3 Possible Black Swan Events in 2021 January 25, 2021

What this report is about:

- New strains of COVID-19 have been reported, prompting vaccine developers to test if current solutions are effective against the mutations.

- Geopolitical tensions still pose a threat to global economies.

- The “seemingly crazed idea” of a US$ collapse in a post-pandemic world is not so crazy anymore, according to Yale University economist, Stephen Roach.

- Historically, though, equity markets have a knack for bouncing back from major crises.

Black swan events are events that are beyond prediction and usually come with severe consequences. While rare and unpredictable, Nassim Taleb – who developed the black swan theory – has advised investors to plan for uncertainties, be it through diversification or greater caution in trading.1

In March 2020, stock markets melted down fast and furious as the world locked down to contain the spread of COVID-19. Major stock indices lost 30-40% from their highs in just one month. The pandemic has gone down in history as the black swan event of 2020! US market circuit breakers were triggered four times within two weeks during the March crash. Miraculously, stock markets recovered swiftly to hit new all-time highs at end-2020.

With the current vaccines looking promising and the completion of the presidential transition in the US, market confidence is gathering momentum, even as daily COVID-19 cases continue to climb. While stock markets remain strong, it is always good to understand the risks and uncertainties to prepare for the rainy day.

1. Virus mutations

2020 was an extremely painful year. Thankfully, various vaccine trials had produced results in November and approval for a few was granted by the FDA in December 2020. While light has started to shine at the end of the tunnel, the COVID-19 virus may mutate further and current vaccine immunity may become ineffective. What’s more, the West has entered winter, which is an active season for viruses. The new strains of COVID-19 are apparently more infectious. Though current vaccines are said to be effective against the new strains, testing is still underway.2

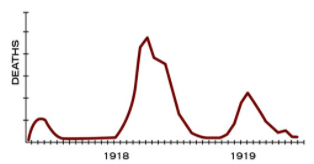

COVID-19 has been repeatedly compared to one of the deadliest pandemics in recent human history: the Spanish flu. This flu started in 1918 during World War I and infected about 500 million people in three waves. The first wave subsided during the summer of 19193 but a highly fatal second wave peaked in the fall of 1918. Yet a third wave peaked in the winter of 1919. Cooler weather was believed to be one of the causes. Thankfully, we have much more advanced biotechnologies today to help us combat viruses, though they keep mutating and adapting.

Source: US Centers for Disease Control and Prevention

Source: US Centers for Disease Control and Prevention

If new mutations become even more infectious and deadlier, lockdowns may return in full force. Scientists may need more time to develop new vaccines. People will be asked to stay at home again, which is happening in some countries now. Countries may even resort to calling states of emergency, with troops mobilised to control movements. More businesses will shut down and more jobs lost. All these on top of precious lives lost.

2. Political unrest and geopolitical tensions

An event that we talked about in Black Swan Events 2020 and are including again this year is political unrest. Yes, a world war is highly unlikely to happen but if it does, could lead to a complete collapse of the world economy. Infrastructures will be destroyed and economic production and exchange come to a standstill. Breakdowns in global supply chains and spikes in demand will cause the prices of commodities to shoot through the roof. Governments will have to direct money to fund the war, leaving little or no funds to help people survive. Unlike wars in the past when troops were sent for land conquests, today’s wars tend to focus on gaining economic or intelligence benefits. They can also start in the form of cyber wars.

This year’s political unrest started with the Washington D.C. attack on 6 January 2021 by Trump supporters. Any escalation of their aggression may cause permanent rifts in the US society. Externally, US tensions with Iran have not gone away. Conflicts in the Middle East are a perennial problem. There have been sporadic attacks on oil vessels and tankers, with Iran allegedly behind them. Over in Asia, border disputes between China and India reared their head again in 2020. The South China Sea is another battleground as China and the US compete for influence in the region.4

We could come close to a real war if these threats and tensions are not handled properly. Even before any outbreak of war, the underlying fears and uncertainties could spark broad market sell-offs. The margin of error is narrower when tensions run higher.

3. Fall of US$ and credit crunch

While the idea of a drastically depreciated US$ sounds crazy, this is not the first time it has been mooted. Yale University economist Stephen Roach now thinks the US$ could collapse by the end of 2021. He predicts a more than 50% probability of a double-dip recession in the US should that happen.5

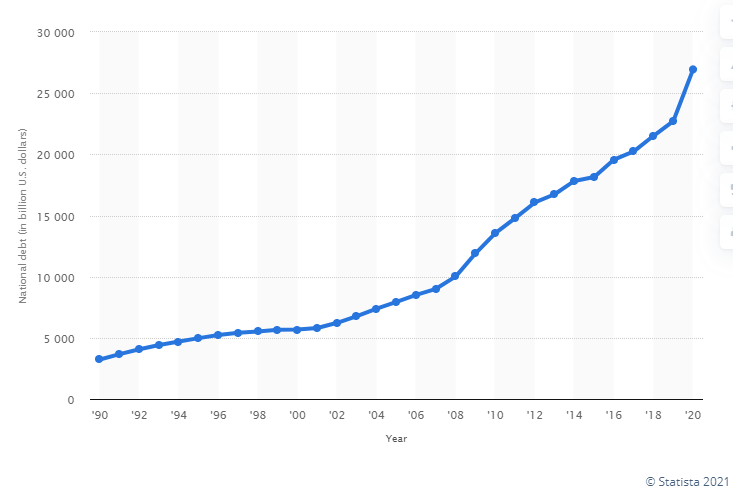

To counter the economic fallout of COVID-19, the US government has been running a huge deficit to bankroll big stimulus. The Fed has cut interest rates all the way down to 0%. Stock markets responded quickly with a V-shaped rebound from their low points in March 2020 as easy money returned. Meanwhile, US public debt ballooned to US$27tr by September 2020, nearly a 20% increase from the previous year. US debt to GDP ratio is now above 120%.6

If the world loses faith in the US$, the American government and the Fed could find it difficult to get hold of more credit lines to roll over existing debt. Debt holders will demand higher interest to compensate for higher risks. Demand for US Treasuries may diminish, pushing down the dollar further. A vicious cycle will form, which could trigger the next credit crunch. The US market could lose access to cheap money to fund business expansion and investment projects.

With debt at a record high and interest rates incredibly low, the central bank risks running out of bullets soon, for propping up the economy. The US government will face sovereign default risks when insufficient money is printed. This could launch its economy into total chaos.

What are the possible black swan events with less severe impact?

There are smaller possible black swan events that could affect markets less severely than the three mentioned above.

We have identified three:

Synchronised cyber hacks. Governments, businesses and individuals have been digitalising at an unmatched pace since the outbreak of COVID-19. This has heightened cyber-security risks. If a digital bank is hacked, depositors’ funds are at stake. If the security of an Internet service provider is breached, huge disruptions will be caused to the operation of all services that rely heavily on Internet connections. In today’s world, this means nearly all services!

Terrorism. Terrorist activities worldwide seem to have waned in recent years. In part, that was due to countries’ increased efforts to snuff out radicalism since 911. While it is not possible to eliminate terrorism completely, with all the stricter anti-terrorist measures in place and greater vigilance, the impact of an attack should be scaled down. However, this does not mean there won’t be another 911.

Bankruptcy of big companies. Too big to fail? Think again. Modern businesses now focus on client acquisition and revenue growth instead of profitability. Many big companies are burning cash either through debt or equity funding to pursue uninterrupted revenue growth and boost their client base. But credit lines could dry up one day when access to easy money is reduced. What if a company can no longer get its hands on funds? Losses could force them into bankruptcy. Contagion may put all the other companies with similar operating models at risk.

We also flag three other risks that may happen or are already happening, though their impact on markets should be minor:

US-China trade war. The US-China trade war started with the US imposing tariffs on steel and aluminium from China in March 2018. In tit-for-tat responses, both countries slapped tariffs on different products throughout the year. The war escalated and affected many businesses in the next two years. Three years on, markets have become immune and businesses seem to have found ways to cope.

Chinese antitrust probes. On 24 December 2020, China launched an antitrust probe into Alibaba, signalling its determination to curb the disorderly expansion of its big tech companies. Alibaba’s share price nose-dived on news of the investigation. Enhancing anti-monopoly rules remains the top priority of Mr Zhang Gong, the head of China’s State Administration for Market Regulation, in 2021.7 Fellow tech juggernauts like Tencent, Baidu, JD etc. are not expected to be spared. With many of them listed in the US, these companies are big enough to have some impact on global markets.

Biden’s health. The oldest US president on record, Joe Biden is 78 years old. Donald Trump tried to make an issue of this throughout his election campaigning, calling him “Sleepy Joe”. Although Biden was declared “healthy, vigorous” in his latest medical assessment and deemed fit to take over the job,8 the media and public continue to express reservations.

What can you do?

Black swan events, which are low-probability but high-impact, are almost impossible to predict. As such, Taleb believes the important thing is not to predict such events but to build robustness against negative events or what he calls “antifragility”.9

And as equity markets have demonstrated throughout history their knack for bouncing back from major crises, investors would do well to stay the course in their investments. You may practise regular investing by using the POEMS Share Builder Plan or Recurring Plan. In addition, whenever there were black swan events such as a war or financial crisis in the past, gold and precious metals came to the rescue as defensive assets. Not forgetting the traditional defensive sectors, which may also help you hedge your portfolios!

Join our Global Markets Investing Community on Telegram and share with us other black swan events that you think may happen in 2021.

Reference:

- [1]Taleb, Nassim Nicholas (2007), The Black Swan: The Impact of the Highly Improbable

- [2]https://abc7news.com/covid-uk-new-strain-of-vaccine-effectiveness-stain/8988644/

- [3]https://www.cdc.gov/flu/pandemic-resources/1918-commemoration/three-waves.htm

- [4]https://www.agcs.allianz.com/news-and-insights/expert-risk-articles/shipping-2020-geopolitical-tensions.html

- [5]https://www.cnbc.com/2020/11/30/virus-is-leading-to-double-dip-recession-dollar-crash-stephen-roach.html

- [6]https://www.statista.com/statistics/187867/public-debt-of-the-united-states-since-1990/

- [7]https://www.scmp.com/tech/policy/article/3117215/after-alibaba-probe-antitrust-top-2021-agenda-chinas-top-market

- [8]https://www.nbcnews.com/politics/meet-the-press/blog/meet-press-blog-latest-news-analysis-data-driving-political-discussion-n988541/ncrd1103456#blogHeader

- [9]https://fs.blog/2014/04/antifragile-a-definition/

- https://en.wikipedia.org/wiki/The_Black_Swan:_The_Impact_of_the_Highly_Improbable

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Allen Tan

Senior Dealer

Allen graduated from Nanyang Technological University with a Bachelor’s Degree, majoring in Economics with a minor in Business. He joined Phillip Securities in 2016 as an Equity Dealer in the Global Markets Team. He specialises in the US and Canada market and also supports the UK and Europe market.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!