Airbnb Inc - Impressive earnings on strong travel demand

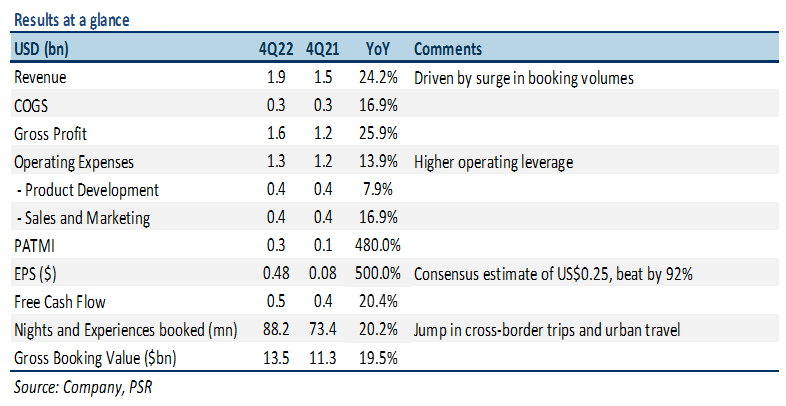

17 Feb 2023- FY22 revenue was in line with expectations at 101% of our forecasts, but PATMI exceeded at 110%. 4Q22 revenue grew 24% YoY to US$1.9bn despite 7% FX headwinds. PATMI spiked 480% YoY driven by a strong jump in travel demand that led to more bookings and higher operating leverage.

- Gross booking value (GBV) grew 20% YoY to US$13.5bn mainly driven by growth in nights and experiences booked (up 20% YoY to 88.2mn), with momentum continuing into 1Q23e.

- We downgrade to ACCUMULATE from BUY after the recent jump in its stock price. We raise our DCF target price to US$149.00 (prev. US$128.00) with a WACC of 7% and terminal growth of 4%. We increased our FY23e Revenue/PATMI by 1%/15% due to continued travel demand and lower expenses. While consumer discretionary spending is being squeezed, we believe Airbnb is well-positioned as the platform offers better non-urban location listings versus hotels, benefits travellers looking for long-term stays, and is more family and group travel-friendly.

The Positives

+ Travel demand remained strong. In 4Q22, revenue grew 24% YoY to US$1.9bn despite 7% FX headwinds, implying 31% growth on a constant currency basis. The significant growth was driven by solid growth in nights and experiences booked. Booking volumes jumped 20% YoY to 88.2mn driven by growth in cross-border trips (up 49% YoY) and urban nights booked (up 22% YoY). Urban areas represented 51% of total nights booked in 4Q22.

+ Long-term stays remained resilient. Long-term stays, or those lasting 28 days or more, represented 21% of gross booking volumes in 4Q22, and were stable with the year-ago quarter. This was mainly driven by the flexibility granted by hybrid/remote work. Stays of at least 7 nights accounted for 46% of gross nights booked in the quarter.

+ Record listings on the platform. Airbnb ended 4Q22 with 6.6mn global active listings – its highest ever. This suggests an increase of about 900,000 active listings (up 16% YoY) compared to 4Q21. The supply growth is mainly due to continued product innovation to attract new hosts (Airbnb Setup and Ask a Superhost) and more people turning to hosting to earn extra income.

The Negative

– Declining ADRs. In 4Q22, Average Daily Rates (ADRs) fell 1% YoY to US$153 due to FX headwinds. Excluding the FX impact, ADR grew by 5% YoY. In FY23e, management expects daily rates to remain under pressure and could see mid-single-digit declines due to the business mix shift towards lower ADR stays (urban and APAC regions) as well as pricing transparency and discounts.

Outlook

Airbnb said that guests were excited to travel despite macroeconomic concerns. Management highlighted that the company is witnessing continued strong demand so far in 1Q23e driven by strength in European bookings, market share gains in Latin America, and continued recovery within APAC regions. For 1Q23e, Airbnb expects to report total revenue in the range of US$1.75bn-US$1.82bn (Figure 1), representing YoY growth rate of 16-21% (18-23% in constant currency). The company also anticipates that the number of nights and experiences booked will increase at a rate similar to 4Q22 (~20%).

For FY23e, Airbnb expects adj. EBITDA margin to be nearly as strong as FY22 (~35%). Management noted that ADR headwinds on EBITDA margin could be offset by higher operating leverage.

Advanced Micro Devices Inc. - More demand for AI

Advanced Micro Devices Inc. - More demand for AI Phillip Singapore Monthly Apr24 - Reflation winner

Phillip Singapore Monthly Apr24 - Reflation winner Venture Corporation Limited - Worst performance since 2016

Venture Corporation Limited - Worst performance since 2016 Elite Commerical REIT - Valuation upside from redevelopment

Elite Commerical REIT - Valuation upside from redevelopment