3 Major Hong Kong IPOs You May Be Interested In August 10, 2018

In the first half of 2018, there were 108 new stocks listed on the Hong Kong Stock Exchange (HKEX).[1]

Xiaomi, one of the most recent companies to launch an IPO, debuted on the HKEX on 9th July with a listing price of HKD 17 (at the lower range of HKD 17-22); raising approximately USD 4.7 billion. The IPO retail tranche was 8.5 times oversubscribed, with the HKD 17 price per share representing a multiple of around 40 times 2018’s earnings and an expected 23 times 2019’s earnings.

Beyond Xiaomi’s IPO, more than 100 companies, including Meituan Dianping, Haidilao and China Tower are set to make their presence felt on the HKEX. These companies have submitted their applications to HKEX and are expected to list during the second half of the year.

According to Bloomberg, in the first half of 2018, the Hong Kong IPOs raised around HKD 50.4 billion.[2]

With a large number of Science and Technology companies and large cap H-shares planned for listing in the second half of this year, the total amount of funds raised from the various Hong Kong IPOs in 2018 is expected to reach HKD 200 billion or more.

With all this activity making the HKEX increasingly attractive for investors, here is an overview of 3 major Hong Kong IPOs that you may be interested in:

China Tower:

China Tower is the world’s largest telecommunications tower infrastructure service provider. In 2017, China Tower was ranked first amongst the global telecommunications tower infrastructure service providers in terms of the number of sites, number of tenants and revenue. At end-2018, China Tower’s sites were spread across 31 out of 34 provinces in China; with a market share of approximately 96.3% in terms of the number of sites, and 97.3% in terms of revenue.

China Tower generates its revenue mainly from its tower business and Distributed Antenna System (DAS) business. During 2015 – 2017, a substantial amount of operating revenue was generated from China’s Big Three Telecommunications Service Providers – China Mobile, China Unicom and China Telecom; with operating revenue increasing by 22.6% from RMB 55,997 million in 2016 to RMB 68,665 million in 2017. Operating profit margin grew from 9.1% in 2016 to 11.2% in 2017.[3]

China Tower was listed on the HKEX on 7 Aug 2018, with the IPO price at HKD 1.26 per share and Pre-IPO trading day price close at HKD 1.25.

Meituan Dianping:

Meituan Dianping is China’s leading e-commerce platform for services that connect consumers and merchants. Their offerings include, but are not limited to, food delivery, lifestyle and travel services.

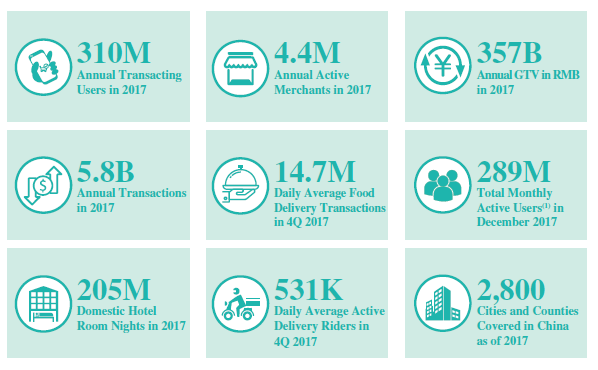

Meituan plays an important role in Chinese consumers’ daily life, serving over 310 million customers. In 2017, Meituan’s on-demand delivery network had an average of approximately 531,000 daily active delivery riders, completing approximately 2.9 million deliveries.

Meituan generates revenue from commissions, online marketing services and other services. From 2015 to 2017, Meituan achieved significant growth, with total revenue increasing by 223.2% from RMB 4 billion in 2015 to RMB 13 billion in 2016 – with a further increase of 161.2% to RMB 33.9 billion in 2017.[4]

The following chart shows the scale of Meituan’s business:

Timeline:

The listing date is expected to be on 20th Sept 2018.

Valuation:

Meituan’s valuation is between HKD 357.5 – 429 billion; corresponding to HKD 60 to HKD 72 apiece.

The offering has attracted five cornerstone investors, including Tencent, with investments coming up to a combined $1.5 billion.[5]

Risk:

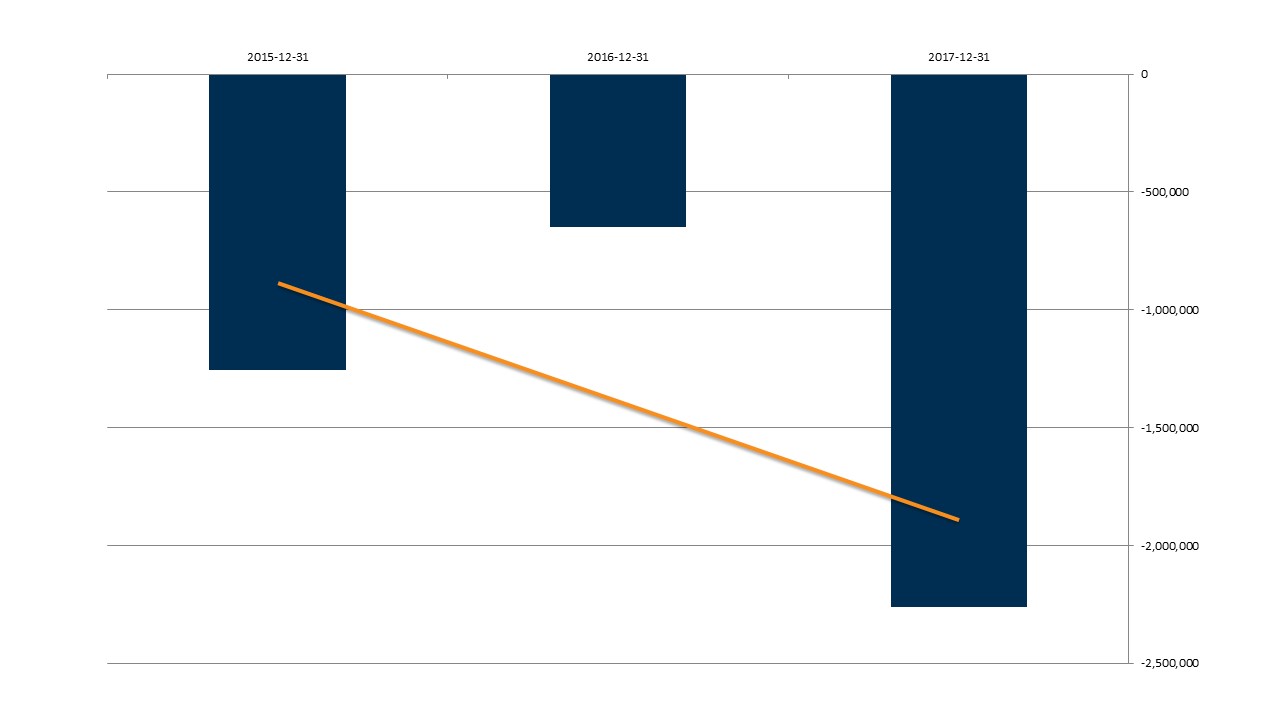

1. The company’s profit is still negative as of now due to the increasing capital expenditure as seen in figure 2.

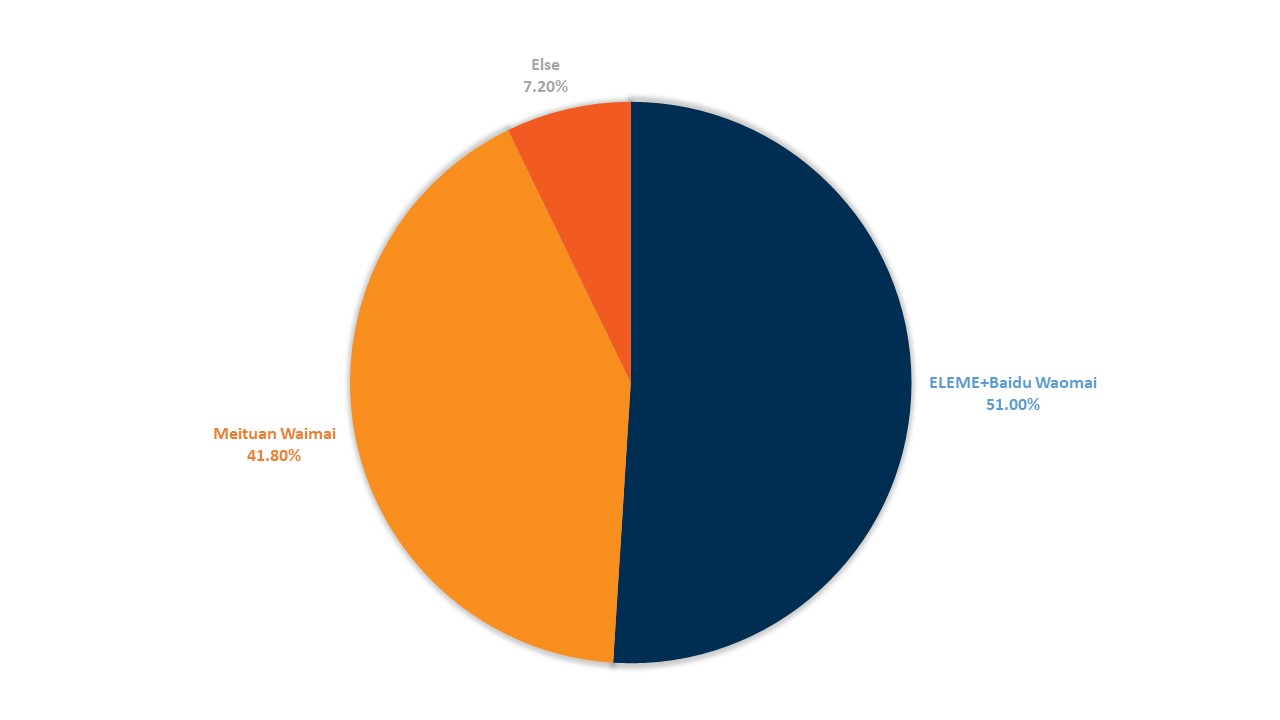

2. Meituan is facing fierce competition from other rival firms in the food delivery industry. With Eleme fully acquiring Baidu Waimai, the takeaway industry has become a two-player game.

Haidilao International Holding LTD.:

Haidilao is one of the leading global and fast-growing Chinese cuisine restaurant brands focusing on hot pot cuisine.

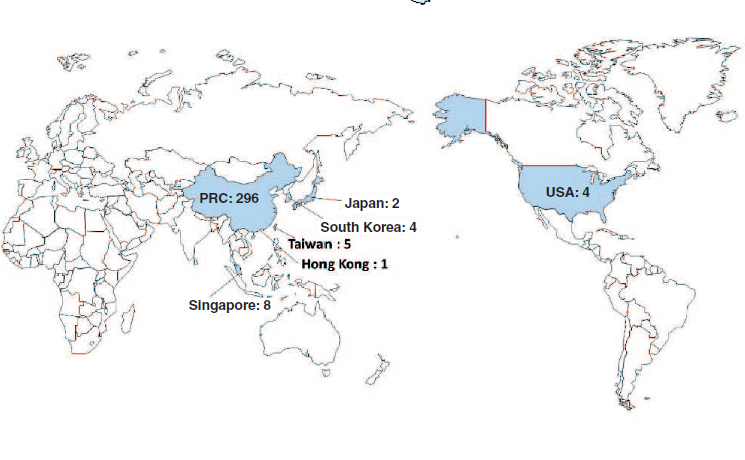

Haidilao serves more than 100 million guests a year, with its global restaurant network growing from 112 in 2015 to 273 in 2017. There are more than 300 Haidilao restaurants around the world, with 296 in the People’s Republic of China, 24 in Taiwan and Hong Kong, with the rest in Singapore, Japan, South Korea and USA. It is worth mentioning that there are a total of 8 Haidilao restaurants in Singapore – nearly a third of Haidilao restaurants located outside of China, Taiwan and Hong Kong.

Haidilao generates revenue from its restaurant operations (over 90%), delivery business and sales of condiment products. Haidilao‘s revenue increased by 35.9% from RMB 5,756.7 million in 2015 to RMB 10,637.2 million in 2017, while profit increased by 70.5% from RMB 410.7 million in 2015 to RMB 1,194.3 million in 2017.[6]

Timeline:

The listing date is expected to be on 26th Sept 2018.

Valuation:

Haidilao plans to raise $7 to 10 billion through this IPO, with a market capitalization of approximately USD 90-120 billion.

CIC, BlackRock, Fidelity, Hillhouse Capital and China Life Insurance are expected to become cornerstone investors for Haidilao’s IPO.[7]

Trade HK shares one day before their official listing!

Interested in trading the above stocks? You may do so one day before their official listing with our new Hong Kong Pre-IPO market offering!

What is Pre-IPO Trading?

Phillip Securities is proud to be the first broking house in Hong Kong and Singapore to offer customers this trading channel. The Pre-IPO market typically takes place one day before official listings. The list of counters eligible for Pre-IPO trading can be found here.

Due to lower levels of transparency and volume, performance of stocks in the Pre-IPO Trading session should not be considered an indicator of its price and demand in the official trading session.

Pre-IPO Trading Hours

Trading hours for the Pre-IPO session are usually from 4:15pm to 6:30pm. In the event of half-day trading, hours will be from 2:15pm to 4:30pm.

All timings stated are in SGT.

If you would like to know more, do visit: https://globalmarkets.poems.com.sg/markets-we-offer/hong-kong-pre-ipo/?utm_source=MarketJournal&utm_medium=Referral&utm_campaign=3%20Upcoming

Information is accurate as of 5 September 2018

Reference:

- [1] https://www.bloomberg.com/news/audio/2018-07-04/hong-kong-on-track-for-record-smashing-ipo-year

- [2] https://www.yicai.com/news/5436597.html

- [3] http://www.hkexnews.hk/listedco/listconews/sehk/2018/0725/LTN20180725011.pdf

- [4] http://www.hkexnews.hk/APP/SEHK/2018/2018062202/Documents/SEHK201806250005.pdf

- [5] https://www.bloomberg.com/news/articles/2018-09-01/meituan-said-to-set-terms-for-up-to-4-5-billion-hong-kong-ipo

- [6] http://www.hkexnews.hk/APP/SEHK/2018/2018051601/Documents/SEHK201805170005.pdf

- [7] https://36kr.com/p/5150669.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jieyuan Zheng

Investment Analyst

Phillip Securities Research

Jieyuan Zheng is an investment analyst in Phillip Securities Research, focusing on the China and Hong Kong markets as well as China stocks listed in America. Jieyuan Zheng holds a Master Degree in Finance from Nanyang Technological University (NTU), and Bachelor Degree in Information and Computing Science from Minzu University of China.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile