The Ultimate Guide to Cash Plus and Cash Management Accounts October 7, 2022

At a glance:

- Choosing the right trading platform and brokerage account can be a headache these days, given the array of services and service providers

- POEMS has two accounts to match your specific investment needs: Cash Plus and Cash Management

- Trade US shares at USD 1.88 flat with no platform fee and custody fee with Cash Plus Account

- Link your CDP account to Cash Management Account and trade your CDP holdings

Cash Plus Vs. Cash Management: Which Account Suits You Best?

Whether you are a beginner or seasoned investor, choosing the right trading platform and brokerage account can be a pain, given the maze of services and service providers available these days.

Truth be told, you can never find the best trading platform or account. But understanding your investment needs is essential.

Phillip’s Online Electronic Mart System, or POEMS, ensures that your account-opening process is as fuss-free as possible. Here are some guidelines to help you take your first step in choosing the right account for your trading needs.

Among all the account types that POEMS has, the two most popular are: Cash Plus and Cash Management. Here are 13 things you need to know before you decide which one suits you best.

Swipe left to view the table

Comparison table

| Features | Cash Plus | Cash Management |

| Online brokerage rates/commission fees https://www.poems.com.sg/stocks/pricing/ |

Lower | Higher |

| Trading access to multi-assets and stock exchanges in more than 20 countries https://www.poems.com.sg/products/stocks/ |

Yes | Yes |

| Free webinars, research reports and market journal content on POEMS | Yes | Yes |

| Multi-currency facility, excess funds facility & online currency conversion facility | Yes | Yes |

| Standby margin financing (borrowing interest applies) | Yes | No |

| Account maintenance fees (S$15 per quarter) | Yes (waiver conditions apply) | No |

| Custody fees for foreign shares | Yes (waiver conditions apply) | Yes (waiver conditions apply) |

| Corporate action services | Yes | Yes, except SGX counters |

| Trading access using CPF & SRS funds | Yes (prefund required) | Yes |

| Trading with BUY limit (buy first, pay later) | No | Yes |

| Contra trading | No | Yes |

| Direct linkage to your CDP account | No | Yes |

| POEMS Rewards (redeem live price subscription, voucher, magazine & services) https://www.poems.com.sg/promotions/#rewards |

Yes | Yes |

The above comparison gives you a clearer picture of the differences of the two accounts.

To guide you further, we have painted a few scenarios for you.

Scenario A: You are an active investor who follows the market closely

A Cash Plus Account would be ideal if you are an active investor who follows market trends closely and trades frequently.

Reasons:

Cash Plus offers the lowest brokerage rates – of as low as US$1.88 flat and 0.05% for minimum HK$15 trades – that allow you to buy and sell multiple times at low costs. Furthermore, your available funds limit will increase once you sell and you may continue to trade based on available funds in your POEMS account. Brokerage rates are determined based on the previous day’s end total asset value in your account. This means that your brokerage rates could potentially be lesser if the funds in your account increase.

Cash Plus also allows you to settle trades in 10 different currencies. This is its multi-currency facility. The currencies are: S$, US$, HK$, A$, RM, ¥, £, €, RMB and C$.

Furthermore, you may now convert currencies live on our POEMS 2.0 platform, POEMS 2 app & POEMS 3 app!

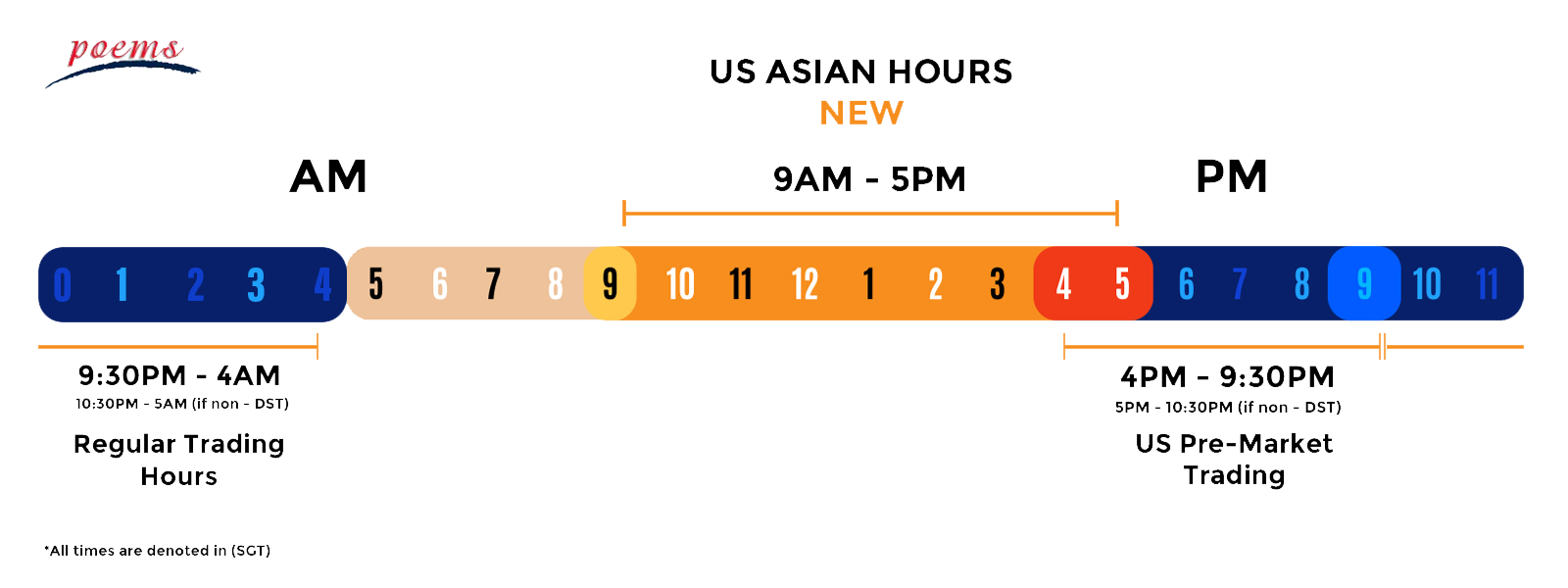

What’s even better? You can trade US market with greater flexibility and convenience from 9am to 5am (US Asian Hour > US Pre-Market Trading > Regular Trading Hours). Login to subscribe for complimentary US live price.

Scenario B: You are a non-active, risk-averse investor or new investor

A Cash Plus Account would be ideal if you are an investor looking to buy some shares at a certain time or opportunity.

Reasons:

Cash Plus offers the lowest brokerage rates of as low as US$1.88 flat and 0.05% for minimum HK$15 trades with no platform fees. The account allows you to buy and sell multiple times at low costs.

Cash Plus allows you to deposit money via PayNow. This only takes up to 15 minutes to process, before you can start trading. It means you can trade anytime, anywhere, without having to deposit spare funds in your POEMS account.

Cash Plus is suitable for new investors who wish to start investing as its brokerage rates are low. You may invest at your comfort risk level as the tiers start from Starter (S$0-29,999) to Premier (S$30,000-249,999) and Privilege (S$250,000 & above).

Just make at least 1 trade per quarter to waive off Account Maintenance Fee. Any market, any amount.

Scenario C: Investing with CPF and SRS

Both the POEMS accounts allow you to trade using CPF and SRS funds. However, both have their pros and cons.

Tips:

With Cash Plus Account, you can trade CPF and SRS funds at attractive brokerage rate from 0.06% onwards (wef 1st Oct 2023), no minimum commission. However you are required to ensure there is sufficient available cash in your Cash Plus Account to place order.

Cash Management Account allows you to utilise your CPF or SRS funds without the need to deposit money. Instead, using your trading limit, you can place orders online and select CPF or SRS as settlement for your trades. The money will be deducted from your CPF or SRS account the next working day.

Looking to trade your CDP holdings? Get ready your CDP account number and open a Cash Management Account. Refer to our Cash Management Account page on benefits of CDP linked account and how to open CDP account online.

We hope this article can help you take your first investment steps. Please visit here if you are ready to open an Account with us! If you are still unsure on which account suits you best, you may contact your Trading Represenative or Dealing Team. Alternatively, contact Customer Experience Unit at 65311555 or email us at talktophillip.com.sg.

Happy trading!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!