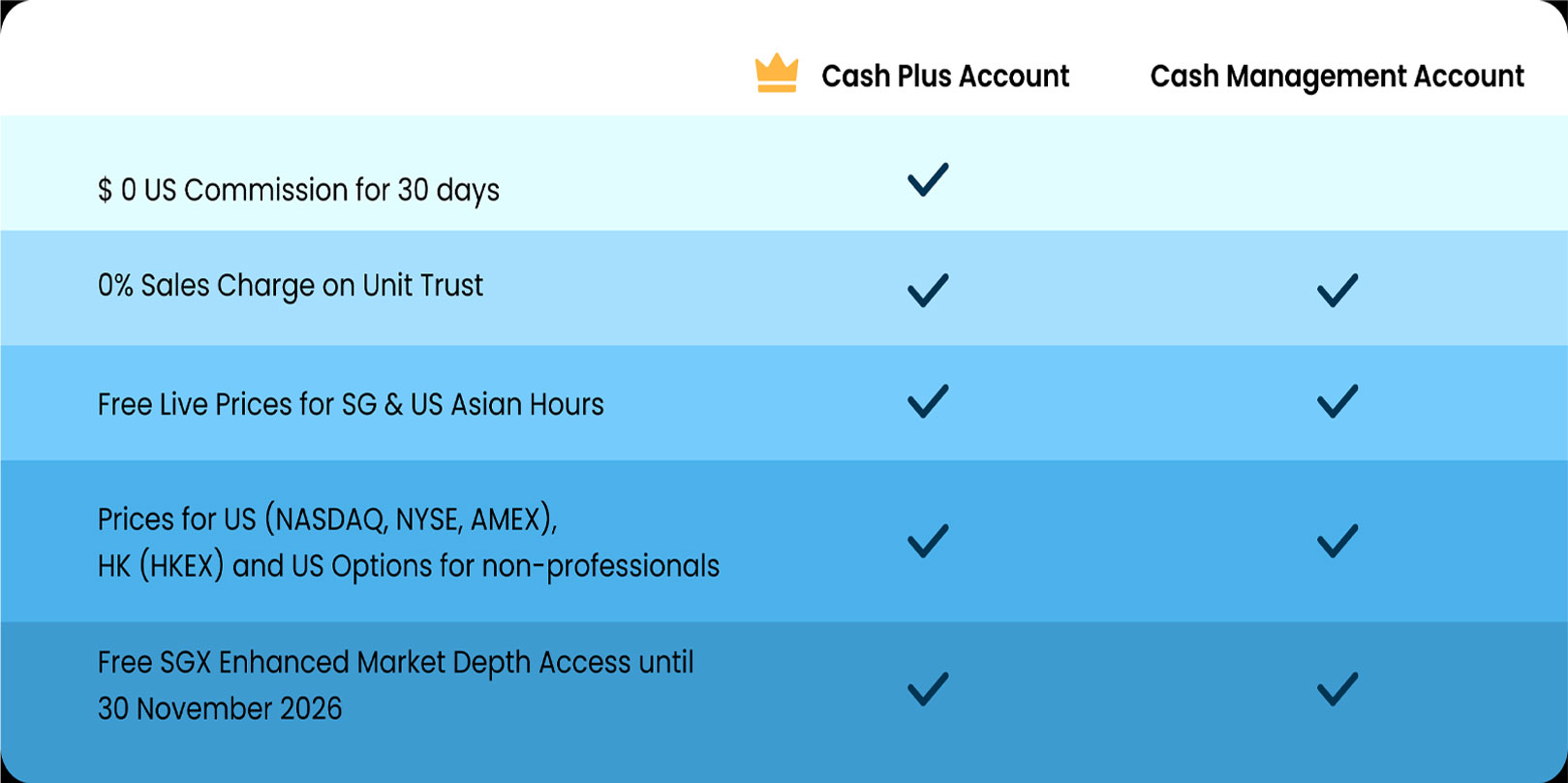

Zero US Commission (Only for Cash Plus)

Zero Sales Charge on Unit Trusts

Free SGX Market Depth

Free Live Prices on Popular Markets

Funds a Minimum of S$1,000

(within 14 days of account opening and holds the funds for 30 days)

Free Stock Coupons

Visit here to learn more about the Referee's rewards

For Referrer

Steps

Rewards

Share Your Unique Referral Link

Your Friends & Family Opens a POEMS Account with SMART Park Opt-in

(Excess Fund Management)

S$10

US Stock Coupon

Your Friends & Family Funds a Minimum of S$1,000

(within 14 days of Account opening & holds it for 30 days)

S$50

Cash Credit

For Referee

Steps

Rewards

Sign Up Using the Unique Referral Link

Opt-in to SMART Park

(Excess Fund Management within 14 days)

Zero US Commission (Only for Cash Plus)

Zero Sales Charge on Unit Trusts

Free SGX Market Depth

Free Live Prices on Popular Markets

Funds a Minimum of S$1,000

(within 14 days of account opening and holds the funds for 30 days)

Free

Stock Coupons

Visit here to learn more about the Referee's rewards

Refer NowRewards for Your Friends & Family

What will They get when They Open an Account?

More Rewards when They Fund

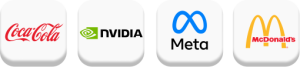

Get Rewarded with S$50 US Stock Coupons

| Stock Coupon | Qty |

|

X5 |

Fund at least S$3,000 within 14 days of Account Opening

|

Hold the funds for at least 30 days from the date of the minimum funds |

Get Rewarded with S$150 US Stock Coupons

| Stock Coupon | Qty |

|

X5 |

Fund at least S$10,000 within 14 days of Account Opening

|

Hold the funds for at least 30 days from the date of the minimum funds |

Frequently Asked Questions

What will I receive when I refer a friend to POEMS?You will receive S$10 US Stock Coupon and S$50 Cash Credit when the following has been verified:

(a) Your friend is new to Phillip Securities, has successfully opened a Cash Plus Account or Cash Management Account with Excess Funds Management (SMART Park) opt in >> You will receive S$10 US Stock Coupon

(b) Your friend funded at least S$1,000 into their Account within 14 days of Account opening and does not withdraw the funds for 30 days >> You will receive S$50 Cash Credit

Am I eligible to be a referrer/referee?All existing POEMS Account Holders with any of the following Accounts can be referrers:

- Cash Plus Account

- Margin Account

- Cash Management Account

- Prepaid Account

- Custodian Account

- Share Financing Account

As a referee, you must not have or have had any Accounts with Phillip Securities Pte Ltd.

What is the maximum number of referrals?You can refer up to 10 referees.

When will my referee who opened Cash Plus Account be able to enjoy Zero commission on US stocks?Referees who opened the Cash Plus Account will receive a notification email on the activation of the Zero US Commission for 30 days Reward within 2 working days following their Account opening.

When will I as a referrer receive the S$10 US Stock Coupon and S$50 Cash Credit?The S$10 US Stock Coupon will be redeemable within 10 working days via POEMS Mobile 3 App > Me > Rewards Inventory once your Referee has fulfilled the requirements (open Cash Plus or Cash Management Account and opts into Excess Funds Management (SMART Park))

The S$50 Cash Credit will be credited into the Referrer’s POEMS Account once it has been verified that the Referee has not withdrawn the fund for 30 days. This process may take up to 40 days following the funding date.

Is the S$10 US Stock Coupon only redeemable on POEMS Mobile 3 App? What if I am using POEMS Mobile 2.0 App?Yes, the S$10 US Stock Coupon is only redeemable on POEMS Mobile 3. If you are using POEMS Mobile 2.0 App, please download POEMS Mobile 3 and log in to claim the Coupon.

Does the referee need to enter a referral code while signing up?No, the referee only needs to open an Account using the unique referral link you provide.

What happens if my referee forgot to use my referral link when opening an Account?We regret that in such cases, it will not be considered as a successful referral.

What if I am a Cash Trading Account holder? Am I eligible for this promotion?No. Cash Trading Account holders are not eligible for this promotion. You may consider opening an eligible Account type or converting your Cash Trading Account to a Cash Management Account.

How do I convert my Cash Trading Account to Cash Management Account?Login to POEMS 2.0 Website > “Acct Mgmt” > “Stocks” > “Online Forms”. Please note that any existing GIRO facility with a Cash Trading Account has to be terminated before we can process the conversion to a Cash Management Account.

What if I have further queries?Please contact your dealer or Trading Representative. Alternatively, you can reach our Customer Service Hotline at 6531 1555 or send an email to talktophillip@phillip.com.sg.

Terms & Conditions

T&Cs for Cash Plus Account Referral Programme- Referral Programme (“Programme”) is valid for existing POEMS Account holders (“Referrer”) who refer Customer(s) new to Phillip Securities Pte Ltd (“PSPL”) to open a Cash Plus Account (“Referee”), from 12 January 2026 to 8 March 2026.

- Within this context, “Referrers” refer to Customers with any of the following Accounts: Cash Plus, Cash Management, Margin, Prepaid, Custodian or Share Financing Accounts (“Qualified Accounts”).

- A referral will be considered successful only when the referee fulfils all of the following:

- Opens a Cash Plus Account using a unique referral link generated by the referrer

- Opts into Excess Funds Management (SMART Park)

- Does not change the Account type during the promotion period

- Abides by the terms and conditions

- If the Referee uses referral link(s) to open multiple Accounts, only the first successfully opened and funded Account will be considered as successful referral.

- Referrers will only receive a S$10 US Stock Coupon and S$50 Cash Credit ONCE for each unique Referee, even if the Referee opens multiple Accounts (regardless of Account type).

- Only the first 10 referred Accounts (regardless of Qualified Account) will be considered as successful referrals.

- Rewards for Referrer: The Referrer will be entitled to a S$10 US Stock Coupon and S$50 Cash Credit when his/her Referee

- Successfully opens a Cash Plus Account and opts in to Excess Funds Management (SMART Park), he/she would receive S$10 US Stock Coupon.

- deposits at least S$1,000 into the Account within 14 calendar days from the Account opening date, he/she would receive S$50 Cash Credit. The deposit cannot withdraw from the Account for a period of at least 30 days.

- Please note that the Stock Coupon and Cash Credit are non-transferable and non-withdrawable.

- Rewards for Referee

- Referees will receive:

- Account Opening Rewards at poems.com.sg/welcome-gifts

- Fund & Trade Rewards at poems.com.sg/welcome-gifts

- Referees will receive:

- Activation and crediting of the Referrer’s Rewards:

- S$10 US Stock Coupon:

- Referrers will be required to download and login to POEMS Mobile 3 App, in order to receive the S$10 US Stock Coupon, once their referees have fulfilled the requirements (refer to point 3). Failure to do so, will result in forfeiture of the Reward/s.

- The S$10 US Stock Coupon will be credited into the eligible Referrers’ Account in the POEMS Mobile 3 App > Me Tab > My Rewards Inventory, within the 10 working days provided that the Referrers login to POEMS Mobile 3 App and their Referees have fulfilled the requirements.

- How to Use:

- Activate – ‘Swipe to Activate’ to apply the Coupon.

- Trade – Place a trade with the Stock Coupon that meets the Eligibility Criteria.

- Rebate Credited – Once the trade is completed successfully, S$10 will be credited to your Account within 2 working days.

- Eligibility Criteria:

- Buy stocks only

- US Market only

- Cash trades only

- The S$10 US Stock Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- The Coupon will expire 30 days from the date of issuance.

- Once activated, the Coupon cannot be deactivated or reissued.

- The S$10 US Stock Coupon will be automatically applied to the first successful eligible trade executed, after the Coupon activation and before its expiry.

- The S$10 rebate, up to the contract value, will be credited to the eligible Account within 2 working days following the successful eligible trade.

- If the Coupon is not activated and/or a successful eligible trade is not executed within the validity period, the coupon will be forfeited, and no rebate will be issued.

- If there are multiple Stock Coupons active, the one which has a nearer expiration date will be used up first by default. If the Coupons have the same expiry date, the Coupon that was activated first by the Customer will be used by default.

- S$50 Cash Credit:

- Referrers will receive the S$50 Cash Credit into their Account within 10 working days once their referees have fulfilled the requirements.

- S$10 US Stock Coupon:

- Activation and crediting of the Referees’ Rewards:

- Please kindly refer to poems.com.sg/welcome-gifts

- Referee consents to the disclosure of his or her name and referral status to the Referrer.

- The following Customers are NOT eligible for this Programme unless approved by the management of Phillip Securities Pte Ltd (“PSPL”)

- Referees who have any type of existing Accounts with PSPL, including joint and corporate Accounts.

- Referees who have closed any Accounts with PSPL

- Referrers and Referees who have already benefited from or will benefit from similar programmes or promotions, including PhillipCFD’s Refer A Friend.

- All employees of PhillipCapital’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all participants.

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Referral Programme (“Programme”) is valid for existing POEMS Account holders (“Referrer”) who refer Customer(s) new to Phillip Securities Pte Ltd (“PSPL”) to open a Cash Management Account (“Referee”), from 12 January 2026 to 8 March 2026.

- Within this context, “Referrers” refer to Customers with any of the following Accounts: Cash Plus, Cash Management, Margin, Prepaid, Custodian or Share Financing (“Qualified Accounts”)

- A referral will be considered successful only when the referee fulfils all of the following:

- Opens a Cash Management Account using a unique referral link generated by the referrer

- Opts into Excess Funds Management (SMART Park)

- Does not change the Account type during the promotion period

- Abides by the terms and conditions

- If the Referee uses referral link(s) to open multiple Accounts, only the first successfully opened and funded Account will be considered as successful referral.

- Referrers will only receive a S$10 US Stock Coupon and S$50 Cash Credit ONCE for each unique Referee, even if the Referee opens multiple Accounts that fulfil clause 9 (regardless of Account type)

- Only the first 10 referred Accounts (regardless of Qualified Account) will be considered as successful referrals

- Referee consents to the disclosure of his or her name and referral status to the Referrer

- The following Customers are NOT eligible for this Programme unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

- Referees who have any type of existing Accounts with PSPL, including joint and corporate Accounts.

- Referees who have closed any Accounts with PSPL.

- Referrers and Referees who have already benefited from or will benefit from similar programmes or promotions, including PhillipCFD’s Refer A Friend.

- All employees of PhillipCapital’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- Rewards for Referrer: The Referrer will be entitled to a S$10 US Stock Coupon and S$50 Cash Credit when his/her Referee:

- Successfully opens a Cash Management Account and opts in to Excess Funds Management (SMART Park), he/she would receive a S$10 Stock Coupon

- Deposits at least S$1,000 into the Account within 14 calendar days from the Account opening date, he/she would receive S$50 Cash Credit. The deposit cannot withdraw from the Account for a period of at least 30 days.

- Please note that the Stock Coupons and Cash Credit are non-transferable and non-withdrawable.

- Rewards for Referee:

- Account Opening Rewards:

- 0% Sales Charge on Unit Trust

- Free Live Prices for SGX and US Asian Hours

- Free Live Prices for US (NASDAQ, NYSE, AMEX), Malaysia (BURSA), Thailand (SET), and US Options for non-professionals.

- Login to POEMS 2.0 web > ‘Market Data & Rewards’ > ‘New Subscriptions’ > tick the boxes for the Live Prices > complete the subscriber agreement and submit > click ‘Submit New’ > Enter your password for confirmation.

- Login to POEMS Mobile 3 App > Me Tab > Market Data under Forms, section > Subscribe US (NASDAQ, NYSE, AMEX), MY (BURSA), TH (SET), and US Options

- Free SGX Enhanced Market Depth Access until 30 November 2026. For more information, please refer to poems.com.sg/sgx-enhanced-market-depth.

- Fund Rewards:

- Fund at least S$1,000 within 14 days of Account opening (“Initial Capital”) and hold the funds for at least 30 days to redeem

- S$10 Stock Coupon

- Fund at least S$5,000 within 14 days of Account opening (“Initial Capital”) and hold the funds for at least 30 days to redeem

- S$20×5 Stock Coupons

- Fund at least S$20,000 within 14 days of Account opening (“Initial Capital”) and hold the funds for at least 30 days to redeem

- S$50×5 Stock Coupons

Requirement Reward Fund at least S$1,000 within 14 days of Account opening (“Initial Capital”) and hold the funds for at least 30 days S$10 Stock Coupon Fund at least S$5,000 within 14 days of Account opening (“Initial Capital”) and hold the funds for at least 30 days S$20×5 Stock Coupons Fund at least S$20,000 within 14 days of Account opening (“Initial Capital”) and hold the funds for at least 30 days S$50×5 Stock Coupons

- S$50×5 Stock Coupons

- Initial Capital must remain in the Account for at least 30 days. It can be used for BUY trades, but it cannot be withdrawn or transferred.

- The deposit must be fresh cash funds transferred from the Customer’s bank account, and does not include funds transferred within PSPL Accounts, cash dividends, sales proceeds or Account credit transactions.

- Customers must ensure that their Net Cumulative Deposit amount does not fall under S$1,000/S$5,000/S$20,000 to be eligible for the Fund Reward for the tier respectively.

- Net Cumulative Deposit refers to accumulated deposit amount, calculated from the day the Customers make and maintain their initial deposits for 30 days. Capital gains and losses are excluded.

- The calculation of Net Cumulative Deposit is done daily. All withdrawals made during the holding period will reduce the Customers’ daily Net Cumulative Deposit.

- Once the daily Net Cumulative Deposit falls below S$1,000, the Customer will no longer receive any Rewards. If the daily Net Cumulative Deposit falls below S$10,000 but remains at or above S$1,000, the Customer will only be eligible for Tier 1 Reward.

- Fund at least S$1,000 within 14 days of Account opening (“Initial Capital”) and hold the funds for at least 30 days to redeem

- Account Opening Rewards:

- Activation and crediting of the Referrer’s Rewards:

- S$10 Stock Coupon:

- The S$10 Stock Coupon will be credited into the eligible Customers’ Account in the POEMS Mobile 3 App > Me Tab > My Rewards Inventory, within 30 days of the end of the campaign. How to Use:

- Activate – ‘Swipe to Activate’ to apply the Coupon.

- Trade – Place a trade with the Stock Coupon that meets the Eligibility Criteria.

- Rebate Credited – Once the trade is completed successfully, S$10 will be credited to your Account within 2 working days.

- Eligibility Criteria:

- Buy stocks only

- US Market only

- Cash trades only

- The S$10 Stock Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- The Coupon will expire 30 days from the date of issuance.

- Once activated, the Coupon cannot be deactivated or reissued.

- The S$10 Stock Coupon will be automatically applied to the first successful eligible trade executed, after the Coupon activation and before its expiry.

- The S$10 rebate, up to the contract value, will be credited to the eligible Account within 2 working days following the successful eligible trade.

- If the Coupon is not activated and/or a successful eligible trade is not executed within the validity period, the coupon will be forfeited, and no rebate will be issued.

- If there are multiple Stock Coupons active, the one which has a nearer expiration date will be used up first by default. If the Coupons have the same expiry date, the Coupon that was activated first by the Customer will be used by default.

- The S$10 Stock Coupon will be credited into the eligible Customers’ Account in the POEMS Mobile 3 App > Me Tab > My Rewards Inventory, within 30 days of the end of the campaign. How to Use:

- S$50 Cash Credit:

- Referrers will receive the S$50 Cash Credit into their Account within 10 working days once their referees have fulfilled the requirements.

- Referrers will be required to download and login to POEMS Mobile 3 App in order to receive the S$10 Stock Coupon, once their referees have fulfilled the requirements. Failure to do so, will result in forfeiture of the Reward/s.

- S$10 Stock Coupon:

- Activation and crediting of the Referees’ Rewards:

- Account Opening Rewards:

- 0% Sales Charge on Unit Trust will be granted upon Account opening.

- Free Live Prices for SGX and US Asian Hours will be granted upon Account opening.

- Free Live Prices for US (NASDAQ, NYSE, AMEX), Malaysia (BURSA), Thailand (SET), and US Options for non-professionals.

- Login to POEMS 2.0 web > ‘Market Data & Rewards’ > ‘New Subscriptions’ > tick the boxes for the Live Prices > complete the subscriber agreement and submit > click ‘Submit New’ > Enter your password for confirmation.

- Login to POEMS Mobile 3 App > Me Tab > Market Data under Forms, section > Subscribe US (NASDAQ, NYSE, AMEX), MY (BURSA), TH (SET), and US Options.

- Free subscription for SGX Enhanced Market Depth Access would be granted automatically.

- Tier 1 or 2 or 3 Fund Reward:

- Customers are required to download and login to POEMS Mobile 3 App within 30 days of Account Opening, in order to receive The Tier 1 or 2 or 3 Fund Reward, once they have fulfilled the requirements.

- Customers must claim the Tier 1 or 2 or 3 Fund Reward and execute the eligible trade/s on POEMS Mobile 3 App within 90 days of becoming eligible. Failure to do so, will result in forfeiture of the Reward/s.

- Customers will be notified via POEMS Mobile 3 App (please ensure that App push notifications are enabled on your mobile device) and by Email once they qualify for the reward.

- The Coupon will expire 90 days from the date of issuance.

- Once redeemed, the Coupon cannot be reissued.

- Eligibility Criteria:

- BUY stocks only

- US Market only

- Cash trades only

- Online trades only

- A minimum contract value of US$100

- This Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- Once activated, the Coupon cannot be deactivated or reissued.

- This Coupon will be automatically applied to the first successful eligible trade executed, after activation and before its expiry.

- The rebate, up to the contract value, will be credited to the eligible Account within 5 working days following the successful eligible trade.

- If the Coupon is not activated and/or a successful eligible trade is not executed within the validity period, the Coupon will be forfeited, and no rebate will be issued.

- If multiple Stock Coupons are active, the one with the nearest expiration date will be used up first by default. If the Coupons have the same expiry date, the Coupon that was activated first by the Customer will be used by default.

- If the Customer holds multiple trading Accounts, the Account performing the first successful eligible trade will receive the rebate, regardless which Account the Coupon was activated in. For example, a Customer has two Accounts, Account A and Account B. The Customer activates the Coupon in Account A, but later performs a successful eligible trade using Account B. In this case, Account B will be awarded the rebate.

- Account Opening Rewards:

- Days refer to calendar days.

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete these Terms and Conditions without prior notification (including eligibility; replacement of the prize; promotional mechanics, promotion duration without prior notification, qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

Referral Program Be our influencer with POEMS

Refer Your Family & Friends, and Receive Cash Credit up to

S$680*

*Refer to 10 new Account holders

Refer Your Family & Friends, and Receive Cash Credit up to

S$680*

*Refer to 10 new Account holders

Start Inviting Your Friends & Family!

Generate your referral link now! Rewards for Your Family & Friends Account Opening Rewards Rewards for Your Family & Friends

Account Opening Rewards

Rewards for Your Family & Friends

Account Opening Rewards

Fund & Trade Rewards

Make a Deposit, and Buy Stocks/ ETFs/ Unit Trusts to Receive Attractive Rewards

Tier 1Deposit S$3,000 + 3 BUY Trades

US$20 Worth of Free Shares

8,888 POEMS Coins

- Make an initial deposit of at least S$3,000 within 14 days of Account opening.

- Hold the funds in your Account for at least 30 days without withdrawal.

- Execute at least 3 BUY Trades of Stocks/ ETFs/ Unit Trusts within 90 days of Account opening.

Deposit S$10,000 + 5 BUY Trades

US$88 Worth of Free Shares

10,888 POEMS Coins

- Make an initial deposit of at least S$10,000 within 14 days of Account opening.

- Hold the funds in your Account for at least 30 days without withdrawal.

- Execute at least 5 BUY Trades of Stocks/ ETFs/ Unit Trusts within 90 days of Account opening.

Bonus

(For Cash Plus Accounts only)

*Capped at S$50,000 and for a 30 days period.

Reach a min. of S$20,000 within the first 14 days of Account Opening

*Capped at S$50,000 and for a 30 days period.

Reach a min. of S$20,000 within the first 14 days of Account Opening

How It Works

You (Referrer)

Existing POEMS Account Holder

- Share your referral link.

- Your friend uses your referral link to open an Account. Kindly note that your friend must be NEW to Phillip Securities to qualify.

- Your friend funds at least S$3,000 to the Account within 14 days of Account Opening with a holding period of 30 days.

Your Friends (Referee)

New to Phillip Securities

- Opens an Account with your unique link and opt-in to Excess Funds Management (SMART Park). Afterwhich, they can redeem the Account Opening Reward.

- By funding at least S$3,000 to the Account within 14 days of Account opening (without withdrawing the funds for 30 days)

For Referees, who open a Cash Plus Account, they can enjoy $0 US commission for 30 days.

You (Referrer)

Existing POEMS Account Holder

You (Referrer)

Existing POEMS Account Holder

- Share your referral link

- Your friend uses your referral link to open an Account *Your friend must be NEW to Phillip Securities

- Your friend funds at least S$3000 to the Account within 14 days of Account Opening with a holding period of 30 days.

Your Friends (Referee)

New to Phillip Securities

Your Friends (Referee)

New to Phillip Securities

- Opens an Account with your unique link and opt-in to Excess Funds Management (SMART Park). They can redeem Account Opening Reward above.

- Upon funding at least S$3,000 to the Account within 14 days of Account Opening (without withdrawing the funds for 30 days) and make at least 3 BUY Trades of Stocks/ ETFs/ Unit Trusts within 90 days of Account opening, they can redeem Fund and Trade Rewards above.

Start Inviting Your Friends & Family!

Send your personalised referral link to your friend! Share your referral linkFrequently Asked Questions

What will I receive when I refer a friend to POEMS? You will receive a S$68 Cash Credit when the following has been verified: (a) Your friend is new to Phillip Securities, has successfully opened a Cash Plus Account or Cash Management Account, and has opted in to Excess Funds Management (SMART Park) (b) Your friend has funded at least S$3,000 into their Account within 14 days of Account opening. (c) Your friend does not withdraw the funds for 30 days Am I eligible to be a referrer/referee? All existing POEMS Account Holders with any of the following Accounts can be referrers:- Cash Plus Account

- Margin Account

- Cash Management Account

- Prepaid Account

- Custodian Account

- Share Financing Account

Terms & Conditions

T&Cs for Cash Plus Account Referral Programme- Referral Programme (“Programme”) is valid for existing POEMS Account holders (“Referrer”) who refer Customer(s) new to Phillip Securities Pte Ltd (“PSPL”) to open a Cash Plus Account (“Referee”), from 26 December 2024 to 28 February 2025, both dates inclusive.

- Within this context, “Referrers” refer to Customers with any of the following Accounts: Cash Plus, Cash Management, Margin, Prepaid, Custodian or Share Financing Accounts (“Qualified Accounts”).

- A referral will only be considered successful when the Referee opens a Cash Plus Account using a unique referral link generated by Referrer, opts in to Excess Funds Management (SMART Park) and fulfils these terms and conditions.

- If the Referee uses referral link(s) to open multiple Accounts, only the first successfully opened and funded Account will be considered as successful referral.

- Referrers will only receive S$68 Cash Credit ONCE for each unique Referee, even if the Referee opens multiple Accounts (regardless of Account type).

- Only the first 10 referred Accounts (regardless of Account type) will be considered as successful referrals.

- Referee consents to the disclosure of his or her name and referral status to the Referrer.

- Rewards for Referrer

- The Referrer will be entitled to a S$68 Cash Credit when his/her Referee

- Successfully opens a Cash Plus Account, opts in to Excess Funds Management (SMART Park) and deposits at least S$3,000 into the Account within 14 calendar days from the Account opening date.

- Does not withdraw this minimum amount for a period of at least 30 days

- Please note that the credits are non-transferable and non-withdrawable.

- The Referrer will be entitled to a S$68 Cash Credit when his/her Referee

- Rewards for Referee

- Referees will receive:

- Account Opening Rewards at poems.com.sg/welcome-gifts

- Fund & Trade Rewards at poems.com.sg/welcome-gifts

- SMART Park 5% p.a. Guaranteed Returns at poems.com.sg/welcome-gifts

- Referees will receive:

- The following Customers are NOT eligible for this Programme unless approved by the management of Phillip Securities Pte Ltd (“PSPL”)

- Referees who have any type of existing Accounts with PSPL, including joint and corporate Accounts.

- Referees who have closed any Accounts with PSPL

- Referrers and Referees who have already benefited from or will benefit from similar programmes or promotions, including PhillipCFD’s Refer A Friend.

- All employees of PhillipCapital’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all participants.

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Referral Programme (“Programme”) is valid for existing POEMS Account holders (“Referrer”) who refer Customer(s) new to Phillip Securities Pte Ltd (“PSPL”) to open a Cash Management Account (“Referee”), from 26 December 2024 to 28 February 2025, both dates inclusive.

- Within this context, “Referrers” refer to customers with any of the following Accounts: Cash Plus, Cash Management, Margin, Prepaid, Custodian or Share Financing (“Qualified Accounts”)

- A referral will be considered successful only when the referee fulfils all of the following:

- Opens a Cash Management Account using a unique referral link generated by the referrer

- Opts into Excess Funds Management (SMART Park)

- Does not change the account type during the promotion period

- Abides by the terms and conditions

- If the Referee uses referral link(s) to open multiple Accounts, only the first successfully opened and funded Account will be considered as successful referral.

- Referrers will only receive S$68 Cash Credit ONCE for each unique Referee, even if the Referee opens multiple Accounts that fulfil clause 12 (regardless of Account type)

- Only the first 10 referred Accounts (regardless of Account type) will be considered as successful referrals

- Referee consents to the disclosure of his or her name and referral status to the Referrer

- The following Customers are NOT eligible for this Programme unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

- Referees who have any type of existing Accounts with PSPL, including joint and corporate Accounts.

- Referees who have closed any Accounts with PSPL.

- Referrers and Referees who have already benefited from or will benefit from similar programmes or promotions, including PhillipCFD’s Refer A Friend.

- All employees of PhillipCapital’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all participants

- By taking part in this promotion, the participant acknowledges that he/she has read and consented to these Terms & Conditions.

- 0% Sales Charge on Unit Trust

- Free Live Prices for SGX and US Asian Hours

- Free Live Prices for US (NASDAQ, NYSE, AMEX), Malaysia (BURSA), Thailand (SET), and US Options for non-professionals

- Free SGX Enhanced Market Depth Access until 30 November 2026. For more information, please refer to poems.com.sg/sgx-enhanced-market-depth.

- Fractional Shares Coupons (value US$20)

- Coca Cola (Worth US$10)

- NVIDIA (Worth US$10)

- POEMS Coins: 8,888 (Worth S$8.88)

- Fractional Shares Coupons (value US$88)

- Coca Cola (Worth US$22)

- NVIDIA (Worth US$22)

- McDonalds (Worth US$22)

- Meta (Worth US$22)

- POEMS Coins: 10,888 (Worth S$10.88)

- Customers must ensure that their Net Cumulative fund amount does not fall under S$3,000/S$10,000 to be eligible for the Fund & Trade Rewards based on the tier respectively.

- Net Cumulative fund refers to accumulated fund amount calculated from the day the Customers make and maintain their initial deposit for 30 days Capital gains and losses are excluded.

- The calculation of Net Cumulative funds is done daily. All withdrawals made during the holding period will reduce the Customers’ daily Net Cumulative Deposit.

- Once the daily Net Cumulative fund falls below S$3,000, the Customers will no longer be eligible to receive any Rewards.

- Activation and Crediting of Rewards:

- 0% Sales Charge on Unit Trust will be granted upon Account opening.

- Free Live Prices for SGX and US Asian Hours will be granted upon Account opening.

- Free Live Prices for US (NASDAQ, NYSE, AMEX), Malaysia (BURSA), Thailand (SET), and US Options for non-professionals. To activate the Free Live Prices, click here

- Free subscription for SGX Enhanced Market Depth Access would be granted automatically

- based on the date that you fulfil the requirements and

- You must complete the following items in order to receive the free US Fractional shares into their Account within 90 days from Account opening:

- Opt-in to US Fractional Shares & acknowledge the disclosure

- W8 BEN form

- Risk Warning Statement (RWS) form

- Customers are required to claim the Tier 1 and Tier 2 Free Shares Reward within 30 days of becoming eligible. Failure to do so, will result in the forfeiture of the reward.

-

- Customers who have any existing Accounts with PSPL

- Customers who have closed any Accounts with PSPL before

- Corporate Accounts and Joint Account holders

- All employees of PSPL’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

SDR No Min

Trade Singapore Depository Receipts (SDR) with

No Minimum Commission

Available Counters

Available Counters

Meituan

Xiaomi Corporation

Ping An Insurance (Group) Company of China, Ltd.

Alibaba Group Holding Limited

BYD Electronic (International) Co., Ltd

Bank of China

Hongkong and Shanghai Banking Corporation

Tencent Holdings Ltd

AOT Airports of Thailand

CP All

PTT Exploration and Production

Siam Cement

The KASIKORNBANK

Advanced Info Service

Delta Electronics

SMIC

JD.com

PetroChina

Bangkok Dusit Medical Services

CP Foods

Gulf Development

CATL

Pop Mart

BBCA

Indofood

Telkom

Baidu

Trip.com

Laopu Gold

Horizon Robotics HK SDR

China Mobile HK SDR

Zijin Gold HK SDR

Available counter

Meituan

AOT Airports of Thailand

Xiaomi Corporation

CP All

Ping An Insurance (Group) Company of China, Ltd.

PTT Exploration and Production

Alibaba Group Holding Limited

Siam Cement

BYD Electronic (International) Co., Ltd

The KASIKORNBANK

Bank of China

Gulf Development

Hongkong and Shanghai Banking Corporation

Advanced Info Service

Tencent Holdings Ltd

Delta Electronics

SMIC

JD.com

PetroChina

Bangkok Dusit Medical Services

CP Foods

Horizon Robotics HK SDR

China Mobile HK SDR

Zijin Gold HK SDR

Your Potential Savings At A Glance

Example 1: Customer invests S$5000 in an SDR that has a price of $5.00 per share, with Cash Management Account.| Cash Management Account | |||

| Before 01/04/2025* | Now | ||

| SGX-listed SDR traded price | S$5.00 | S$5.00 | |

| Quantity Purchased | 1,000 units | 1,000 units | |

| Gross Amount | S$5,000 | S$5,000 | |

| Commission | S$25 (Fees calculated at 0.28% or minimum S$25, for Cash Management Account with contract value below SGD50k) | S$14 (0.28% x $5,000) (Fees calculated at 0.28%, for Cash Management Account with contract value below S$50,000) | |

| Commission Saved | S$11 | ||

| Cash Management Account | |||

| Before 01/04/2025* | Now | ||

| SGX-listed SDR traded price | S$1.50 | S$1.50 | |

| Quantity Purchased | 100 units | 100 units | |

| Gross Amount | S$150 | S$150 | |

| Commission | S$25 (Fees calculated at 0.28% or minimum S$25, for Cash Management Account with contract value below SGD50k) | S$0.42 (0.28% x S$150) (Fees calculated at 0.28%, for Cash Management Account with contract value below S$50,000) | |

| Commission Saved | S$24.58 | ||

*"Online commission shown does not include any promotional discounts."

Note: The above examples do not include Exchange Fee and GST.

For pricing of other account types, please refer here.

Terms & Conditions

Terms and Conditions for “No Minimum Commission for Singapore Depository Receipts (SDR)”- No minimum commission rates for Singapore Depository Receipts (SDR) are applicable for all POEMS Trading Accounts from 1 April 2025 onwards. For standard rates, please refer to the respective account pricing.

- This promotion is only applicable for ONLINE trades traded through POEMS suite of platforms available on Singapore Depository Receipts (SDR)

- Applicable for Cash trades only.

- The following persons are not eligible to participate in those promotions unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

- PSPL institutional Customers and corporate Customers

- PSPL Account holders whose Accounts have been suspended, cancelled or terminated

- All employees of PSPL and its associated entities; PSPL and all its subsidiaries

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and / or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and / or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, Customer acknowledges that he/she has read and consented to these Terms & Conditions.

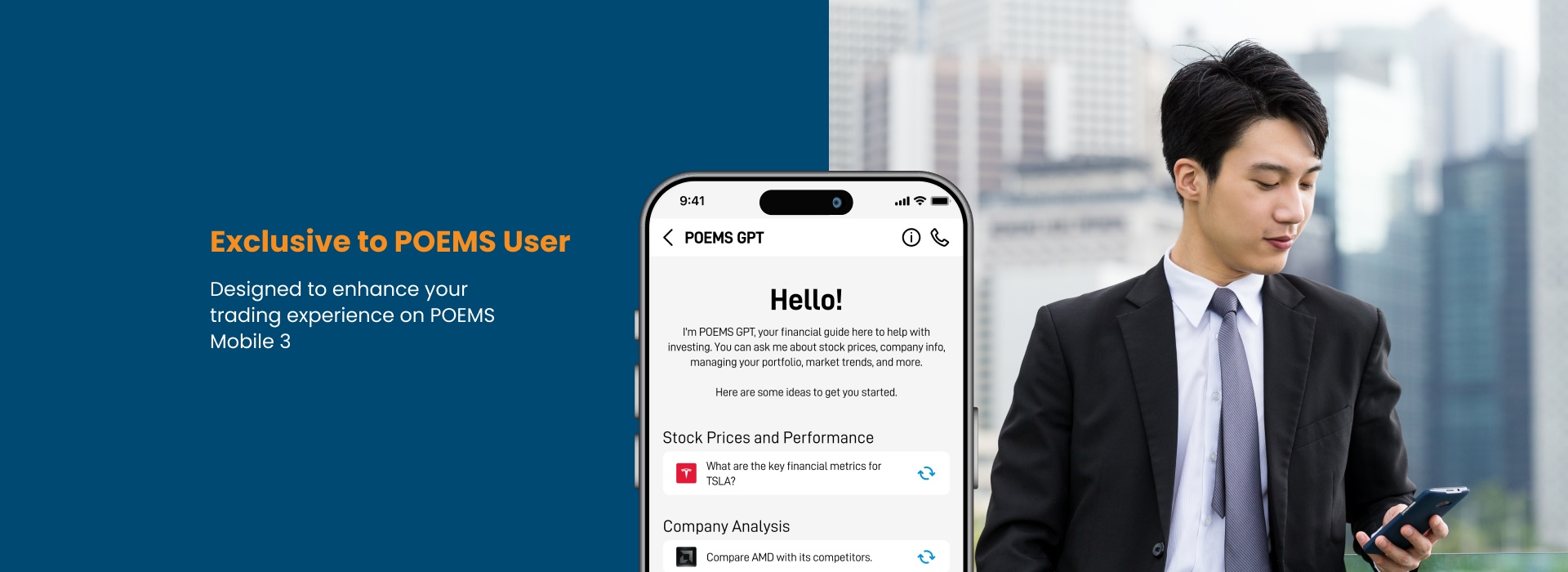

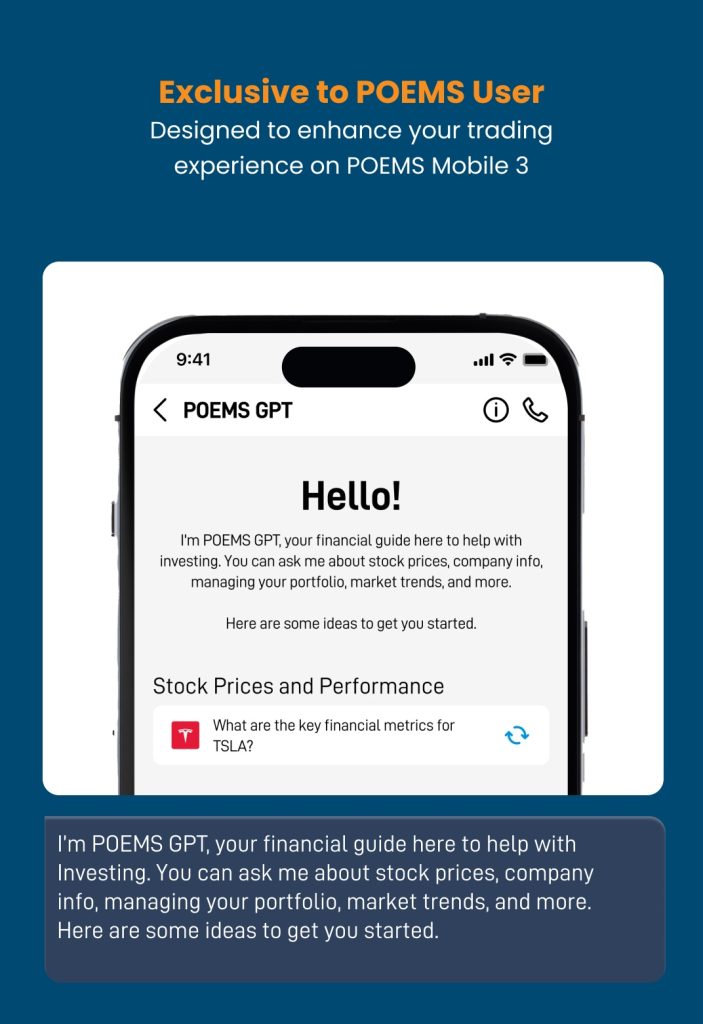

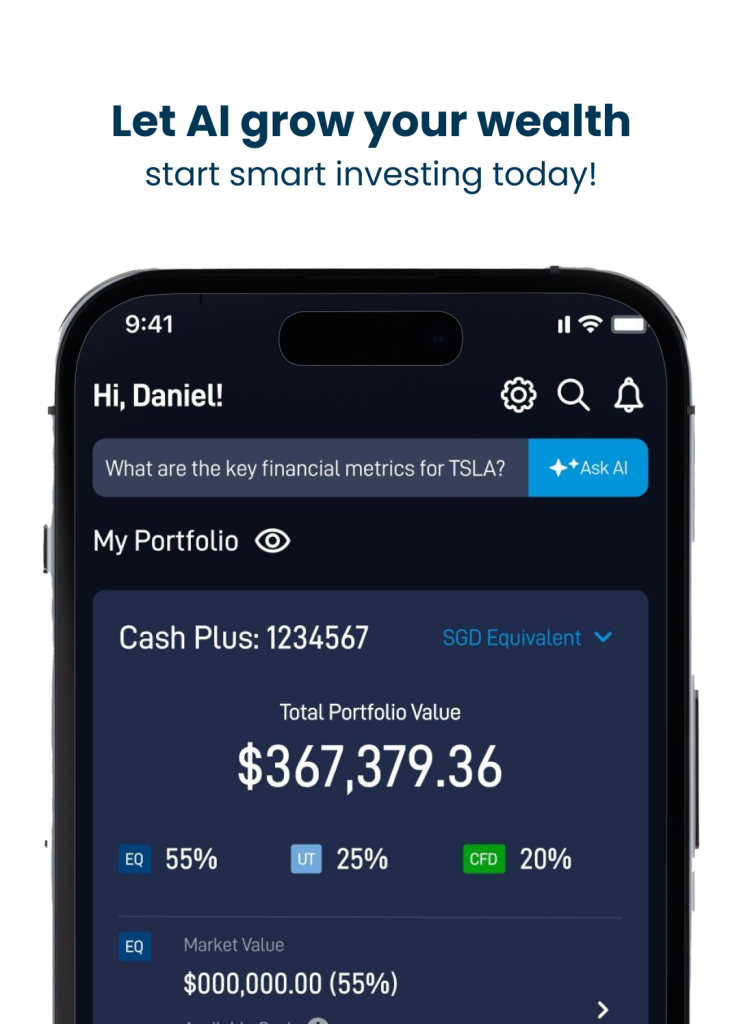

POEMS GPT

POEMS GPT

Smarter Trading with AI

https://www.poems.com.sg/wp-content/uploads/2025/03/POEMS-GPT-page-mobile-No-Text-1.webm

https://www.poems.com.sg/wp-content/uploads/2025/03/POEMS-GPT-page-mobile-No-Text-1.webm

POEMS GPT

Smarter Trading with AI

Get Started Now

Get Started Now

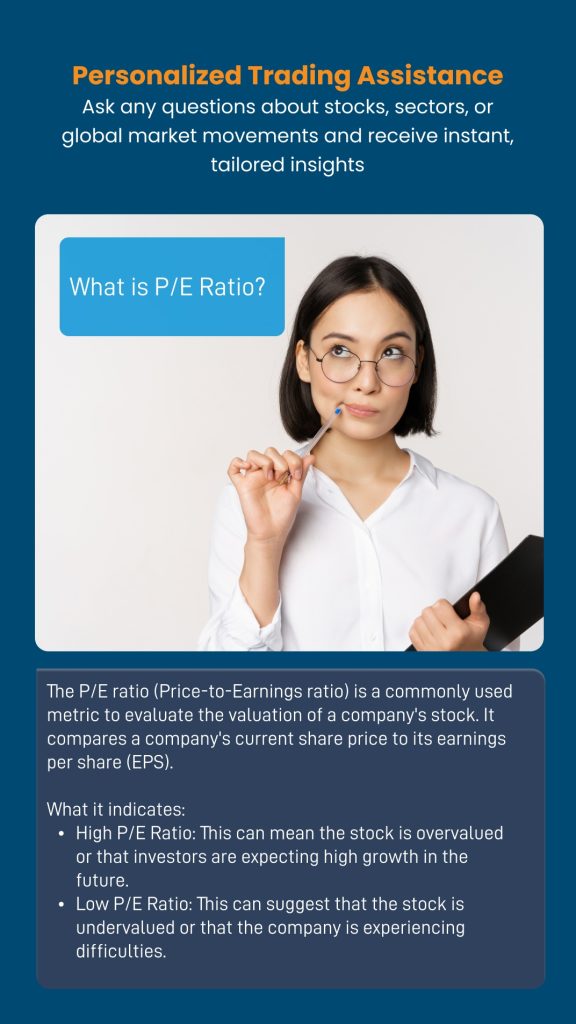

Frequently Asked Questions

What is POEMS GPT?POEMS GPT is the first financial AI investment assistant of its kind, developed by PhillipCapital and powered by Generative AI. It aims to support intelligent investment decision-making by leveraging advanced natural language processing and machine learning. POEMS GPT interprets users’ natural language queries, quickly extracts relevant insights from vast financial datasets, and delivers professional responses.

Is POEMS GPT free of charge or is there a subscription fee?POEMS GPT is free to use at launch. We look forward to seeing you enjoy your investment journey with this new tool!

Is the content of POEMS GPT reliable?Our goal in launching POEMS GPT is to provide accurate responses to your questions based on reliable data. However, POEMS GPT utilizes AI technology provided by Generative AI. As such, like ChatGPT, it is inherently prone to errors. Please carefully verify the data and facts provided in POEMS GPT’s answers.

If you encounter any issues with the responses, we encourage you to share your feedback using the feedback button located in the lower right corner of POEMS GPT’s dialogue window.

Please note that the answers from POEMS GPT are provided as-is and are intended for reference purposes only. They do not constitute financial advice. The risk of relying on such content rests solely with you. Investing involves risks, so please make decisions with caution.

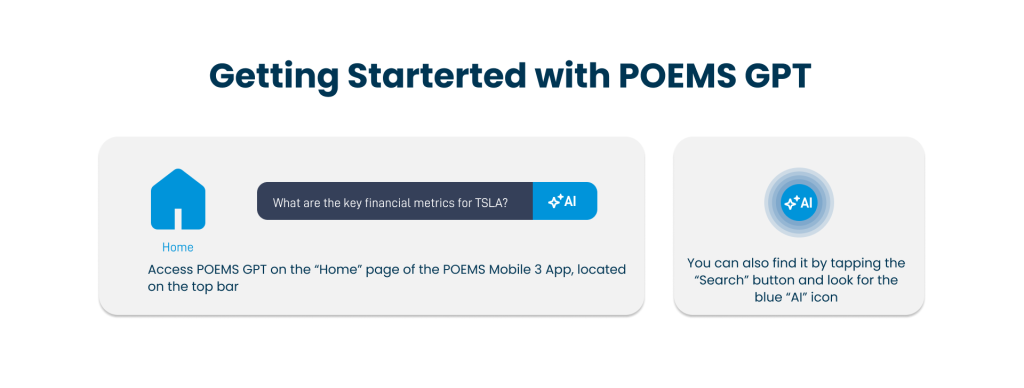

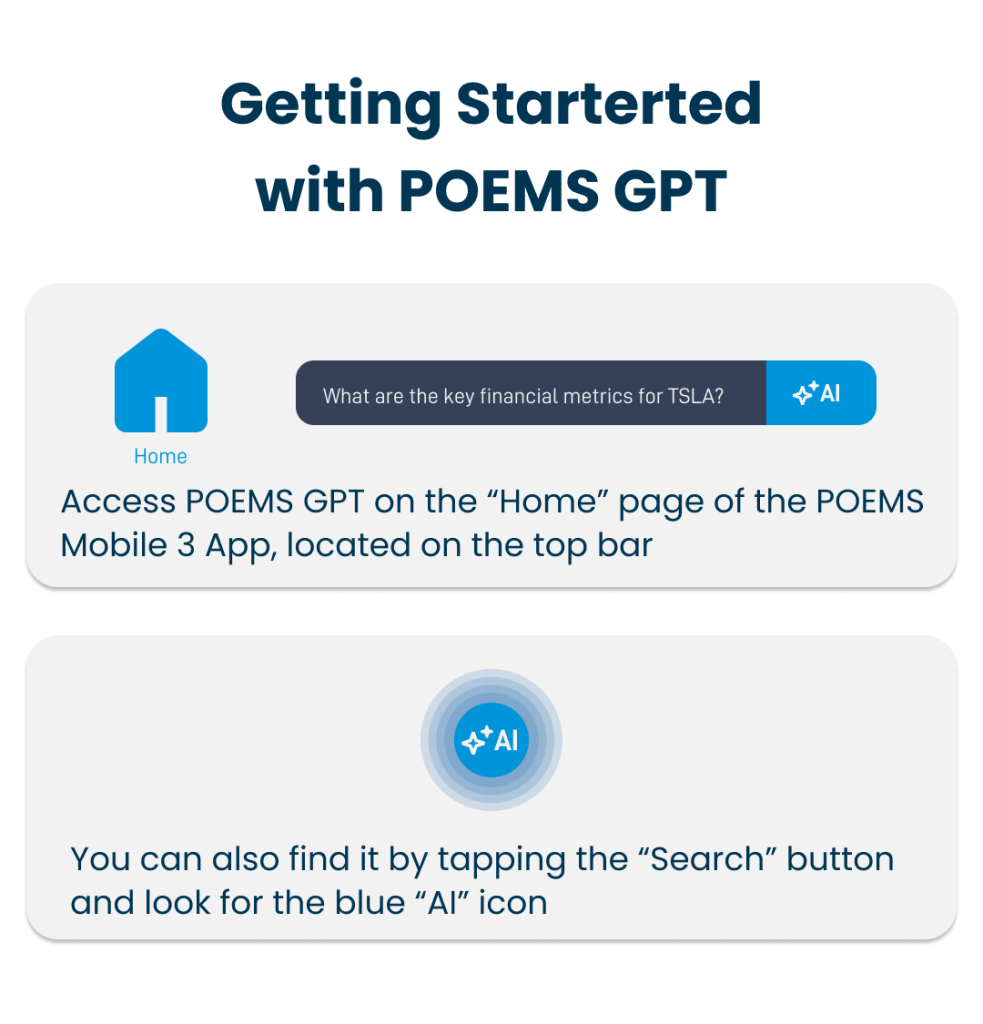

Where can I find POEMS GPT?You can find POEMS GPT on the “Home” page of the POEMS Mobile 3 App, via the top navigation bar. Alternatively, tap the “Search” button and look for the blue “AI” icon. You may also scan the QR code below to get started.

Frequently Asked Questions

What is POEMS GPT?POEMS GPT is the first financial AI investment assistant of its kind, developed by PhillipCapital and powered by Generative AI. It aims to support intelligent investment decision-making by leveraging advanced natural language processing and machine learning. POEMS GPT interprets users’ natural language queries, quickly extracts relevant insights from vast financial datasets, and delivers professional responses.

Is POEMS GPT free of charge or is there a subscription fee?POEMS GPT is free to use at launch. We look forward to seeing you enjoy your investment journey with this new tool!

Is the content of POEMS GPT reliable?Our goal in launching POEMS GPT is to provide accurate responses to your questions based on reliable data. However, POEMS GPT utilizes AI technology provided by OpenAI. As such, like ChatGPT, it is inherently prone to errors. Please carefully verify the data and facts provided in POEMS GPT’s answers.

If you encounter any issues with the responses, we encourage you to share your feedback using the feedback button located in the lower right corner of POEMS GPT’s dialogue window.

Please note that the answers from POEMS GPT are provided as-is and are intended for reference purposes only. They do not constitute financial advice. The risk of relying on such content rests solely with you. Investing involves risks, so please make decisions with caution.

Where can I find POEMS GPT?You can find POEMS GPT on the “Home” page of the POEMS Mobile 3 App, via the top navigation bar. Alternatively, tap the “Search” button and look for the blue “AI” icon.

SDR Voucher April 2025

What is a SDR?

Singapore Depository Receipts (SDR) are instruments that represent the beneficial interest of an underlying security listed on an overseas exchange. An SDR is issued for trading on the securities market of the Singapore Exchange (SGX-ST) on an unsponsored basis by an intermediary, referred to as a SDR issuer, who does not have a formal agreement with the underlying company.

Available CountersMeituan

Xiaomi Corporation

Ping An Insurance (Group) Company of China, Ltd.

Alibaba Group Holding Limited

BYD Electronic (International) Co., Ltd

Bank of China

Hongkong and Shanghai Banking Corporation

Tencent Holdings Ltd

AOT Airports of Thailand

CP All

PTT Exploration and Production

Siam Cement

The KASIKORNBANK

Gulf Energy Development

Advanced Info Service

Delta Electronics

Available Counters

Click on the logo or the counter name to read more about the company.

Trade

Trade

Trade

Trade

PTT Exploration and Production

Trade Siam Cement

Trade

Siam Cement

Trade

Trade

Trade

Trade

Trade

Trade

Trade

Delta Electronics

Trade

Delta Electronics

Trade

For more information about Singapore Depository Receipts (SDR), please refer here.

How to Redeem?

Simply login to POEMS Mobile 3 App > Head to "Me" Tab > Visit "Rewards" to Redeem your S$20 SDR Voucher!

Redeem NowAre you ready? Scan the QR code and redeem now!

(The Vouchers are only redeemable via POEMS Mobile 3 App, scan and download now if you haven't done so)

Terms & Conditions

Terms and Conditions- The S$20 SDR (Singapore Depositary Receipts) Vouchers, purchasable with one POEMS coin, can be redeemed for a S$20 Cash Credit upon Successful Trades.

- Successful Trades refer to the purchase of any listed SDR on SGX, with a minimum contract value of at least S$2,000 and must be executed by 30 April 2025 (to receive the S$20 Cash Credit).

- The S$20 SDR Voucher will be released on 1 April 2025 and remain valid until 30 April 2025, 23:59 PM (Promotion period).

- The One POEMS Coin used to purchase the SDR will not be refunded once the SDR Voucher is redeemed.

- Each Customer is eligible to redeem one S$20 SDR voucher per month using the POEMS coins during the Promotion period.

- The S$20 Cash Credit will be credited to your Account within the second week of the following month after redeeming the voucher and completing Successful Trades.

- E.g. Customer redeems the S$20 SDR Voucher on 15 April 25 and makes Successful Trades on 20 April 25. The Customer will receive the S$20 Cash Credit in his/her Account by the second week of May.

- The S$20 SDR Voucher is not refundable, exchangeable for cash nor transferable to other Account holders.

- This Promotion is not applicable to

- Cash Account(s)

- Joint Account(s)

- PSPL institutional Customers and corporate Customers

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives.

- Phillip Securities Pte Ltd (“PSPL”) reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all Customers shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all Customers.

- PSPL and its affiliates and their respective employees and agents shall not be liable to any person for any loss, damage, injury, costs or expenses incurred, suffered, borne or arising from this promotion.

- By redeeming this item, you acknowledge that you have read and consented to these Terms and Conditions.

Macquarie Warrants 7 April 2025 – 30 June 2025

From 7 April to 30 June 2025

By executing any 1 BUY trade of Macquarie Warrants online

Trade Now

What is a Structured Warrant?

A Structured Warrant (SW) is an exchange-traded derivative that gives the holder the right but not the obligation to buy or sell the specific underlying asset at an agreed price (exercise price) on the expiry date.

A call warrant gives investors the right, not the obligation to buy the underlying asset. Typically, the price of a call warrant increases as the underlying asset price goes up.

A put warrant gives investors the right, not the obligation to sell an underlying asset. Typically, the price of a put warrant increases as the underlying asset price goes down.

Structured warrants are available over a range of assets, including shares and share indices.

Don't have an Account yet?

Open an Account NowAlternatively, visit any of our Phillip Investor Centres or contact your trading representatives.

Why Trade Warrants?

Leverage

Leverage up to 3 times the daily performance of an underlying index

Flexible Investment Strategies

Flexibility to trade both rising and falling markets

Limited Downside Risk

Warrants have a longer lifespan and do not expire worthless

Liquidity

Many warrants are actively traded on organised exchanges

Diversification

Investors can gain exposure to different sectors, industries, or regions without directly owning the underlying securities

For more information on Warrants, please refer here.

Frequently Asked Questions

How do I qualify for the S$68 Cash Credit?To qualify, a POEMS account holder must:

I) Execute at least ONE “BUY” trade of a minimum gross value of S$3,000 on Macquarie Warrants online between 7 April 2025 and 30 June 2025;

II) Hold the Warrant for a minimum of one night; and

III) Have not executed any Macquarie Warrants trade from 2 January 2025 to 6 April 2025.

You can identify the Issuer by the name of the Warrant. Let’s use the Alibaba Call Warrant for example: Alibaba MB eCW251003 175 (SHKW)

SHKW | Counter Code |

Alibaba | Underlying asset |

MB | Issuer (MB = Macquarie Bank) |

251003 | Expiry Date (YYMMDD) |

No. Each Customer is only eligible to claim the Cash Credit once despite having multiple Accounts. Please see the following example.

Client A has Accounts 1234567 & 2345678 with POEMS and both Accounts have not traded Macquarie Warrants with PSPL since 2 Jan 2025. Client A executed 1 “BUY” trade of Macquarie Warrants on Account 1234567 on 10 April 2025 and executed another 1 “BUY” trade of Macquarie Warrants on Account 2345678 on 2 May 2025. Assuming that both Accounts are meeting other conditions, Customer A will qualify for Cash Credit based on the Account that first traded the Macquarie Warrants. In this case, Customer A will receive S$68 into his POEMS Account 1234567.

Is there a minimum contract value?Yes, the minimum gross contract value per transaction is S$3000. For example, Customer A buys 1 warrant contract of S$3500 during the promotion period, he/she would be eligible for the Cash Credit. Customer B buys 1 warrant contract of S$2500 during the promotion period, he/she would NOT be eligible for the cash credit.

How do I redeem the S$30 Macquarie HK Stock Warrants coupon?1. Log in to POEMS:

Log in to your POEMS account via the POEMS Mobile 3 app and navigate to:

Me > Rewards > Macquarie HK Warrant S$30 Coupon.

2. Exchange the Coupon:

Swipe ‘BUY WITH 1 COIN’ to exchange your coupon.

3. Redeem:

Tap the ‘REDEEM’ button to apply the coupon to your next eligible trade.

4. Trade:

Navigate to the trade page and place a trade on any Macquarie HK stock warrant.

· The trade must be held for at least one night.

· The minimum gross trade value must be S$3,000.

· The trade must be executed by 30 June 2025 to qualify for the S$30 cash credit.

5. Receive Rebate:

Qualifying customers will receive a S$30 cash credit in their trading account within one month after the campaign concludes.

Terms & Conditions

Terms and Conditions1. This promotion is for Customers who trade Warrants issued by Macquarie from 7 April 2025 to 30 June 2025, both dates inclusive (the Promotion Period).

2. Eligibility Criteria for the promotion:

- Customers must not have traded Macquarie Warrants with Phillip Securities Pte Ltd (PSPL) between 2 January 2025 and 6 April 2025.

- At least ONE BUY trade on Macquarie Warrants must be executed within the promotion period.

- Hold the traded Warrant for a minimum of one night.

- Accounts used for trading of Macquarie Warrants must be either Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and/or Share Financing (V) Accounts.

- BUY Trades of the same counter listed in SGX, that are placed on the same trading day on POEMS Trading Platforms using the same payment mode (cash or SRS) with the same Account, are considered as one trade. This is because we only charge one commission for such trade orders. Please refer HERE for more information.

- The reward is limited to the first 200 Customers participating in the campaign.

3. The reward is capped at S$68 per Customer, regardless of the number of Eligible Accounts through which the Customer places Macquarie Warrant trades during the Promotion Period.

4. The minimum gross contract value per transaction is S$3000.

5. Each Customer can only claim the reward once. Customer(s) with multiple Accounts will not qualify for the reward more than once.

6. The Reward will be credited to Eligible Accounts by the end of August 2025.

7. The following Customers are not eligible for this promotion, unless approved by the management of “PSPL”:

- PSPL institutional Customers and corporate Customers

- PSPL Account holders whose Accounts have been suspended, cancelled or terminated

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives including their spouse and direct family members.

8. In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

9. PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all participants.

10. By taking part in this promotion, the participant acknowledges that he/she has read and consented to these Terms & Conditions.

FAQs and T&Cs for SMART Portfolio (YIG)

SMART Portfolio Promo (Young Investor Programme)

Terms and Conditions- This Promotion is valid from 7 April 2025 to 31 March 2026.

- Eligible Customer Types:

- New and Existing Customers of Phillip Securities Pte Ltd (PSPL).

- Aged 18 years old to 25 years old.

- Open and fund a SMART Portfolio Account, with Cash or Supplementary Retirement Scheme (SRS) during the Promotion Period.

- Requirements for the Rewards:

- Open and fund the SMART Portfolio Account with a minimum of S$3,000 to receive a 6-month fee waiver in the form of a Cash Credit (known as Promotional Incentive). Capped at $100 cash credit (Capped Promotional incentive).

- Each Customer is eligible for only one Account per portfolio service type under this Promotion

- The SMART Portfolio Account must be funded within 14 days of the Account opening date.

- Customers will be assessed for eligibility of the Promotion, 30 days after the Account opening date.

- To qualify for the promotional incentive, Customers must maintain their holdings for a minimum of six (6) months.

- Customers who meet the eligibility criteria of the Promotion will receive the Promotional incentive after completing the 6-months holding period from the date the Account is funded.

- For Customers who withdraw funds from their existing SMART Portfolio accounts and re-deposit them into their new SMART Portfolio accounts during the Promotion Period, only the Net Investible Amount (total net of deposits less withdrawals during the Promotion Period) will be considered for the Promotion.

- Withdrawal of funds from one SMART Portfolio Account to top up another existing SMART Portfolio Account during the Promotion Period will not be eligible for the Promotion.

- The Promotional Incentive is non-transferable and non-exchangeable for other items. Should the Promotional Incentive be unavailable for any reason whatsoever, PSPL, in its discretion, reserves the right to substitute the Promotional Incentive with an alternative reward with similar monetary value.

- Days refer to calendar days.

- The following Customers are NOT eligible for this promotion unless approved by the management of PSPL:

- Customers who engage the services of a representative from an external provider (B2B)

- Corporate Accounts, Institutional Accounts, and Joint Account holders

- All employees of PSPL’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Promotional Incentive.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete these Terms and Conditions without prior notification (including eligibility; replacement of the prize; promotional mechanics, promotion duration without prior notification, qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- By taking part in this campaign, the participant acknowledges that he / she has read and consented to these Terms & Conditions.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

FAQs

Who is eligible to participate in the Promotion?The Promotion is valid for individual Customers who are aged between 18 years old to 25 years old, who open and fund a SMART Portfolio Account, with Cash or the Supplementary Retirement Scheme (SRS), during the Promotion Period.

Open and fund the Account with a minimum of S$3,000 to receive a 6-month fee waiver in form of Cash Credit (Promotional Incentive) capped at S$100 Cash Credit (Capped Promotional incentive).

How can I open a SMART Portfolio Account?You can open a SMART Portfolio account through any of the following methods:

- The “Get Started” button on this page

- Phillip MyWealth App > ‘Home’ tab > swipe to SMART Portfolio banner on the top

- POEMS Mobile 3 App > ‘Trade’ tab > ‘Robo’ page > Create New SMART Portfolio

Yes, existing SMART Portfolio Customers can still participate in the promotion. You may do so by opening a new SMART Portfolio account and funding it within 14 days of account opening.

When must I fund my Account to be eligible for the Promotion?The Account must be funded within 14 days of the Account Opening Date.

How can I fund my SMART Portfolio Account?You may fund your SMART Portfolio with Cash or the Supplementary Retirement Scheme (SRS). You may click HERE or refer to the ‘Funding’ tab on the top of this page for the full funding options.

What fund source is eligible to participate in the Promotion?You may fund your SMART Portfolio with Cash or via the Supplementary Retirement Scheme (SRS).

Can I open more than one Account to participate in the Promotion?Yes, you can open multiple SMART Portfolio Accounts. However, only one Account per portfolio service type per Customer will be counted as an eligible Account for this promotion.

When can I get my Promotional Incentive?Customers who meet the criteria of the Promotion will receive the Promotional incentive after the 6-month holding period from the Account Funding date.

Young Investor Programme

Invest in Your Future,

Unlock Your Path to Financial Freedom

START NOW

Invest in Your Future,

Unlock Your Path to Financial Freedom

START NOWCalling all Young Investors out there!

Join POEMS & Enjoy Exclusive Benefits Designed Just for You*!

*Aged 18 to 25 Years old

Calling to all Young Investors out there!

Join POEMS & Enjoy Exclusive Benefits Designed Just for You*!

*Aged 18 to 25 Years Old

Wondering which Investment is Heading to the Moon?

Look no further - Let POEMS break Financial Barriers with You!

US Fractional Shares

Gain Access To Your Dream Companies without breaking the bank!

Enjoy 5 Free US Fractional Trades Every Month (worth US$4.40)!

LEARN MORERobo Advisory

Harness the Power of Tech and Expert Management to Rebalance your Investments - Hands-free!

Enjoy a 6-months Fee Waiver on Us when You Open & Fund a SMART Portfolio!

LEARN MORESMART Park

Not Sure what to Invest yet?

Fund with SMART Park and Grow your Idle Cash while waiting for the Right Opportunity!

SGD 3.379% p.a.

USD 4.000% p.a.

Rates updated as of 10 March 2025

#Based on the average rate of annualised returns over the last rolling week.

Past performance is not necessarily indicative of future performance.

View disclaimer

LEARN MORE

Wondering which Investment is Heading to the Moon?

Look no further -

Let POEMS break Financial Barriers with You!

US Fractional Shares

Gain Access To Your Dream Companies without breaking the bank!

Enjoy 5 Free US Fractional Trades Every Month!

Robo Advisory

Harness the Power of Tech and Expert Management to Rebalance your Investments - Hands-free!

Enjoy a 6-months Fee Waiver on Us when You Open & Fund a SMART Portfolio!

Shares Builders Plan

Start small.

Invest regularly in Stocks, SDRs, ETFs, or REITs at a lower cost, no lump sum needed!

Be one of the first 100 Customers to receive a S$50 Cash Reward when you sign up for Shares Builders Plan!

SMART Park

Not Sure what to Invest yet?

No worries. Fund with SMART Park and Grow your Idle Cash while waiting for the Right Opportunity!

SGD 3.379% p.a.

USD 4.000% p.a.

Rates updated as of 10 March 2025

#Based on the average rate of annualised returns over the last rolling week.

Past performance is not necessarily indicative of future performance.

View disclaimer

LEARN MORE

Baby Steps to Financial Freedom Journey

1

2

3

1

Open Your POEMS Account and opt-in to SMART Park to earn idle cash

2

Opt-in to Fractional Share & Enjoy Your 5 Free Monthly Trades

3

Open & Fund with SMART Portfolio to Enjoy a 6-months

Fee Waiver

Open Your POEMS Account and opt-in to SMART Park to earn idle cash

Opt-in to Fractional Share & Enjoy your 5 Free Monthly Trades

Open & Fund with SMART Portfolio to Enjoy a 6-months Fee Waiver

START NOWLevel Up with Educational Guides

READ NOW

READ NOW

READ NOW

READ NOW

READ NOW

READ NOW

Level Up with Educational Guides

Access Easy-to-Digest Resources that’ll take you One Step Closer to Financial Success.

READ NOW

READ NOW

READ NOW

READ NOW

READ NOW

READ NOW

Link up with Like-Minded Peers and Smash Goals!

Download the POEMS Mobile 3 App and Join our Community Groups Tailored to your Investing Interests!

All about ETFs

Singapore Stocks Investing

SMART Solutions

Symphony Digital Assets

Technical Analysis

US Earnings Calendar

Scan the QR Code to Get Connected

Follow Us on Social Media @PhillipCapital

Stay in the Loop with our Latest News, Valuable Tips, and Exclusive Promotions!

Ready to Invest?

Check Out our Current Promotions to Get Started!

Welcome Gifts

Receive up to S$1,000 Worth of Welcome Gifts when you open an Account and fund.

Referral Programme

Earn up to S$600 in Rewards when you refer your family/friends to POEMS!

START NOWDisclaimer

This advertisement is intended for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell any investment products mentioned herein. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of any investments and the income from them may fall as well as rise. The risk of loss in leveraged trading can be substantial and you could lose in excess of your initial funds.

You may wish to obtain advice from a financial adviser before investing in any investment products mentioned herein. In the event that you choose not to obtain advice from a financial adviser, you should consider whether the investment product is suitable for you. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in investment products.

This is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks including the possible loss of the principal amount invested. Unit trusts distributed by Phillip Securities Pte Ltd (“PSPL”) are not obligations of, deposits in, or guaranteed by, PSPL or any of its affiliates.

The value of the units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in this publication are not necessarily indicative of future or likely performance of any unit trust. You should read the prospectus and product highlights sheet before deciding to subscribe for units in the respective fund. A copy of the prospectus can be obtained from the issuer or PSPL, or online at https://www.poems.com.sg/fund-finder/phillip-money-market-fund-534010/

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

SocGen DLCs 1 April 2025 – 30 June 2025

From 1 April 2025 to 30 June 2025,

receive S$88 Cash Credit when you execute any 2 BUY trades of SocGen DLCs online!

Trade NowWhat is a DLC?

A Daily Leverage Certificate (DLC) is a form of structured financial instrument issued by banks and traded on the securities market. DLCs offer investors fixed leverage of 3 to 7 times the daily performance of an underlying index, be it a rising or falling market. The basic principle is simple – if the underlying index moves by 1% from its closing price of the previous trading day, the value of the 3x DLC will move by 3%.

SGX is Asia’s first venue to offer trading in DLCs, allowing investors to gain fixed leveraged exposure to developed Asian market indices and single stocks. This comes without the features impacting pricing for options such as implied volatility, time decay or margin calls.

DLCs were first introduced in Europe in 2012, where they are also called constant leverage products or factor certificates. They received wide interest from investors in Europe shortly after their launch.

Don't have an Account yet?

Open an Account NowAlternatively, visit any of our Phillip Investor Centres or contact your trading representatives.

Why Trade DLCs?

Leverage up to 7 times the daily performance of an underlying index

Flexibility to trade both rising and falling markets

Low capital outlay and loss is limited to invested amount

No margins. No implied volatility impact. No time decay impact.

Transparent pricing due to tradability of the products on exchange

For more about Daily Leverage Certificates (DLCs), you might refer to here.

Frequently Asked Questions

How do I qualify for the S$88 Cash Credit?To qualify, a POEMS account holder must:

I) Execute at least TWO “BUY” trades on Societe Generale (SocGen) DLCs online between 1 April 2025 and 30 June 2025; and

II) Have not executed any SocGen DLC trades from 2 January 2025 to 31 March 2025.

As a leverage product, Daily Leverage Certificates (DLC) give investors increased exposure to an underlying asset with the potential for higher returns. The leverage of a DLC can be 3, 5 or 7 times. Based on 5x leverage, if the underlying asset, typically a single stock or index, moves 2% in favour from its previous closing price, you earn a 10% gain on the DLC (2% * 5 = 10%). However, if the underlying asset moves in the direction against your position, you could experience a -10% loss.

How do I identify if the DLC listed is issued by Societe Generale?You can identify the Issuer by the name of the DLC. Let’s use the counter Tencent for example. The Tencent DLC name is NUGW – Meituan 5xLongSG250924

|

NUGW |

Counter Code |

|

Meituan (3690.HK) |

Underlying |

|

5x |

Leverage Factor |

|

Long |

Long/Short |

|

SG |

Issuer (SG = Societe Generale) |

|

24092025 |

Expiry Date (YYMMDD) |

Do note that only Societe Generale DLCs will be counted for this promotion.

I have multiple POEMS Accounts, can I claim the rewards more than once?No. Each Customer is only eligible to claim Cash Credit once despite having multiple Accounts. Please see the following example.

Client A has Accounts 1234567 & 2345678 with POEMS. Client A executed 2 “buy” trades of SocGen DLCs on Account 1234567 on 7 April 2025 and executed another 2 “buy” trades of SocGen DLCs on Account 2345678 on 11 May 2025. Assuming that both Accounts are meeting other conditions, Customer A will qualify for Cash Credit based on the Account that first traded the SocGen DLCs. In this case, Customer A will receive S$88 into his POEMS Account 1234567.

Terms & Conditions

Terms and Conditions- This promotion is for Customers who traded Daily Leverage Certificates (“DLCs”) issued by Societe Generale (“SocGen DLCs”) from 1 April 2025 to 30 June 2025 (the Promotion Period).

- Eligibility Criteria for the promotion:

o Accounts used for trading of SocGen DLCs must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts.

o Customers must not have executed any SocGen DLC trades between 2 January 2025 and 31 March 2025.

o At least TWO BUY trades on SocGen DLCs must be executed.

o BUY or SELL Trades of same counter listed in SGX are placed on the same trading day on POEMS Trading Platforms using the same payment mode (cash/SRS) with the same Account are considered as one trade. This is due that we only charge one commission for such trade orders. Please refer to HERE for more information.

- The Reward is capped at S$88 per Customer, regardless of the number of Eligible Accounts through which the Customer places SocGen DLCs trades during the Promotion Period.

- The reward is limited to the first 200 Customers participating in the campaign.

- Each Customer can only claim the reward once. Customer(s) with multiple Accounts will not qualify for the reward again.

- Eligible customers will receive the reward at the end of August 2025.

- The following Customers are not eligible for this promotion, unless approved by the management of “PSPL”:

o PSPL institutional Customers and corporate Customers

o PSPL Account holders whose Accounts have been suspended, cancelled or terminated

o PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives including their spouse and direct family members.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all participants.

- By taking part in this promotion, the participant acknowledges that he/she has read and consented to these Terms & Conditions

FAQs and T&Cs for US Fractional Shares (YIG)

US Fractional Shares Promo (Young Investor Programme)

Terms and Conditions- This Promotion is valid from 7 April 2025 to 31 March 2026.

- Eligible Customer Types:

- New and Existing Customers of Phillip Securities Pte Ltd (PSPL).

- Aged 18 years old to 25 years old.

- Account Types:

- Cash Management

- Margin

- Cash Plus

- Custodian

- Prepaid Custodian

- Eligible Trades:

- Customers will receive 5 free trades per calendar month (resets on the 1st of each month).

- From the 6th trade onward, standard fractional standalone brokerage fees of US$0.88 will apply.

- The promotion applies to Standalone US Fractional Share trades only (i.e. trades involving less than 1 full share).

- Eligible trades include BUY orders placed online via POEMS 2.0 and the POEMS Mobile 3 App only.

- The following Customers are NOT eligible for this promotion unless approved by the management of PSPL:

- Cash Trading Account

- Corporate Accounts and Joint Account holders

- All employees of PSPL’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.