5 Possible Black Swan Events In 2020 January 13, 2020

Black Swan is a term used to define an event that is beyond prediction at the point it occurred and usually comes with severe consequences. While black swan events are rare and unpredictable, Nassim Taleb stated in his book that it is still important to anticipate such events and make plans accordingly1.

The U.S. subprime mortgage crisis in 2008 within a few months. Based on historical observation, a cycle typically lasts for 8 to 10 years and the market will likely enter the bear session of economic cycle thereafter. However, the stock market is both on its longest bull trend ever and creating new all-time highs. While the economic data and market remain strong, investors are getting worried about the risk and uncertainties that come with the next crisis.

Key highlights

- A financial crisis usually starts with a break in the credit chain

- Can Trump claim his second term of presidency? His failure may cause some of his pro-business policy to roll back

- Escalated tension amongst the world’s two largest economies will eventually involve other countries due to the affected world trade

- Snowball effect happens as a result of downward revaluation of IPOs and start-up Unicorns companies, thereby affecting their companies that back them

- War in modern days no longer involves the conquest of territories but the possession of economic benefits and Intel but with more catastrophic impact than a physical warfare

1. Potential Credit Crunch and Inverted Yield Curve

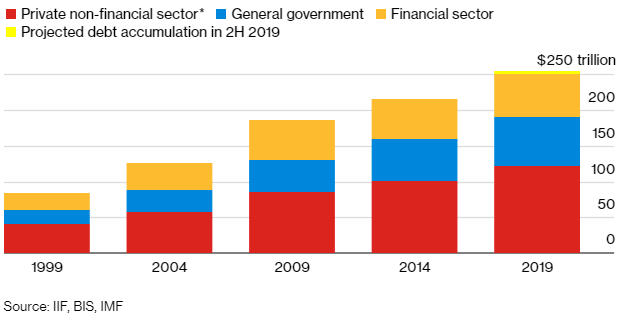

Market is still on the Bull Run whilst flooding with easy money – investors are investing with margin, corporates have easy access to low rate fund, governments are running deficits and central banks pursuing expansionary monetary policy. This resulted in the world getting into record high debt of approximately $250 trillion2. The following chart indicates the increase in debt over the years since 1999:

Every recession starts with an event that sparks fear and uncertainty in the market. It then triggers the credit crunch or break in credit chain. If the market loses access to cheap money to fund expansion, margin positions will be forced to close and private investment projects will be stalled. Governments and central banks will end up getting more credit lines to allow projects to continue running. We have witnessed the increase in debt ceiling by the U.S. government and the cut in interest rates by the central banks, with some even getting into negative territory. Thus, the European Central Bank President Christine Lagarde urged goverments to borrow more for projects 2 With a debt at record high and interest rates being incredibly low, it leaves one to question the sustainability of economic growth and credit snowball. This poses a problem when the central bank might end up being “out of bullet” if the rate is in negative territory and the government faces sovereign default risk when insufficient money is printed.

In May 2019, the yield of the 3-month treasury was above the 10-year yield which resulted in an inverted yield curve and fear spreads among investors. The 3-month yield was above the 10-year yiled by 51 basis point in August 2019, marking the greatest inversion3. Having predicted the past seven recessions, the inverted yield curve is now showing signs of danger. According to Prof Campbell Harvey the inventor of the inverted yield curve as a recession indicator, inversion usually points to a downturn of about 6 to 18 months in the future. If this forecast is true, recession might happen in year 2020.

2. 2020 Presidential election

An upcoming major event that will happen in U.S. is the presidential election held on 3rd November 2020 (click here to read on the Key Events for 2020). The election will kick off with a series of primary elections and caucuses from January 2020 to July 2020. A slate of delegates will be selected to the party’s nominating convention to elect their party’s nominee, before both parties come together to hold the national convention and official election. The market will be impacted as companies have to react accordingly to the changes in policies implemented.

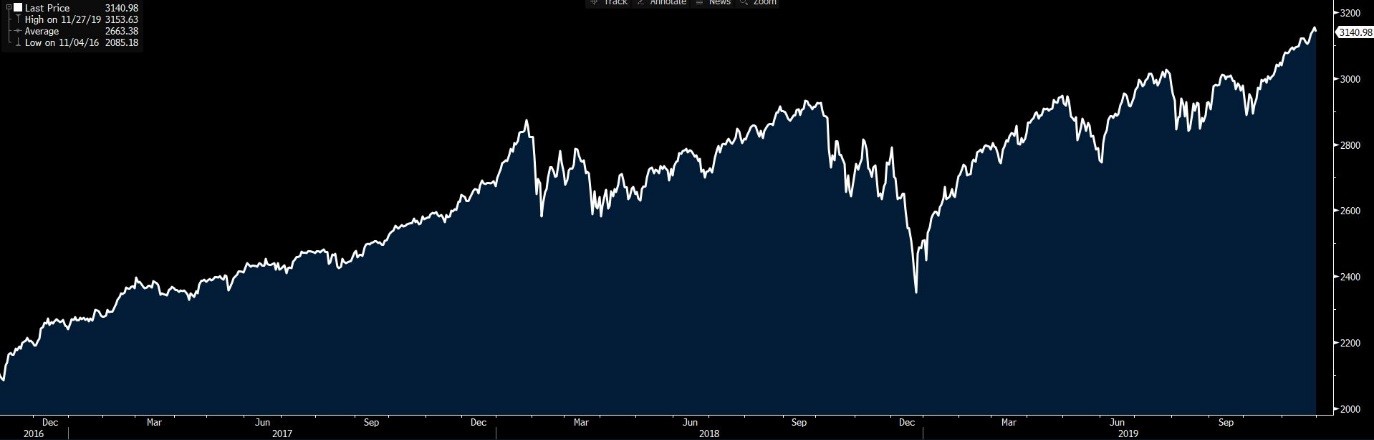

In 2016, the stock market indeed hit right to the rock bottom on the election night when Donald Trump was positioned to win over Hillary Clinton as predicted by the popular investors or fund managers. Fortunately, losses were recovered immediately after Donald Trump delivered his first presidential speech the next day. The stock market has been performing astonishingly well thereafter. The S&P 500 index rose more than 1,000 points from approximately 2,100 points in 2016 to over 3,200 points at the end of 2019, around 50% increase in total and/or approximately 14% annual return4.

S&P 500 Index, Source: Bloomberg

Today, people are discussing whether the market will go haywire The next topic of discussion many focused on is the market performance in the event Donald Trump fails to win his second term, leading to Elizabeth Warren becoming the next president. The rising stock market is largely due to Donald Trump’s pro-business policies such as lowering of corporate tax, bringing manufacturing back to the state and demanding USD depreciation which improves the trade deficit and export. The momentum might lose its steam should Donald Trump loses the 2020 election.

Furthermore, Elizabeth Warren’s plan is heavily focused on developing renewable energy, reforming the healthcare system as well as breaking up the big technology companies 5. She has plans to implement a wealth tax on the ultra-rich to narrow the income equality. Her policies might benefit some, but will impact the firms in the Bull Run, i.e. technology firms, negatively.

Trump’s loss and Warren’s changes in the policies could potentially lead to fluctuations in the stock market.

3. U.S.-China relationship

The relationship between the world’s two largest economies, United States and China, is still causing the world to be on its feet. While it is ideal to see the two economies cooperating, competition between the US and China is still ongoing. The market performance is almost entirely dependent on the playout of discussions held by both parties. To date, the trade war has been the most concerning issue in the past 2 years and the stock market moves volatilely whenever related news is published.

The trade war started with the U.S. imposing tariff on steel and aluminium in March 2018, leading to both countries imposing tariff on different products throughout the year. The trade war subsequently escalated and affected many businesses. The U.S. further banned some of the Chinese companies like Huawei from doing businesses with the U.S. entities while China maintained its own “unreliable entities” list that made it difficult for the U.S. firms to survive in China 6. Despite the meetings and talks held between the two, uncertainties remain with the situation looking mostly gloomy.

According to International Monetary Fund (IMF), Georgieva forecasted the world’s Gross Domestic Product (GDP) to be reduced by US$700 billion by 2020 due to the trade tension between U.S. and China 4. Many other countries with close ties to the U.S. and China received negative repercussions as a result of this trade tensions. This is highlighted when U.S. imposed tariff and negotiated new trade deals with the Europe, Mexico, Canada, and other Asia countries like Japan and India.

The world will be keeping a close eye on the deal between the U.S. and China because it may affect and involve many other countries should they fail to come to an agreement. The impact will be largely significant on countries and firms that rely heavily on global trade.

4. Valuation crisis

Investors are questioning the excessive valuation of start-up unicorns after the recent initial public offering (IPO) failure of WeWork. Both Uber and Lyft which had their IPO earlier this year are now trading way below their offering price. Funded companies are investing with a focus on high growth rates in the long run to become profitable. These companies are also exchanging cash for popularity or market share.

The well-known tech investment firm, SoftBank was faulted by its investors for fuelling this bubble. SoftBank’s Vision Fund assisted young companies in out-competing their rivals by providing them massive funds and increasing their valuations. With a higher valuation compared to the market, Softbank was regarded as the exit of choice by venture capitalists who were ready to take profits7. Thus, if their IPO fails and the SoftBank stops the investment flow, it will probably be an ending point for the start-up company. WeWork definitely falls into such situation where its original value dropped from US$70 billion to US$47 billion and to US$15 billion prior to withdrawal from IPO. WeWork was poised to run out of cash and will not survive through 2019 if Softbank did not come in to rescue 8.

| Sector | Company |

| Enterprise | Automation Anywhere, Cambridge Mobile Telematics, Cohesity, Globality, Gympass, MapBox, Osloft, Slack |

| Fintech | C2FO, Creditas, Greensill, Kabbage, OakNorth, OneConnect, Paytm, Policy Bazaar, ZhongAn Insurance |

| Frontier Tech | Arm, Brain Corp, CloudMinds, Energy Vault, Fungible, Improbable, Light, Petuum, Zymergen |

| Health Tech | 10x Genomics, Collective Health, Guardant Health, Ping An Good Doctor, Ping An HealthKonnect, Relay Therapeutics, Roivant, Vir |

| Real Estate | Clutter, Compass, Katerra, OpenDoor, View, WeWork |

| Logistics | Koubei, Auto1, Delhivery, Didi, DorDash, Fair, Flexport. Full Truck Alliance, Getaround, GM Cruise, Grab, Guazi, Loggi, Nauto, Nuro, Ola, Rappi, REEF, Uber, Uber ATG, Zume |

Source: Softbank Vision Fund

Revaluation of these IPOs and unicorn may not have great and immediate impact for the listed and well-established company but it could reduce the IPO activity and funding of those company at seeding stages. The companies that back these IPOs and unicorn like Alibaba, Alphabet, and Softbank will inevitably face doubts from its investors. In fact, there are more crosslink and highly complex structures between businesses nowadays which could cause a snowball effect. It might destroy the credibility of investment banks and venture capital in valuation, and lead to the restructuring of investment banking or venture investment arm by many financial institutions. As the fear and revaluation mood spread on, many listed companies will be affected due to the high P/E ratio (Price–earnings ratio) that many technology firms are trading. The NASDAQ Composite Index will likely take a hit if this happens.

5. Geopolitical tension and war

A war, be it internal or external, leads to a global catastrophic collapse with devastating results; infrastructures are destroyed and economic activities become disrupted. Breakdown in the global supply chain of commodities and spike in demand will cause the price of commodities to spike, as people struggle to survive. The government will then direct money to fund the war, leaving little or no funds for other profitable projects.

Unlike wars in the past where troops are sent for land conquests, wars today focus on gaining economic or intel benefits and can start in the form of cyber wars. Some of the recent geopolitical tensions that may lead to a war are the North Korea’s refusal to denuclearise, Middle East tension, Hong Kong’s unrest as well as South China Sea dispute. In fact, we are already seeing some civil wars going on in some of the Middle Eastern countries. The oil plant in Saudi was attacked by drones and Iran being blamed for it. Furthermore, Donald Trump recently signed a bill deemed as an action backing the Hong Kong protestors worsening the strained relationship with China. This may however deepen the ties between China and Russia as they work together against the West.

We could come close to a real war if the threats and tensions are not handled properly, which would lead to fears and uncertainties in the financial market, resulting in a broad market sell off.

In conclusion

A black swan event is a plausible event that cause an uncertainty with catastrophic consequences. Based on past evidence, when there is a black swan event such as a war or financial crisis, gold and precious metal will act as a defensive asset. In addition, the traditional defensive sectors may also act as hedge for your portfolio.

Come join our SG Trading telegram chat group and share with us as well as fellow investors on other likely black swan events you think may happen in 2020.

Reference:

- [1]Taleb, Nassim Nicholas (2007), The Black Swan: The Impact of the Highly Improbable

- [2]https://www.bloomberg.com/news/articles/2019-12-01/the-way-out-for-a-world-economy-hooked-on-debt-yet-more-debt

- [3]https://www.marketwatch.com/story/heres-what-a-positive-yield-curve-may-mean-for-the-us-economy-2019-10-16

- [4]Bloomberg

- [5]https://www.cnbc.com/2019/10/26/investors-guide-to-stock-picking-under-president-elizabeth-warren.html

- [6]https://www.china-briefing.com/news/the-us-china-trade-war-a-timeline/

- [7]https://asia.nikkei.com/Spotlight/Cover-Story/Fallout-SoftBank-s-next-big-crisis-may-be-brewing-in-India

- [8]https://theconversation.com/fallout-from-weworks-failed-ipo-shows-the-folly-of-excessive-valuations-125014

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Allen Tan

Senior Dealer

Allen graduated from Nanyang Technological University with a Bachelor’s Degree, majoring in Economics with a minor in Business. He joined Phillip Securities in 2016 as an Equity Dealer in the Global Markets Team. He specialises in the US and Canada market and also supports the UK and Europe market.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap