Environmental, Social and Governance (ESG)

Enquiry

Have an enquiry? Get in touch with us at (+65) 6531 1555 or message us below!

Enquiry

Have an enquiry? Get in touch with us at (+65) 6531 1555 or message us below!

Choose your own method

Manage On Your Own

Use our screeners and educational resource to build your own portfolio:

Plan with Our Advisor

Get personalised advice and learn about various options from a dedicated Financial consultated supported by a team of specialist:

ESG Investment through Investment Tools

Exchanged Traded Fund (ETF)

ETFs are open-ended investment funds traded on a stock exchange. ESG ETFs aim to track or correspond to the performance of an underlying index or asset based on the different ESG lens. With hundreds of ESG ETFs and counting on POEMS, you have a wide range of ETF solutions ready to be deployed for your green portfolio

Explore the riches of the ETF world and advance filters powered by Morning Star

Unit Trust (UT)

As the first Unit Trust platform to advocate ESG investing, we strongly believe that you can "Do Well by Doing Good" (Benjamin Franklin's quote) by including a sustainable investment objective into your portfolio. We offer our clients a vast selection of more than 40 ESG unit trust funds that may suit their investment needs.

To simplify your search for ESG funds, select "ESG" under the Sector/Strategy filter in our Fund Finder

Seminars

Hang on tight, more exciting events are coming up!

Meanwhile, Click to view seminars/webinars for Platform, Bond, CFD, ETF, Forex/Futures, Insurance, Unit Trust and more.

LATEST ESG CONFERENCE

Resources

ESG Frequently Asked Questions

Sources: CFA Institute, ESG Issues in Investing (2015)

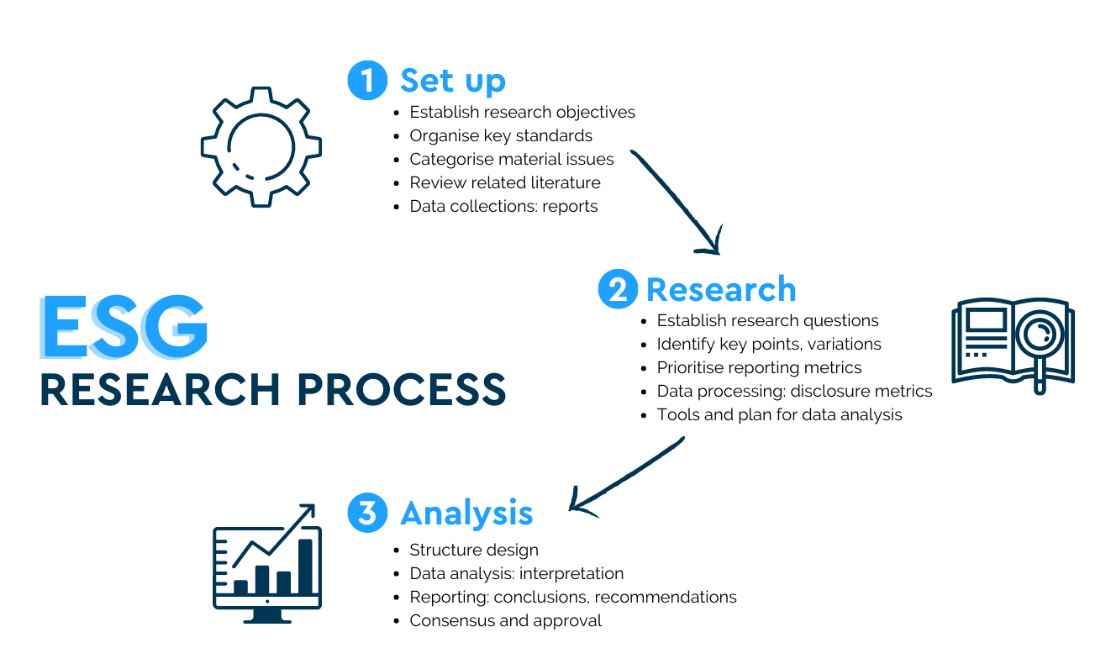

There are a number of ESG standards and principles today.

Numerous institutions, such as the UN Principles of Responsible Investing (PRI), Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and the Task Force of Climate-Related Financial Disclosures (TCFD) are working to form standards and definite materiality to facilitate incorporation of these factors into the investment process.

The evidence is that the long-term performance of ethical funds versus their conventional counterparts is neither better nor worse. There are good and bad ethical funds, just as there are good and bad conventional funds. However, ethical funds tend to focus on certain sections of the market and as a result do not track headline benchmarks such as the FTSE 100 Index. This means that ethical funds can go through periods of both under and out performance relative to these indices, but over the long-term there are reasons why these thematically driven funds could actually perform better, since they are designed to benefit from the opportunities created by climate change, resource pressures and demographic change.

Most ESG investments are designed to focus on solutions to social and environmental challenges. Clean technologies, renewable energy, healthcare, clean water, and waste management all require large amounts of capital, and through our portfolios we are helping to bring about the transition to a more sustainable future.

POEMS provides a wide range of ESG investment products.

For Funds and Exchange Traded Funds, you may use instrument screeners to filter ESG. For Funds, Visit https://unittrust.poems.com.sg/all-about-funds/fund-finder/ > Advance Criteria > Sector/Strategy > ESG.

For ETFs, Visit https://www.poems.com.sg/etf-screener/ > Fund name > Type ESG

You can visit https://www.poems.com.sg/ESG/seminar/ page for the latest ESG seminars

The costs for trading publicly listed ESG ETFs is similar to trading stocks, where the cost incurred will differ according to your account type. More information can be found here: https://www.poems.com.sg/pricing/