BRC Asia - Disappointing 1H23, strong uptick expected in 2H23

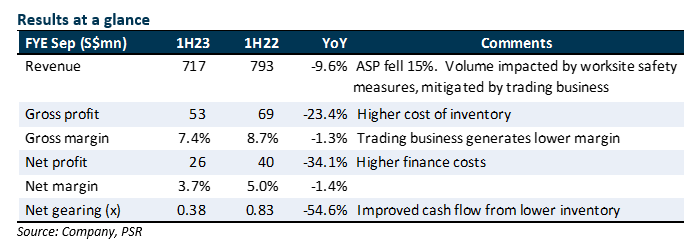

18 May 2023- 1H23 net profit was below our expectations, at 31% of our FY23e forecasts. Net profit fell 34.1% YoY, due to 1) 15% decline in ASP; and 2) slow construction progress with safety measures implemented at worksites, which caused deliveries to be deferred. Lower order delivery was mitigated by trading volume, which reduced gross margin by 1.3% pt to 7.4%.

- Construction activities have picked up since April. Demand remains strong, underpinned by pent-up demand in residential and infrastructure development. BCA has projected 2023 construction demand at S$27bn-32bn (2022: S$29.8bn) and progress payment to grow by 9-20%. BRC’s orderbook has further grown to S$1.42bn. Rebar prices have stabilized from Feb 2023.

- Maintain BUY with a lower DCF-derived target price of $1.99 (prev. $2.14). We cut our forecasts by 23.2% and 27.7% for FY23e and FY24e to reflect the lower 1H23 earnings. We expect steel prices to stabilize for the rest of the year, though this implies a 20.4% YoY decline in 2H23. Order deliveries should rise as construction activities are ramped up.

The Negative

– 1H23 earnings came in at only 31% of our FY23e estimates. The shortfall was due to lower order deliveries, which was impeded by low construction progress at work sites to meet heightened safety measures. The measures are mandated to last till end-May, but activities are picking up with improved safety conditions. BRC booked more lower-margined trading businesses during the period, and gross margin fell 1.3% pt to 7.4%. Interest costs rose 170% YoY to S$6.3mn, resulting in 34.1% YoY decline in 1H23 net profit.

The Positives

+ Net gearing improved to 0.38x (Sep 22: 0.76x). With easing of steel prices and freight costs, inventory holdings were brought down. Credit terms from suppliers become more favourable, leading to strong operating cash inflow of about S$0.608/share.

+ Orderbook edged higher to S$1.42bn (Sep 22: $1.4bn), as demand remains robust. BCA estimates that progress payments, which represent work done and revenue booked, to grow by 9-20% in 2023. We estimate about 60% of the orderbook are for jobs in the public sector which are less volatile and payments are more certain. While the delay in construction work had affected cash flow and credit conditions of some contractors, we do not see any risk of default that could impact building material suppliers.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments