Apple Inc. - Hurt by supply constraints and FX

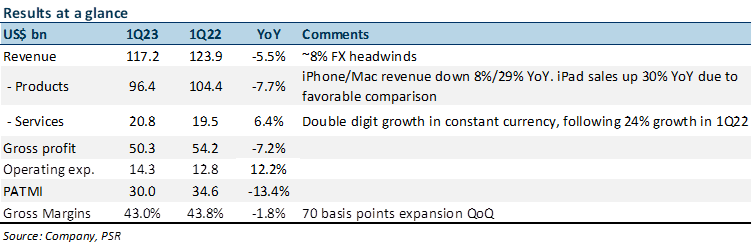

6 Feb 2023- 1Q23 revenue/PATMI was a modest miss to our expectations at 28%/29% of our FY23e forecasts.

- Services was the fastest growing segment with 6.4% YoY rise despite the ~7% currency headwinds. Gross margin expanded by 70 basis points.

- 2Q23 guidance is for revenue YoY decline of around 5% with stronger QoQ gross margin.

- We cut our FY23e revenue by 5% and PATMI by 1% to account for expected decline in hardware revenue. We maintain a BUY rating with a lowered target price of US$186.00 (prev. US$190.00), with a WACC of 6.5%, and a terminal growth rate of 3%. Apple is facing currency headwinds and weaker hardware sales, namely Mac and wearables, from a softening macroeconomic environment. iPhone sales are expected to recover with supply chain normalizing and services continues to build up its user base with 150mn new subscriptions in 2022.

The Positives

+ Services grow despite increasing FX headwinds. Services revenue grew 6.4% YoY to US$20.8bn despite ~7% FX headwinds, implying a double-digit growth on a constant currency basis, on top of a tough comparison against 1Q22 where it grew 24%. App Store subscription grew double digits, while revenue from cloud, payment services, and music set new records. In aggregate, Apple indicated it has 935mn paid subscriptions, up >150mn in the last 12 months and 4x from 5 years prior. The segment’s performance was helped by the continued increase in device installed base, which reached 2bn units (up 150mn units YoY) driven by double-digit growth in emerging markets, such as India and Brazil.

+ Sequential gross margin expansion. Product gross margin increased by 240 basis points (2.4%) QoQ to 37% while services gross margin expanded 30 basis points to 70.8%. Both segments’ increase was attributed to leverage and favorable product mix, resulting in overall QoQ gross margin expansion of 70 basis points to 43% despite stronger FX headwinds.

The Negatives

– Hardware sales decline. Product revenue was down 7.7% YoY with iPhone revenue declining 8% (flat on constant currency basis) to US$65.8bn due to the iPhone 14 Pro and 14 Pro Max supply being constrained throughout November and December 2022. Mac sales were down 29% YoY to US$7.7bn, in line with Apple’s previous guidance as a result of unfavorable comparison against 1Q22 where it benefitted from the launch of the M1 MacBook Pro. Decline in hardware sales was partially offset by 30% YoY growth in iPad sales to US$9.4bn, mainly due to favorable comparison against 1Q22 when it faced supply constraints, as well as benefitting from the launch of new iPad and M2 iPad Pro. Management indicated the softening macroeconomic environment affected Mac and Wearables sales the most, while iPhone was the least impacted.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments