Airbnb Inc - Strong performance overshadowed by soft guidance

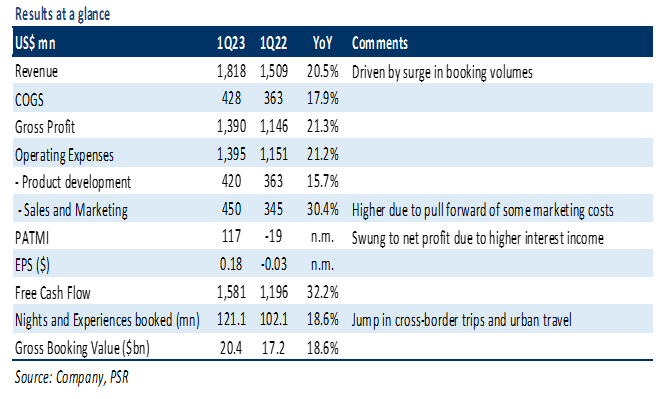

17 May 2023- 1Q23 revenue/PATMI was within expectations at 19%/6% of our FY23e forecasts because of seasonality weakness. Revenue growth of 20% YoY was led by a 19% YoY surge in booking volumes. We expect profitability in 2H23e to rebound strongly driven by summer travel demand and higher operating leverage.

- Airbnb expects 2Q23e revenue growth of 12-16% YoY. Booking volumes face pressure from tough comparisons following the Omicron-fueled pent-up demand in 2Q22. Management reiterated its adj. EBITDA margin guidance of about 35% for FY23e.

- We upgrade to BUY from ACCUMULATE recommendation after the recent fall in its stock price. We lower our DCF target price to US$143.00 (prev. US$149.00) with a WACC of 7% and terminal growth of 4%. We lower our FY23e revenue estimates by 2% due to softening travel demand, while increasing our PATMI by 13% to account for higher interest income. We believe Airbnb platform offers better non-urban location listings versus hotels, benefits travelers looking for long-term stays, and is more family and group travel-friendly.

The Positives

+ Consumer travel demand remained strong. In 1Q23, revenue grew 20% YoY to US$1.8bn despite 4% FX headwinds, implying 24% YoY growth on a constant currency basis. The significant growth was driven by record booking volumes and stable average daily rates (ADRs) of US$168. The number of nights and experiences booked jumped 19% YoY to 121.1mn driven by growth in cross-border trips (up 36% YoY) and urban nights booked (up 20% YoY). Long-term stays (28 days or more) accounted for 18% of total booking volumes driven by the flexibility granted by remote work.

+ Supply continued to accelerate. Total active listings on the platform increased by 18% YoY to an implied 7.6mn. Both urban and non-urban supply increased by 18% YoY. The supply growth is mainly due to continued product innovation to attract new hosts (Airbnb Setup, Ask a Superhost, and insurance and better tools for hosts) and more people turning to hosting to earn extra income.

The Negative

– Soft 2Q23e revenue guidance due to tough comparisons. For 2Q23e, Airbnb anticipates total revenue to be in the range of US$2.35bn to US$2.45bn (up 12-16% YoY). The slowing revenue growth is mainly because of tough comparisons following the Omicron-fueled pent-up demand seen in 2Q22 and as well as lower average daily rates (ADRs) due to the business mix shift towards urban and APAC regions.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments