Why Invest in Canada? August 27, 2019

In our Go Global article published earlier, we discussed on the topic of home country bias – something that is prevalent amongst investors. Aside from this, general investors also suffer from availability bias, whereby investors only invest in what they heard of or easily recall from their mind. These biases usually result in an investor’s portfolio being overexposed to their home country’s stocks, potentially acting as a barrier for them to invest abroad.

The first half of 2019 has been very volatile for major markets like the US, Europe, Hong Kong and China, mostly fueled by the trade war tension that left investors bewildered and unsure of their next course of actions. Investors are looking for a market that is outside the eye of the storm. While the bigger players are embroiled in the trade war, there might be a market – one that we offer – that investors could pay more attention to, and that is Canada’s stock market. In this article, we explore the opportunities available in the Canadian stock market, highlighting a few key sectors that investors can watch out for.

Demographic

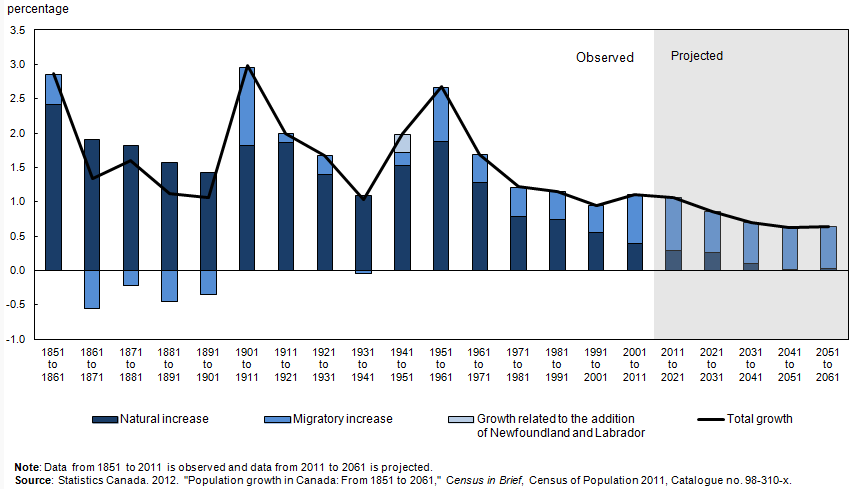

Located to the north of US, Canada is the world’s second largest nation by total area – spanning approximately 9.98 million km2 with a total population of 36 million – making it one of the least densely populated countries in the world. Almost one third of the population are from the 3 major cities in Canada, namely Toronto, Montreal and Vancouver. Similar to other developed countries, Canada is also facing an aging population alongside declining fertility rates, resulting in natural increase accounting for less than one third of the country’s population growth. With the support of government policies, the country’s population growth is now being fueled by immigrants.1

From Figure 1, we can see that the projected natural increase is likely to decline to 0 in the future. Migratory increase will still be one of the key drivers for population growth, which could help boost the economy as these immigrants bring in skills, experiences or funds into Canada.

Figure 1: Population Growth in Canada

Economic Background

Canada, one of the top 10 economies in the world, recorded a GDP of USD 1.7 trillion in 2018, 1.8% real GDP growth from 2017 and GDP per capita of USD 46,261 in 2018. According to International Monetary Fund (IMF), the real GDP growth for 2019 is projected to be 1.5%.2

From Figure 2, we can see that real GDP growth was relatively stable between 2-4% except during early 2016, while unemployment rate was mostly below 2%. This indicates that Canada is at full employment and their economic strength is relatively steady.

Figure 2: Output and Employment

Given Canada’s huge land area and low population, the country is largely dominated by forest, making the country rich in natural resources with an estimated value of USD 33.2 trillion, ranking 3rd in the world.3 Canada’s economy has always been tied together with the strength of the US economy. While it is true that the US is their largest trading partner, accounting for around 70% of exports and 60% of imports, both countries’ economic activities are vastly different.4

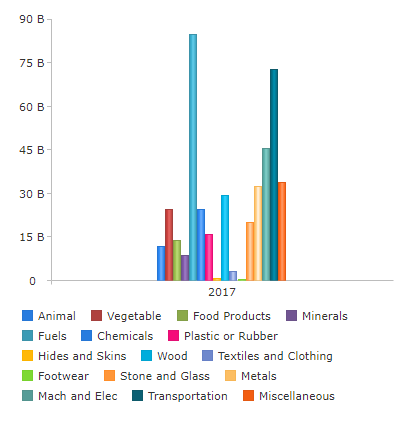

The Agriculture, Mining and Petroleum industries are the primary sectors in Canada’s economy, being one of the largest exporters of Minerals and Agriculture products in the world. Agriculture, Mining and Energy accounts for almost 50% of Canada’s exports while Machinery, Automotive and other manufacturing products account for another 35%.4 These sectors usually act as very good portfolio diversifiers and play an important role in many fund manager’s portfolio to hedge against portfolio risk.

Figure 3: Product Exports by Canada to All Countries 2017

Source: wits.worldbank.sg

Currency

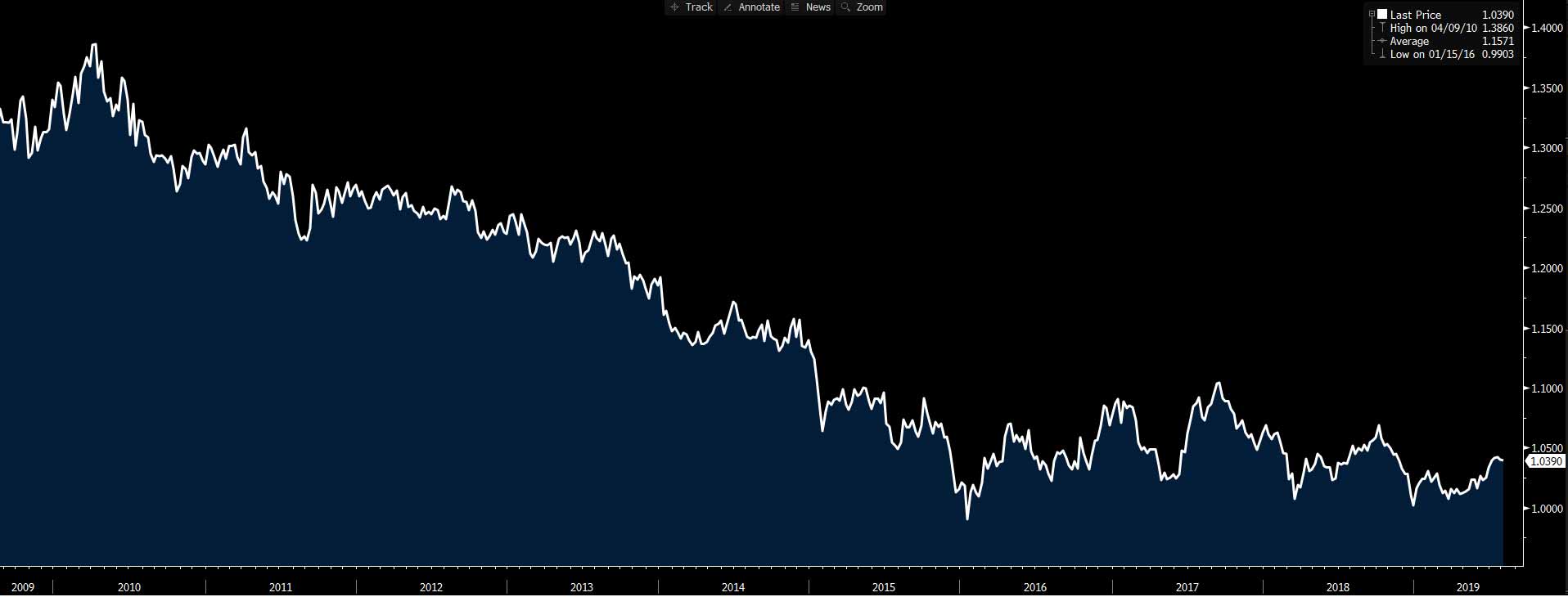

The official currency used is Canadian Dollar (CAD), which is the 5th most held reserve currency in the world after USD, EUR, YEN & GBP.5 Given its close ties with the US economy, the CAD is usually impacted by USD movements. The below figures show the price movement of the CAD against USD and SGD.

Figure 4: USD/ CAD 10 Years Chart

Source: Bloomberg

Figure 5: CAD/ SGD 10 Years Chart

Source: Bloomberg

Canada has a safe and sound banking system which is backed by the strength of its currency. The central bank, Bank of Canada, uses inflation-targeting monetary policies to preserve the currency value while keeping inflation low and stable. The foreign exchange reserves have also been rising steadily over the years as shown in the figure below.

Figure 6: Foreign Exchange Reserves in Canada

Source: Bloomberg

For investors interested to trade in the Canadian stock market, you can invest in the Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV), which are operated by the TMX Group, through PhillipCapital! The TMX Group operates the world’s 9th largest stock exchange with more than 3000 listed companies and a total market capitalization of over USD 2 trillion. One unique difference between the TMX Group and the other stock exchanges in the world is that there are more Mining, Marijuana and Oil & Gas related companies listed in the TSX and TSX Venture.6

The S&P / TSX Composite Index – comprises approximately 95% of the Canadian stock market – is the closest gauge of the Canadian stock market performance. Investors who wish to invest in the Canadian stock market as a whole may look at iShares S&P/TSX 60 Index ETF (XIU.CN), the first ETF in the world and the largest ETF in Canada, which tracks the S&P/TSX 60 Index.

| Ticker | Name | Market Cap (CAD million) | Price (CAD) | 30D ADV | P/E | P/B |

| XIU | ISHARES S&P/TSX 60 INDEX ETF | 8696 | 24.54 | 12m | N/A | N/A |

Source: Bloomberg

Here’s a closer look at 3 sectors that differentiates the Canadian stock market from the rest of the world!

World Leading Industrial Mineral Producer

Given the richness of natural resources, Canada has become the leading exporter of minerals like Zinc, Uranium, Nickel, Aluminum, Steel, Coal and Lead, with most of them exported mainly to the US. These raw materials are critical to the manufacturing sector as they are commonly used for the production a wide variety of products. If you are interested to invest in the Mining sector in the Canadian stock market, you may consider the following stocks.

| Ticker | Name | Market Cap (CAD million) | Price (CAD) | 30D ADV | P/E | P/B |

| TECK/B | Tech Resources | 16893 | 29.87 | 2.3m | 7.87 | 0.73 |

| CCO | Cameco Corp | 5469 | 13.79 | 1.4m | 43.13 | 1.1 |

| FM | First Quantum Minerals | 8520 | 12.35 | 7.5m | 13.82 | 0.68 |

Source: Bloomberg

Alternative to Traditional Gold Investment

Besides the industrial minerals, Gold is also one of the key export products for Canada. It is also popularly used as a hedge for portfolios. There are many ways for you to invest in Gold, including but not limited to, the direct holding of physical gold, commodity futures, ETFs and gold miner stocks. Aside from those mentioned, investors can also invest in Gold through gold royalty companies. The royalty companies support the gold miners upfront and receive a fixed percentage of the gold miner’s future production in return. This means that it has unlimited upside – royalty collection goes on as long as there is still supply and demand for Gold, with limited downside, which is the upfront investment. Here are some gold royalty companies that you can take stock of.

| Ticker | Name | Market Cap (CAD million) | Price (CAD) | 30D ADV | P/E | P/B |

| FNV | Franco-Nevada Corp | 20739 | 110.79 | 814,722 | 68.7 | 3.34 |

| SSL | Sandstorm Gold | 1349 | 7.52 | 993.391 | 223.47 | 1.81 |

Source: Bloomberg

The Unusual Energy Exporter

Beyond its large pool of minerals, Canada has another hidden gem – its oil reserve. With a 13% share of global oil reserve, this ranks Canada 3rd in the world in terms of oil reserve, behind Venezuela and Saudi Arabia, also making it an unusual net energy exporter amongst the developed nations. The country has also continued to step up in its role in oil production. For investors looking to ride on this trend, the below table list 4 counters that you may consider.5

| Ticker | Name | Market Cap (CAD million) | Price (CAD) | 30D ADV | P/E | P/B |

| SU | Suncor Energy | 65494 | 41.63 | 5.9m | 16.92 | 1.48 |

| CNQ | Canadian Natural Res | 44216 | 36.83 | 6.2m | 15.52 | 1.37 |

| IMO | Imperial Oil | 27989 | 36.6 | 1.3m | 13.98 | 1.16 |

| ENB | Enbridge | 92984 | 45.94 | 8.5m | 16.52 | 1.48 |

Source: Bloomberg

The Growth Potential of the Cannabis Market

Cannabis, or Marijuana, was legalised in Canada for recreational purposes in 2018. While Cannabis is currently still predominantly used for medical purposes, the legalisation of Cannabis for recreational purposes has brought growth to the sector and is expected to boost the market exponentially. This is further propelled by the huge growth potential for Cannabis exports due to the increase in countries legalising Cannabis, including the US. The global Cannabis market is estimated to be worth USD 66.3 billion by 2025 and is projected to grow at 23.9% annually from 2018’s valuation of USD 13.8 billion.

For investors interested to trade Cannabis stocks, you can consider companies like Canopy Growth (WEED.CN), Aurora Cannabis (ACB.CN) or Aphria Inc (APHA.CN). ETFs are also a good way to enter the Cannabis market should you be interested to invest in the industry rather than in specific stocks. Horizon Marijuana Life Sciences Index ETF (HMMJ.CN) is an ETF that provides you exposure to the performance of a basket of Cannabis related companies.7

| Ticker | Name | Market Cap (CAD million) | Price (CAD) | 30D ADV | P/E | P/B |

| HMMJ | Horizon Marijuana Life Sciences Index ETF | 823 | 18.04 | 424,905 | N/A | N/A |

| WEED | Canopy Growth | 17805 | 51.52 | 2.7m | N/A | 2.5 |

| ACB | Aurora Cannabis | 9887 | 9.74 | 9.8m | N/A | 2.26 |

| APHA | Aphria Inc | 2299 | 9.16 | 4.4m | N/A | 1.36 |

Source: Bloomberg

While the Natural Resource and Cannabis sectors in Canada presents itself as great investment opportunities for investors, these sectors are just part of the diverse offerings that the Canadian stock market offer. Many well renowned companies are also being traded in the Canadian stock market, as can be seen from the list of top traded counters by value in Table 6.

| Ticker | Name | Market Cap (CAD million) | Price (CAD) | 30D ADV | P/E | P/B |

| RY | Royal Bank of Canada | 148858 | 103.67 | 3.6m | 11.94 | 1.95 |

| CNR | Canadian National Railway | 86266 | 119.31 | 1.6m | 21.21 | 4.92 |

| TRI | Thomson Reuters | 42151 | 84.15 | 822,712 | 209.72 | 3.59 |

| BBD/B | Bombardier Inc | 5339 | 2.19 | 15m | N/A | N/A |

Source: Bloomberg

Ready to trade in the Canadian Stock Market? Get more information on the Canadian stock market like brokerage rates and trading details at https://www.poems.com.sg/markets/canada-tsx/

Information is accurate as of 25 Jul 2019.

Reference:

- [1]https://www.statcan.gc.ca/eng/start

- [2]https://www.imf.org/en/Countries/CAN

- [3]https://www.worldatlas.com/articles/countries-with-the-most-natural-resources.html

- [4]https://wits.worldbank.org/CountryProfile/en/CAN

- [5]https://www.imf.org/en/Data

- [6]https://www.tmxmoney.com/en/index.html

- [7]https://www.grandviewresearch.com/industry-analysis/legal-marijuana-market

- [8]Bloomberg

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Allen Tan

Senior Dealer

Allen graduated from Nanyang Technological University with a Bachelor’s Degree, majoring in Economics with a minor in Business. He joined Phillip Securities in 2016 as an Equity Dealer in the Global Markets Team. He specialises in the US and Canada market and also supports the UK and Europe market.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It