Apple Inc. - Expecting revenue contraction

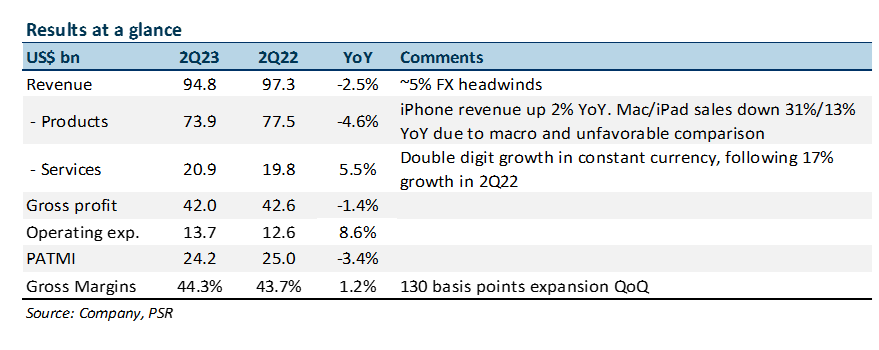

8 May 2023- 2Q23 results were within our expectations. 1H23 revenue/PATMI at 53%/54% of our FY23e forecasts.

- Revenue contraction was lower than company guidance due to better-than-expected iPhone sales. Gross margin expanded by 130 basis points QoQ.

- 3Q23 guidance is for revenue YoY decline of around 2%-3% with gross margin remaining stable QoQ. Weakness due to product revenue facing challenges from the macro conditions.

- We cut our FY23e revenue by 5% and PATMI by 4% to account for expected continued revenue contraction in 3Q23. We downgrade from BUY to ACCUMULATE rating with a lowered target price of US$183.00 (prev. US$186.00), with a WACC of 6.5%, and a terminal growth rate of 3%. We forecast FY23e revenue to contract relative to FY22 as sales are expected to continue declining in 2H23e, with positive growth returning in FY24e.

The Positives

+ Revenue beat company guidance. Revenue dipped 2.5% YoY to US$94.8bn, lower than company guidance of 5% YoY contraction due to better-than-expected iPhone sales. iPhone revenue grew 2% YoY to US$51.3bn despite FX headwinds and challenging macro conditions, driven by strong growth in emerging markets with revenue doubling in India, Indonesia, Turkey, and UAE. Mac/iPad revenue were down 31%/13% YoY, in line with guidance, as both products faced challenging comparisons and macro conditions. Services revenue grew 5.5% YoY (~11% in constant currency) to US$20.9bn, on top of a tough comparison against 2Q22 where it grew 17%. Apple indicated it has >975mn paid subscriptions, 2x from 3 years ago and up from 935mn disclosed in 1Q23.

+ Sequential gross margin expansion. Services gross margin expanded 20 basis points QoQ to 71%, partially offset by QoQ product gross margin contraction of 30 basis points to 36.7%. Overall gross margin expanded by 130 basis points QoQ to 44.3%, largely driven by favourable revenue mix towards Services (22% of total vs 18% in 1Q23) and cost savings.

The Negatives

– Revenue contraction to continue. Apple guided YoY revenue performance in 3Q23 to be similar to that of 2Q23, implying a potential contraction of 2%-3%, with FX expected to be a headwind of 4%. This is below our initial expectation of positive sales growth in 2H23e. Services YoY revenue performance is also expected to be similar to its growth in 2Q23, suggesting a continued increase at ~6%, while facing challenges in digital advertising and mobile gaming due to the macroeconomic environment.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments