How to Use Stock Screener to Invest September 22, 2020

Reading time: 5 minutes

Are you always running out of ideas on which counters to buy? With thousands of counters available on the stock market, finding the “ideal” counter to invest is akin to searching for a needle in a haystack. It takes a lot of legwork to find the best stocks, but the good news is, technology makes it near effortless!

In this guide, we will explain how you can utilise the Stock Screener tool to identify potential stocks worthy of your attention.

What is a Stock Screener?

Stock Screener is a tool that allows you to filter counters based on fundamental metrics such as market capitalisation, dividend yield and financial ratios.

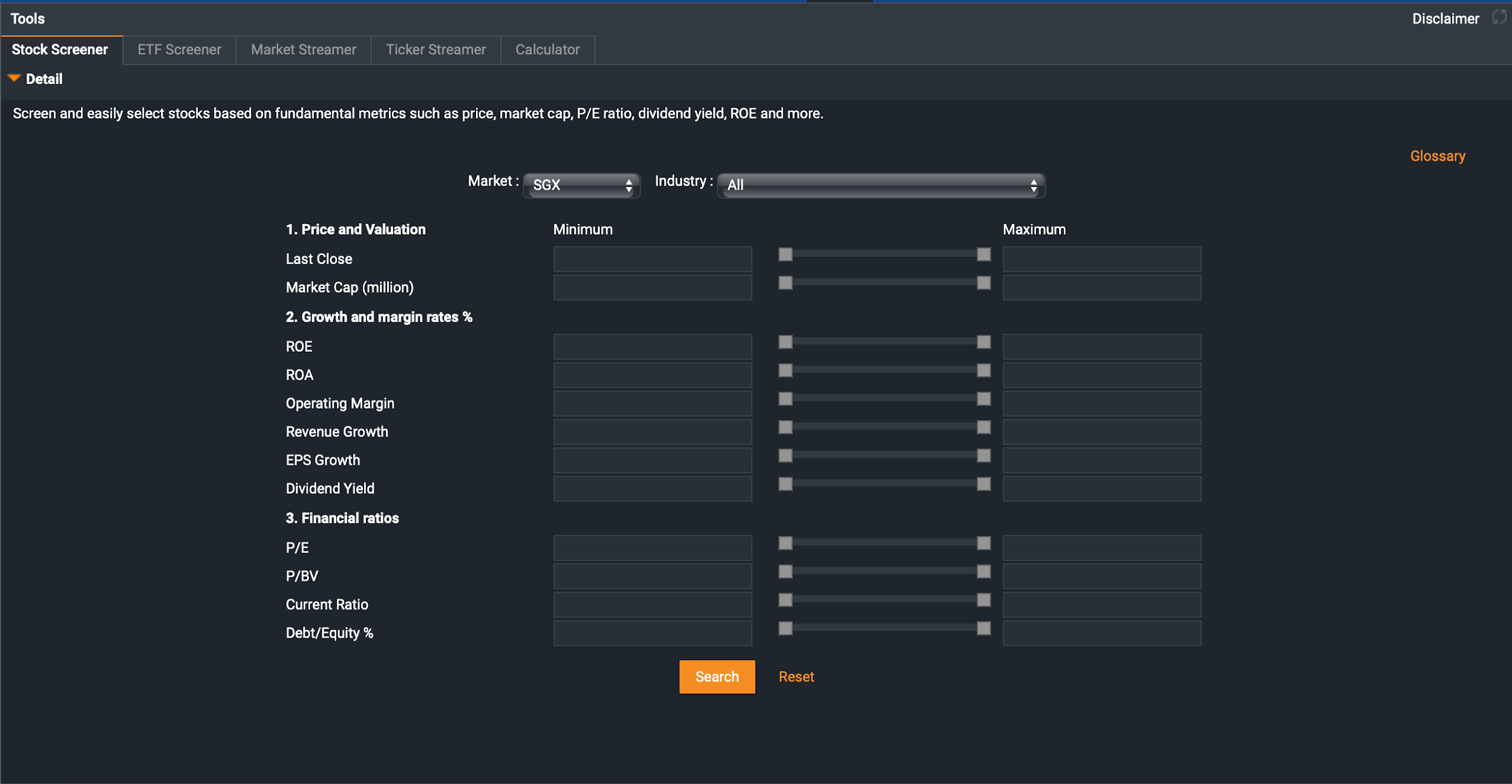

Simple yet broad in coverage, the POEMS Stock Screener allows you to screen and select counters easily with a wide range of criteria based on important ratios and figures. With the sheer volume of companies listed on the stock market, this tool saves you the time by narrowing down your options to display counters that possess the specific traits you are looking for.

How to use a Stock Screener to invest?

The Stock Screener tool is used by many investors to find counters that conform to their search criteria, find new stock ideas, as well as build and diversify a strong portfolio.

POEMS Stock Screener provides numerous fundamental search criteria for you to filter from across all industries and a wide range of markets. Investors and traders can utilise this tool to filter the Price and Valuation, Growth and Margin Rates, as well as Financial Ratios.

- Price and Valuation – includes two search filters, a counter’s last closing price and market cap to identify small, mid, or large companies

- Growth and Margin Rates – includes key metrics such as Return on equity (ROE), Return on assets (ROA), Operating Margin, Earnings per share (EPS) Growth and Dividend Yield

- Financial ratios – includes key ratios such as Price-to-Earnings (P/E), Price-to-Book (P/B) and Debt/Equity

Before using the tool, you must understand what the different ratios represent so that you can utilise them more effectively in your analysis.

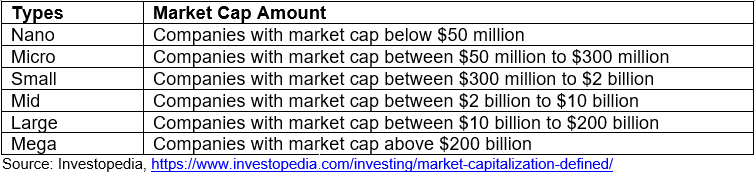

1. Market Cap, or Market Capitalisation tells the size of a firm based on its market value. This ratio provides information about a company’s growth potential and stability. There are six types of market cap:

2. Revenue Growth is often an indication of a healthy company and this figure should at least keep up with the rate of inflation.

3. EPS (Earnings per Share) Growth provides an idea of how the company has grown in terms of profitability.

4. Dividend Yield (%) can be a signal of clear financial health and confidence for a company to pay out dividends.

5. P/BV (Price-to-Book) ratio allows you to determine if a company is over or undervalued. Generally, a P/BV of less than one suggests that a stock is undervalued while anything above 1 may indicate that a stock is overvalued.

To get started, here are some questions that you may want to ask yourself to abet your search for stocks that meet your requirements:

- Is there a specific market and/or industry you are looking at?

- Are you interested in small, mid or large cap companies?

- What is an acceptable dividend yield range?

- What is an acceptable P/E range?

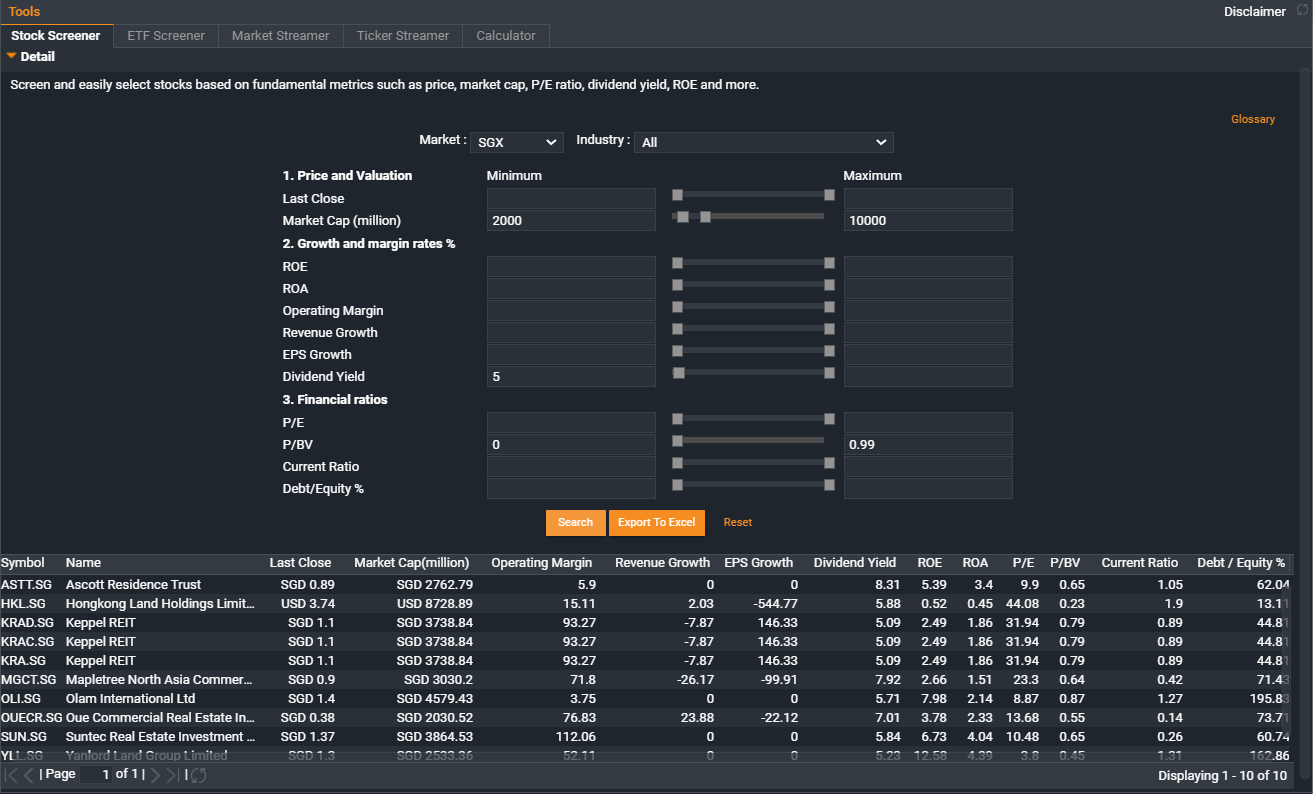

For example, if you are looking to find undervalued stocks among mid-cap companies with at least a 5% dividend yield, simply key in these criteria in the relevant boxes and you will find the search results at the bottom.

The information above is meant for illustrative purposes and is not a recommendation to buy, sell or hold this security. The figures are current as of August 2020.

The information above is meant for illustrative purposes and is not a recommendation to buy, sell or hold this security. The figures are current as of August 2020.

Looking for the “ideal” stocks can be a long and tedious process. Fortunately, the stock screener tool is a convenient way to comb through an exhaustive list of stocks to find the counters that meet your unique parameters.

While Stock Screeners are a great way to identify counters that match your search criteria, it is also important to conduct further analysis on the companies to make more informed investment choices. A great complement to this tool is Stock Analytics (click here to learn how you can utilise Stock Analytics to enhance your investment decisions).

Discover counters across multiple exchanges worthy of your attention with POEMS Stock Screener. Available on POEMS 2.0.

POEMS suite of trading platforms is made to suit the needs of all traders and investors. Open a Cash Plus Account to enjoy commission fee as low as 0.08%, no minimum* when you trade equities. Jumpstart your investing journey with POEMS now!

You may also interested in…

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It