5 Featured ETFs Listed on SGX to Build your SRS ETF Portfolio September 14, 2022

Exchange-Traded Funds (ETFs) have become a popular investment tool over the years as they provide diversity, flexibility and lower costs. Currently, there are 53 ETFs listed on SGX that span across different asset classes. Investors can choose to pay with cash or invest with their funds in their Supplementary Retirement Scheme (SRS) accounts. The latter allows account holders to enjoy a dollar-for-dollar tax relief as they reap investment gains from the ETFs they invest in.

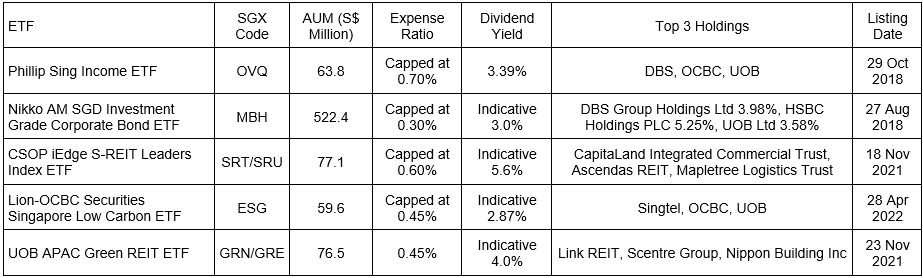

Here are 5 Singapore-listed ETFs that you may find suitable for your investment needs.

The Phillip Sing Income ETF (OVQ) caters to yield seeking investors, while providing exposure to Singapore stocks. Dividend, paid out on a bi-annual basis, is at about 5.0% estimated gross dividend yield, based on index performance before expenses and costs. The Phillip Sing Income ETF tracks the Morningstar Singapore Yield Focus, which comprises 30 high quality dividend companies listed on SGX. Looking at the index constituents, you will see many familiar names that are also in the Straits Times Index (STI), such as the three local banks – UOB, DBS, OCBC and telecommunications companies like – StarHub and Singtel.

Compared to the STI, the Singapore Yield Focus index appears to be more defensive and conservative. Although both indexes appear to be similar at first glance, the latter has more weightage to REITs and the telecommunications sector, which generally has more consistent dividend and yield. The STI has a larger weightage on the three local banks. The market capitalisation weighted method that the STI adopts results in the three banks occupying over 40 per cent of the index. The higher weightage of the three banks acts as a double-edged sword, as what happens to OCBC, UOB and DBS impacts the index. On the other hand, the Phillip Sing Income ETF, Morningstar Yield Focus has a cap of 10 per cent per stock to prevent over-concentration.

Nikko AM SGD Investment Grade Corporate Bond ETF (MBH) is an ETF that provides exposure to SGD corporate bonds and complements equity ETFs in your portfolio. Nikko AM SGD Investment Grade Corp Bond ETF is also Singapore’s first investment grade corporate bond ETF. It provides easy access to Singapore dollar-denominated corporate bonds, which usually require a minimum investment of S$250,000. Singapore-based investors are subject to currency risk if they have a bond that is foreign currency denominated, such as HKD or USD. This is especially important to note as during times of market uncertainty, currency fluctuations may greatly diminish investment returns. For the Nikko AM SGD Investment Grade Corporate Bond, where the fund is SGD-denominated, the currency risk is less of a threat. In addition, the SGD has proven to be a relatively stable currency.

CSOP iEdge S-REIT Leaders Index ETF (SRT) offers a stable and competitive dividend yield, while catering to investors looking to hedge against inflation. It also provides exposure to reputable local REITS such as CapitaLand Integrated Commercial Trust, Mapletree Logistics Trust, and Ascendas REIT. One of the advantages of CSOP S-REIT ETF is the competitive management fee of 0.50% with a cap of 0.80%. With the relaxation of COVID-19 measures in Singapore, people are gradually returning to the office and going to shopping malls more often. This implies that we may see an increase in the need for both commercial and retail properties in Singapore. The iEdge S-REIT Leaders Index, is comprised of about two- thirds geographical allocation in Singapore, with the remaining holdings spread across the APAC region – Australia, United States, Hong Kong and Japan. This ensures that investors get portfolio exposure to regional REITs with a focus on Singapore REITs.

The Lion-OSPL Singapore Low Carbon ETF (ESG) works as a great tool that enables you to decarbonise your portfolio, providing exposure to 50 Singapore based companies with lower carbon footprints. Out of the top 10 holdings of the index that the ETF tracks, eight of them are SGX-listed blue chip stocks such as UOB Ltd, DBS Group, Singapore Exchange, Singtel and Wilmar International. It is suitable for investors who are interested in a green portfolio while maintaining exposure to the Singapore equities market.

The UOB APAC Green REIT ETF (GRN) is another prominent ESG ETF, and is the world’s first ETF that tracks the iEdge-UOB APAC Yield Focus Green REIT Index. The index comprises a basket of 50 REITs listed across the region, and delivers a healthy dividend yield through investments in the APAC region including Japan and Australia. The index also has a weightage cap of 7 per cent per company to ensure diversification without over exposure to a single stock. The REITs that make up the index were chosen based on the attributes set by GRESB’s Real Estate ESG assessment, while fulfilling the minimum liquidity requirements. The UOB AP Green REIT ETF supports green buildings within the real estate sector.

Portfolio construction using ETFs and SRS

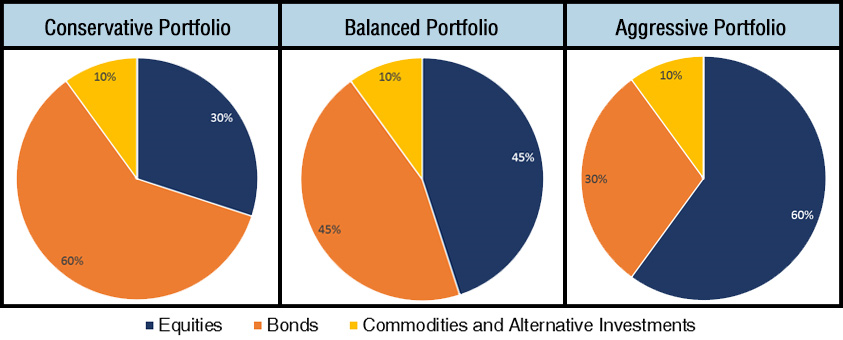

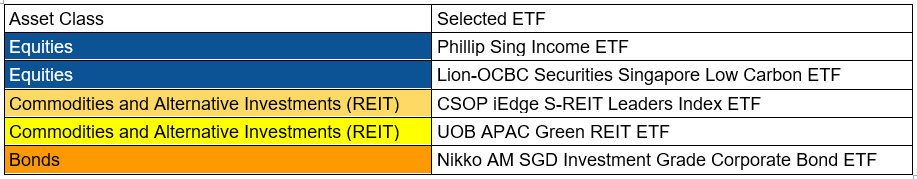

You can start building your ETF portfolio today with the five selected ETFs. An investment portfolio is a collective financial asset comprising of different asset classes – stocks, bonds, cash or alternative investments. An alternative investment is one that does not fit into the typical conventional income/equity/cash category.

A prime example of an alternative investment is a REIT, which serves to provide diversity to a portfolio consisting of traditional stocks and bonds.

The importance of good portfolio construction is that it provides a healthy balance between risk and return. You can structure your portfolio according to your investment needs and risk appetite. Here are a few model examples of portfolio construction based on different needs and risk appetite.

Make use of idle SRS funds in your SRS account through investing in ETFs. The interest earned in the SRS account is only 0.05%, whereas ETFs generally offer a higher return (ROI). Contribution to the SRS account will also enable you dollar for dollar tax relief of up to $15,300 maximum contribution. Buying ETFs using cash means you are tying up liquid funds for a longer term investment, whereas SRS funds is more suitable for retirement planning.

Asset Class Breakdown of the 5 ETFs

You can start building your ETF portfolio today with any of the five selected ETFs. Make use of the benefits of diversification to help alleviate the risks of market fluctuations through reducing the volatility of portfolio performance. Economic cycles mean that the performance of different asset classes varies.

By spreading out your exposure across different asset classes, a gain in one asset class within your portfolio may offset the downturn in another, therefore providing a level of portfolio stability.

The five ETFs listed above are part of our ETF National Day Campaign. From now until 31 October 2022, receive up to S$ 57 cash rebate when you trade five selected ETFs. Terms and conditions apply.

For any enquiries, please email ETF@phillip.com.sg

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Marcus Teo

ETF Specialist

Based in Singapore, Marcus is responsible for developing and building Phillip Securities' ETF business. He works closely with ETF asset managers for distribution opportunities. He also educates retail clients on ETF through hosting ETF webinars and writing market journals. Marcus holds a Bachelor of Economics from the National University of Singapore.

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Investing in Unit Trusts with POEMS

Investing in Unit Trusts with POEMS