Apple Inc. - Services the spark amidst weak outlook

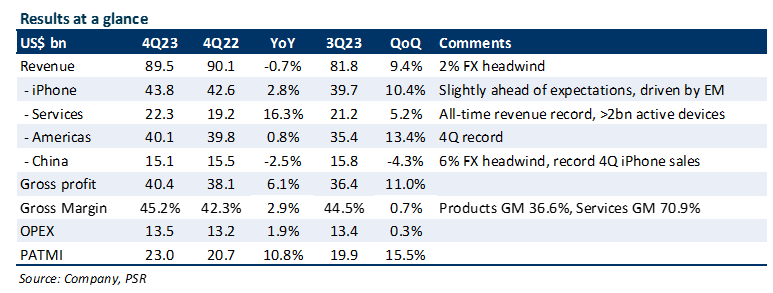

6 Nov 2023- 4Q23 results were within our expectations. FY23 revenue/PATMI were at 101%/100% of our FY23e forecasts. Services growth of 16% YoY was the standout.

- Services benefited from a higher installed base of >2bn active devices, while iPhone demand remains resilient – especially in China which saw record 4Q sales. iPad/Mac/Wearables remain a drag, with continued weakness moving into 1Q24e.

- We left our FY24e forecast unchanged but raised revenue/EBITDA by 5% for FY25e. We expect Services and iPhones to be the main drivers of growth and are encouraged by market share gains in China and India. As a result, we upgraded our rating from NEUTRAL to ACCUMULATE, with a raised DCF target price of US$194.00 (prev. US$$183.00), a WACC of 6.5%, and a terminal growth rate of 3%.

The Positives

+ Services benefit from higher installed-base. Services was the standout with revenue of US$22.3bn (16% YoY) beating our estimates by ~12%. Growth was broad-based across categories and geographies, and benefitted from AAPL’s growing installed base of >2bn active devices, and >1bn paid subscriptions. In our opinion, faster growth in Services vs Products is AAPL’s most significant way of expanding margins given Services Gross Margin is ~70%, twice that of Products. Services currently contribute ~25% of total revenue.

+ iPhone sales resilient. iPhone sales of US$43.8bn (3% YoY) were resilient given the uncertainty surrounding demand for tech hardware, beating both AAPL’s and our estimates. Much of the growth was driven by demand in emerging markets like India, Latin America, and China. Sales in China were a pleasant surprise given worries over increasing competition from Chinese manufacturers in the Premium smartphone category, with AAPL seeing record 4Q iPhone sales in China while the overall market contracted – implying market share gains for the company. Revenue growth from China would have been ~4% YoY in constant currency.

The Negatives

– Weak outlook for products. Aside from iPhones, AAPL’s other products (iPad/Mac/Wearables) saw revenue declines YoY as demand remained muted for these products. Product revenue contracted -5% YoY in 4Q23. AAPL’s outlook for its products was not any better, with the company guiding 1Q24e YoY acceleration only for Mac – although we still estimate contraction of 10-15% YoY, while expecting iPad and Wearables to decelerate significantly due to unfavourable timing of product launches. We believe the continued weakness in demand for AAPL’s other products will remain a drag on Product growth.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments