A Good time for Gold: 3 Reasons to Buy Gold – Inflation, Negative Yield and Debt trap (2021 edition) October 7, 2021

Summary

- Unprecedented fiscal and monetary stimulus may have averted a global economic crisis, but it comes with its own set of issues in the form of potential runaway inflation.

- Inflation is explored in three parts and may not be as transitory as the US Federal Reserve would like us to believe.

- We explore negative yields and its inverse relationship with gold

- The US Federal Reserve is caught between a rock and a hard place when it comes to increasing interest rates to combat inflation.

- We have previously written an article on gold in 2020 (link here) and another on Ways to Invest during Inflation (link here).

The re-opening of the US economy after the COVID-19 pandemic, coupled with, unprecedented fiscal and monetary stimulus ignited the strongest inflationary pressure since the 1970s. With budget deficit projected to be US$3 trillion this year1, the US national debt is exploding at its fastest pace since WWII.

This, however, seems to be just the tip of the iceberg. Adding into the mix is a recent US$1 trillion infrastructure bill to (1) rebuild the nation’s deteriorating roads and bridges (2) fund new climate and IT initiatives. This bill was overwhelmingly approved by the senate2 on 9 September 2021.

Along with the US$1 trillion infrastructure bill, US President Joe Biden also expressed confidence that the congress will pass a US$3.5 trillion spending bill. This bill will serve to fund childcare, community college and other social programs with an increase in taxes on companies and the rich3.

However, US government is not done with adding more money to the economy in the form of fiscal stimulus. While on the monetary front, the Fed may consider some form of tightening at a later date. It is evident that plans to further inject tidal waves of cash are already put into motion. This will further engulf the already cash-soaked US economy.

This article looks at the effects of negative yield as the Fed continues to hold interest rates at record low. We look at the US debt trap as the government increasingly find themselves caught between a rock and a hard place with regards to interest rates, more specifically the need to raise it to combat inflation.

So what do these factors entail for us investors given the broad macro-picture? In this 2021 Gold article, we look at Inflation, Negative yield and Debt trap.

1.Inflation

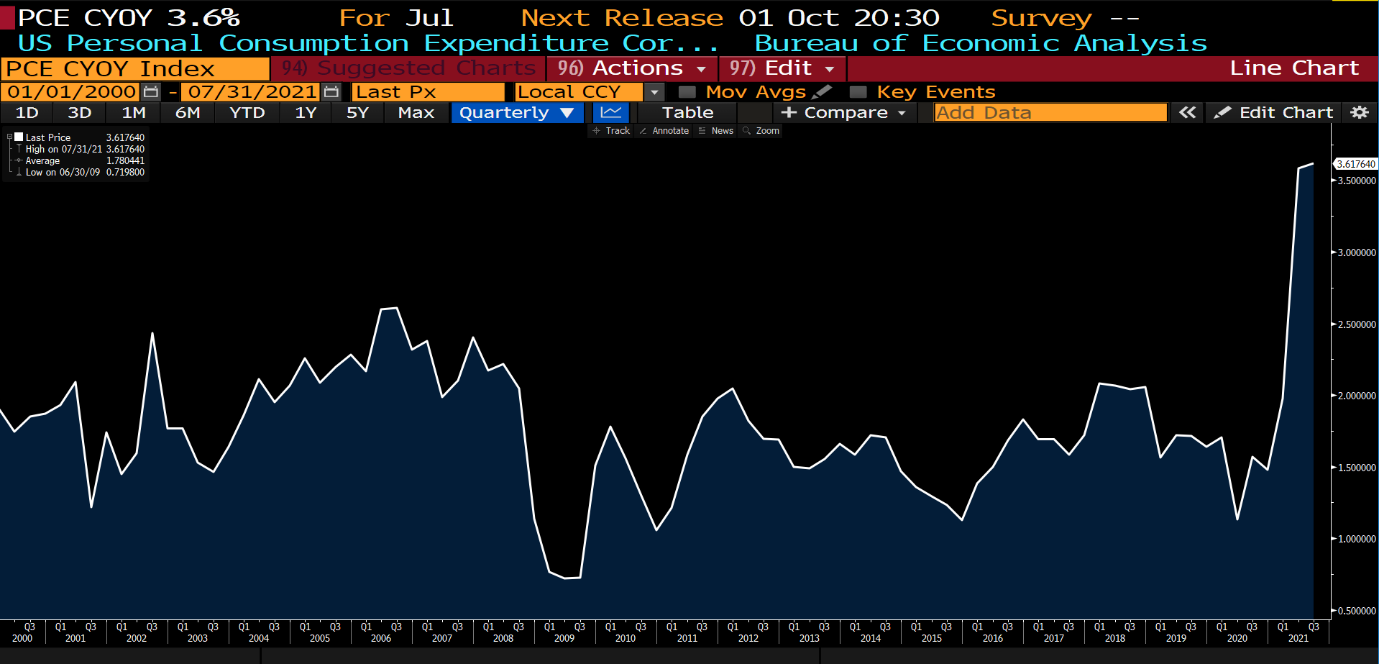

The US Federal Reserve’s preferred inflation gauge, the PCE (Personal Consumption Expenditures4) YOY prices index climbed 0.4% in July5 to post a 12-month rate of 3.6%, since 2008. While the Fed has been sticking to its official mantra that this burst of inflation is transitory, reasons exist that high inflation may be stickier than what the central bank is willing to admit.

Source: Bloomberg

Source: Bloomberg

It is important to understand that inflation is multifaceted and does not exist as a single reason. There are several types of inflation.

- Supply and Demand imbalances;

- Wage Inflation;

- Monetary Inflation (increase in money supply); and

- Monetary Velocity (how quickly dollars change hands)

Unsurprisingly, all of the above are present today which shows that inflation might be here to stay.

Supply and Demand Inflation

Fundamentally, Supply and Demand imbalances tend to work themselves out over time. Higher prices incentivise producers to make more goods to meet the stronger demand. As prices rise, cheaper alternatives are sought after as substitutes, deepening the supply chain. Eventually, as the higher prices diminish the demand, supply increases, and the imbalances even out. Over the last 12 to 15 months, we have witnessed commodity prices surge substantially.

For example, oil was US$63 per barrel pre-COVID, today it is US$71; 13% higher than before. Copper has jumped from US$2.87 pre-COVID to US$4.13; 44% higher than before. Lumber went from US$474 to a high of US$1,680; a whopping 3.5x jump before tapering off. Food prices are rising as well. In the last 12 months soybean and corn prices have surged 86% and 111%, respectively.6

Source: Bloomberg, Crude prices as of 21 Sep 21

Source: Bloomberg, Crude prices as of 21 Sep 21

Source: Bloomberg, Copper prices as of 21 Sep 21

Source: Bloomberg, Copper prices as of 21 Sep 21

Source: Soybean prices as of 21 Sep 21

Source: Soybean prices as of 21 Sep 21

Almost everything we consume is in high demand for a variety of reasons. Some may be transitory, like the cost of rental cars from a semiconductor chip shortage7, while others may be structural. Global food prices were already rising before the pandemic hit. Do refer to the link for a write up on the semiconductor article brilliantly written by Joel.

While inflation might have been caused partially by the imbalance of the supply and demand of certain segments of the global supply chain, it is certain that this is not the only contributing factor.

Wage Inflation

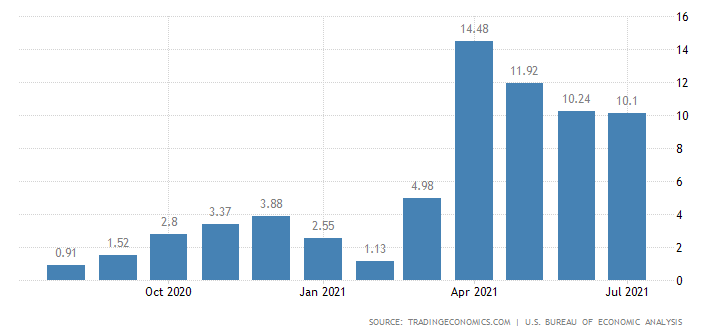

While commodity prices can surge and fall, wages are a much “stickier” component of inflation. When employers are competing for workers, they offer higher wages. According to trading economics, wages in the US increased 10.1% in July 2021 over the same month in the previous year8. From the chart, we can still see that the wage numbers seem to have tapered off from a dramatic drop and remain significantly high as compared to previous sessions.

Even now, with the threat of COVID-19 somewhat decreasing as more are getting vaccinated, companies are having difficulty finding the manpower they need9. Many workers report that they are still worried about COVID-19, likely exacerbated by the devastating spread of the Delta variant strand. Some are waiting for schools to reopen before they can re-enter the job market in earnest, with working mothers particularly affected by the pandemic, while some continue to stay in the side-lines of the job market thanks to benefits of governmental aid, though expiration is drawing near in the coming months.

The inability to hire sufficient manpower / talents is a widespread problem across all sectors of the economy. As workers earn more, their spending power increases, which is fundamentally inflationary which keeps the inflationary ball rolling once it starts. As wages rise, they are hard to reduce, unlike commodity prices that can rise and fall much more quickly.

In other words, wage inflation (a component of total inflation) will be stickier and may not be as transitory as explained by the Federal Reserve.

Money Supply Inflation

Increases in money supply are highly inflationary. Through quantitative easing (QE), the Fed has flooded the financial system with US$4 trillion in new dollars since the pandemic started.

The balance sheet has reached US$8.36 trillion as of 7 September 202110. QE is fundamentally inflationary because it dilutes the value of all dollars in the money supply, reducing the purchasing power of each dollar.

Take a quick look at the chart below to get an idea of the enormity of the balance sheet size.

Source: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

Source: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

However, the creation of new dollars is not always directly inflationary if the speed at which money changes hands, or its velocity is low. For example, the Fed created US$4 trillion following the 2008 financial crisis. But the velocity of money declined steadily from 2008 to 2021, keeping inflation persistently under 2%, despite the huge influx of new dollars. The economy may have been flooded with cheap cash, but people were not spending it quickly, therefore prices did not rise11.

This view was also echoed by billionaire hedge fund manager John Paulson12 who stated in a recent Bloomberg interview that while in 2009 when the Fed printed money, they concurrently raised the capital and reserve requirements for the banks. Hence, the money was recycled and never really entered the money supply chain, resulting in limited inflationary pressure.

Let’s compare the differences between the two crises in recent times. The 2008 financial crisis that rattled the global economy, spooked consumers as they hunkered down on spending as they prepared for the worst. Money was simply kept and not spent.

On the other hand, the COVID-19 pandemic had initially brought the global economy to its knees as countries closed its borders and enforced shutdowns. This resulted in a pent-up demand for services and goods as consumers became fatigued from the inability to spend. They had incentive and motivation to spend, hence effectively moving money through the economy.

With this understanding, it is evident that unlike the previous 2008 stimulus, the most recent fiscal and monetary stimulus to support the US economy from disruptions caused by the pandemic has injected money supply and was up 25% from last year13. Monetary supply and velocity inflation will hence likely prove to be more nefarious this time around.

The various movements in the market seem to point to inflation moving higher, perhaps for a sustained period of time. Truth be told, the supply chain imbalance explains only a portion of the inflationary picture. Given the massive, unprecedented amount of money that has been and will be further injected into the economy, inflation may play a more sinister role than what the central bankers would like us to believe.

Gold should continue to be well supported as investors seek ways to preserve purchasing power. For those that are interested, you may refer to a recent write up here as well.

2.Negative Real Yield

While real bond yields continue to hover near their lowest levels in decades14 as concerns mount over the outlook for economic growth, it is important for us to understand that gold prices tend to move sharply higher when the real yield on US Treasuries turn negative. Looking at the chart below, from 2009 to 2011, we can see that generally as yields decline (depicted by the white line), gold (depicted by the yellow line) moves inversely.

Source: Bloomberg (10-year treasury yield v Gold spot price – 2008 to 2011)

Source: Bloomberg (10-year treasury yield v Gold spot price – 2008 to 2011)

A negative real yield is when the rate of inflation is greater than the rate of return on an investment, most frequently measured against the benchmark 10-year US Treasury yield. If the 10-year Treasury yield is 1.5% and the inflation rate is 2.0%, the real yield is a negative 0.5%.

Both the 2011 and 2020 gold peaks of $1,900 and $2,069 respectively, have one factor in common: they coincided almost perfectly with the largest negative real yields in recent history, as measured against 10-year T-Bill yields. If this trend holds true, gold is due for another major rise.

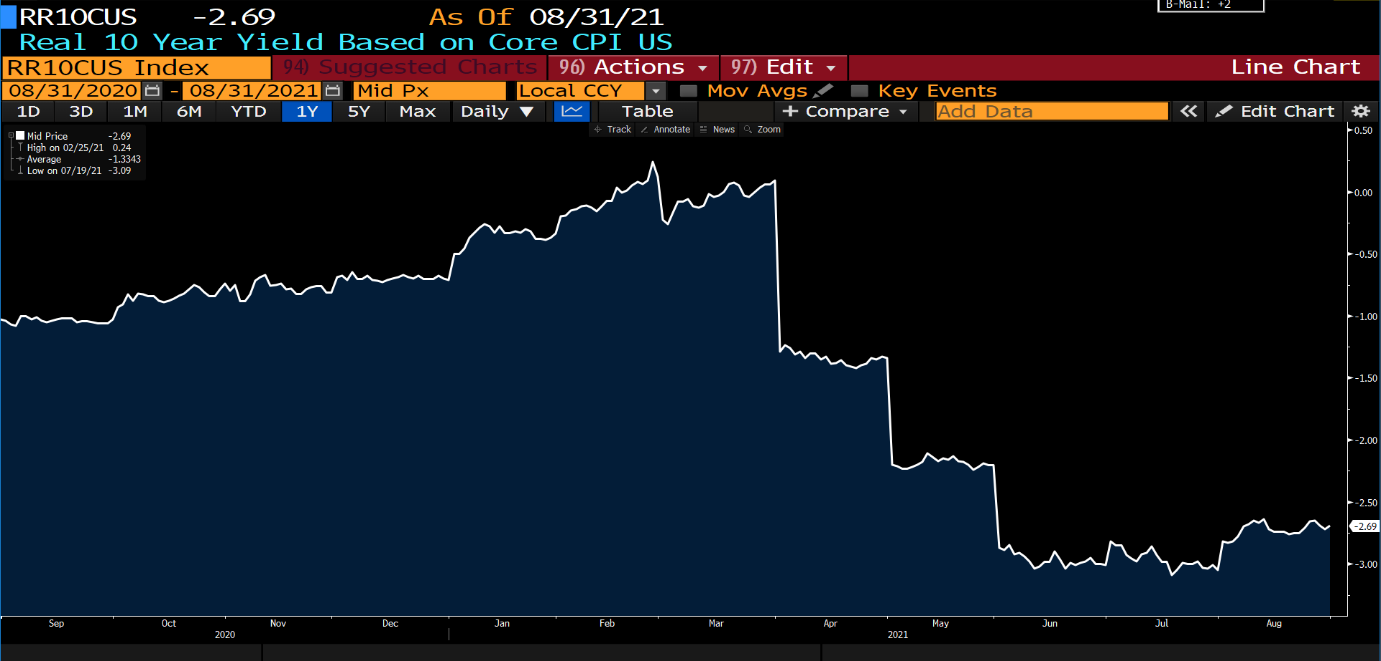

Source: Bloomberg (Negative real yield – as of 31 Aug 2021)

Source: Bloomberg (Negative real yield – as of 31 Aug 2021)

The recent negative real yield on the benchmark 10-year Treasury is -2.69%, which is more than double the negative real yields in 2011 and 2020, when gold hit record highs.

The Fed has pledged to hold interest rates to historically low levels in support of full employment. Gold has more room to respond to the current inflationary surge that has pushed this negative real yield to record lows.

With inflation projected by the IMF to be 4.3% in 2021 and 2.5% in 202215, negative real yields (already at extreme lows) could drop further, which would limit gold downside risk.

Considering all the different ways in which inflation is marching higher, plus the additional driver of record-low real yields, gold has massive potential to explode to much higher prices, spiking well above the previous record of US$2,067.15 in the coming quarters16.

3. Debt Trap

Consider a scenario where interest rates rise, pushing the negative yield to positive territory. Will this take the shine off gold?

The answer can be summarised in two words: debt trap.

The US government has exploded in response to the second major global economic shock in 10 years with unprecedented stimulus. The mismatch between government revenue and spending has gone to a potentially reckless situation as the national debt; now approaching US$30 trillion17, spirals out of control.

The reality is it is unlikely for the US to pay down its debt in a meaningful way. As interest rates rise, the interest payments to service this debt may well be unmanageable. National debt service was a record $585 billion in 2019. This record was when their debt was under $24 trillion and interest rates averaged about 2%. Today, the US debt is about 25% higher, but with interest rates being lower, this mitigates the debt cost for now18.

If the Fed is forced to raise interest rates substantially to combat inflation, it risks exploding the cost of carrying out the enormous debt burden, creating a debt trap. Rate hikes rooting from the financial crisis had dramatically negative consequences, hammering equities markets and inhibiting growth. The last thing the Fed could wish for today is repeating that mistake and having a court recession.

Conclusion

In conclusion, Inflation and Gold have gone hand in hand for centuries. They continue to work closely, even in this age. Until proven otherwise, we believe Gold will continue to provide at least partial protection from any serious bout of inflation.

Considering the current backdrop, it is a good time to add Gold to your portfolio through an ETF like the SPDR Gold Trust (GLD.US or O87/ GSD listed in SGX) which is available for trading on POEMS.

For sophisticated traders looking for a leveraged exposure to gold via a gold futures ETF, there is a 2X Long Gold ETF tradeable under the ticker UGL.

However, do note that leveraged ETFs are not suitable for beginners and retail investors as the loss will be magnified as well. Furthermore, leveraged ETFs are not meant to be held long-term as daily rebalancing will cause the value of the investment to erode over time.

Read here to know more about leveraged and inverse ETFs. Click here.

| Ticker | TOTAL ASSETS | AVERAGE VOLUME | EXPENSE RATIO | INCEPTION DATE | NAV 20 Sep 21 | LEVERAGE | PHYSICAL COMMODITY |

| GLD (US)O87/ GSD (SG) | USD 56.54B | 8.7M | 0.4% | 18 NOV 2004 | USD164.21 | NO | YES |

| IAU (US) | USD 28.16B | 10.5M | 0.25% | 28 JAN 2005 | USD 33.42 | NO | YES |

| SGOL (US) | USD 2.33B | 1.37M | 0.17% | 9 SEP 2009 | USD 16.86 | NO | YES |

| UGL (US) | USD 232.5M | 159K | 0.95% | 3 DEC 2008 | USD 55.36 | 2X | NO |

Reference:

- [1] https://www.nytimes.com/2021/07/01/business/economy/united-states-deficit.html

- [2] https://www.nytimes.com/2021/08/10/us/politics/infrastructure-bill-passes.html

- [3] https://www.reuters.com/world/us/biden-says-he-expects-congress-deliver-spending-infrastructure-bills-2021-09-16/

- [4] https://www.investopedia.com/terms/p/pce.asp

- [5] https://www.bea.gov/news/2021/personal-income-and-outlays-july-2021

- [6] https://www.bloomberg.com/news/articles/2021-07-30/here-s-who-wins-and-who-loses-from-the-surge-in-commodity-prices

- [7] https://fortune.com/2021/07/26/rental-car-shortage-covid-how-to-rent-a-vehicle/

- [8] https://tradingeconomics.com/united-states/wage-growth#:~:text=In%20the%20long%2Dterm%2C%20the,according%20to%20our%20econometric%20models.

- [9] https://www.cnbc.com/2021/08/10/the-labor-shortage-isnt-main-streets-biggest-problem.html

- [10] https://www.statista.com/statistics/1121416/quantitative-easing-fed-balance-sheet-coronavirus/

- [11] https://www.stlouisfed.org/on-the-economy/2014/september/what-does-money-velocity-tell-us-about-low-inflation-in-the-us

- [12] https://www.bloomberg.com/news/videos/2021-08-29/john-paulson-on-why-gold-goes-parabolic-video

- [13] https://www.cnbc.com/2021/08/30/john-paulson-says-inflation-will-shoot-much-higher-and-hes-positioning-with-energy-and-gold-bets.html

- [14] https://www.bloomberg.com/news/articles/2021-07-26/u-s-real-yields-fall-to-record-low-amid-growth-concerns

- [15] https://www.bloomberg.com/news/articles/2021-07-01/fed-likely-needs-to-raise-rates-as-soon-as-late-2022-imf-says#:~:text=Inflation%20Forecasts&text=The%20IMF%20forecasts%20the%20increase,run%20average%20target%20of%202%25.

- [16] https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/highest-price-for-gold/#:~:text=Highest%20price%20for%20gold%3A%20Historical,the%20sweeping%20COVID%2D19%20pandemic.

- [17] https://www.forbes.com/sites/johnmauldin/2020/04/02/federal-budget-deficits-to-30t-and-beyond/?sh=4ca1ed6e5508

- [18] https://en.wikipedia.org/wiki/National_debt_of_the_United_States

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Roger Chan

Roger holds a Business Degree in Electronic Commerce from the Monash University and is also the recipient of the Golden Key Scholarship Award for outstanding academic performance. He currently heads the Global Markets Night Trading team assisting clients with the US and European markets.

Prior to the night desk, he was a bond trader at the Debt Capital Markets desk and brings with him a wealth of equity and debt market knowledge.

.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry! ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close  Deciphering the Updates: Understanding the latest CPF Changes

Deciphering the Updates: Understanding the latest CPF Changes