Navigating the Emotional Factors of Long-Term Investing April 14, 2023

Investing for the long-term can be a challenging and emotional journey. Just like a game of Jenga, one wrong move could affect the whole foundation. Have you ever invested in an asset, telling yourself that I am investing for the “long-term”, only to see the asset value drastically decrease in the next few months? If your answer is yes, then i’m glad to tell you that you’re not alone. I was in the same position once and even started asking myself if I have made the right decision.

It is natural to feel nervous when the stock market takes a downturn, but it is also important to remember that investing is a marathon, not a sprint. The danger of emotions during investing for the long term can lead to impulsive decisions that could hurt your financial future.

Here are four factors to be aware of so that you can better navigate the emotional minefield of long-term investing:

1. The Fear Factor

The stock market can be a scary place, especially when the news is filled with stories of market crashes and economic turmoil. Events like the Russia-Ukraine war; tensions between US and China, or even inflationary pressures, create uncertainty for investors on a global scale. It is easy to get caught up in fear and panic, but it is important to remember that fear is a natural part of investing. The key is to avoid letting it take control over your investment decisions.

2. The Greed Factor

On the other end of the spectrum, there is greed. It is tempting to make quick profits. You would have heard of friends who put all their money into a single speculative trade, or even into lottery tickets, in order to “win big”. However, that is essentially “gambling” in a nutshell. We can get so distracted by the potential of huge gains that we end up losing so much more.

It is important to resist the urge to make impulsive decisions based on short-term market movements. Greed can often lead to overinvesting in a particular stock or market sector, which can be risky and unsustainable in the long-run.

3. The Discipline Factor

Discipline is key when it comes to long-term investing. It is important to stick to your investment plan and avoid making impulsive decisions based on your emotions. A well-diversified portfolio and a solid investment strategy can help you weather the ups and downs of the stock market and reach your long-term financial goals.

4. The Patience Factor

Investing for the long-term also requires patience. The stock market can be volatile in the short-term, but over time, it has historically proven solid returns. It is important to remember that your investment portfolio should have a long-term horizon and that short-term market fluctuations are normal, where chasing the dip will see asset prices dip further.

In conclusion, investing for the long-term can be an emotional journey. However, it is important to remember that your emotions should not drive your investment decisions.

By being disciplined, patient and avoid making impulsive decisions based on fear or greed, you can navigate the emotional minefield of long-term investing to reach your financial goals.

If you would like to know more about the different investment products that are suitable in order to achieve your financial goals, you may visit the POEMS website or head down to any of our 10 Phillip Investor Centres to find out more.

Alternatively, you may also wish to try out FinanceFit, a free financial tool that helps to assess your financial health status as well as your progress towards achieving your financial goals.

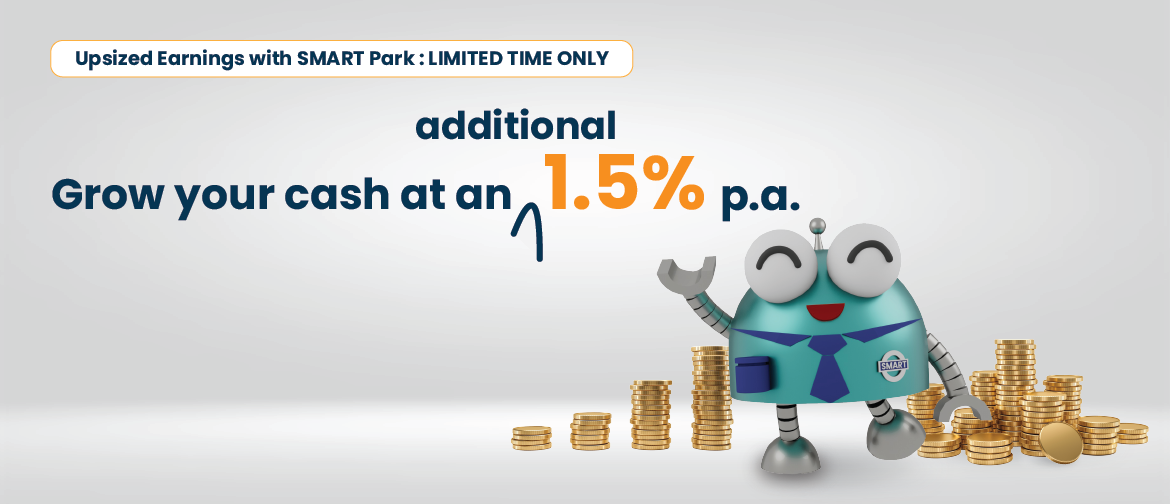

While waiting for the right investment opportunities, you might be wondering, what are other cash management solutions where you can park your idle cash? T-bills and Fixed Deposits have a lock-in period, which means that you are unable to mobilise your cash in times when the market is in your favour. Banks generally offer low interest rates for their traditional savings accounts whereas their step up accounts have a capped deposit limit and require you to hit a certain criteria in order to be eligible for higher returns.

Consider Phillip SMART Park instead! It is an excess funds management facility where you can enjoy flexibility (no lock in period) and no cap limit to grow your idle cash.

SMART Park invests in one of the largest retail SGD Money Market Fund, Phillip Money Market Fund based on the total asset figures reflected in FundSingapore.com, which has had no defaults since its inception in Year 2001. SMART Park allows you to park your idle cash and enjoy returns on deposits in both SGD and USD with a minimum account balance of $100 when you opt-in for the facility with POEMS account.

Promotion

SMART Park is currently running a campaign from 17 April 2023 to 16 June 2023! Earn 2.90% p.a.* + 1.5% p.a. bonus return on your new deposits (min. deposit of $100, capped at $10,000) in SMART Park with a 1 month holding period!

*The indicative rate is the Annualized 7-Day returns shown on POEMS Excess Funds Management website. You may refer to https://smart.poems.com.sg/smartpark/ or click HERE to find out more about SMART Park campaign!

For enquiries, please email us at digichannel@phillip.com.sg.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Loo Chenkai

Digital Marketing Executive

Chenkai is an executive with the Digital Channel that specializes in Excess Fund Management (SMART Park), SMART Portfolio, FinanceFit, and Phillip Protect.

He is passionate about investment tips and tricks that would help clients benefit in the long-term. Thus, he is always reading articles and blogs that would provide insights.

From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close  Deciphering the Updates: Understanding the latest CPF Changes

Deciphering the Updates: Understanding the latest CPF Changes