BRC Asia - Earnings declined 12.2% YoY for 1Q23

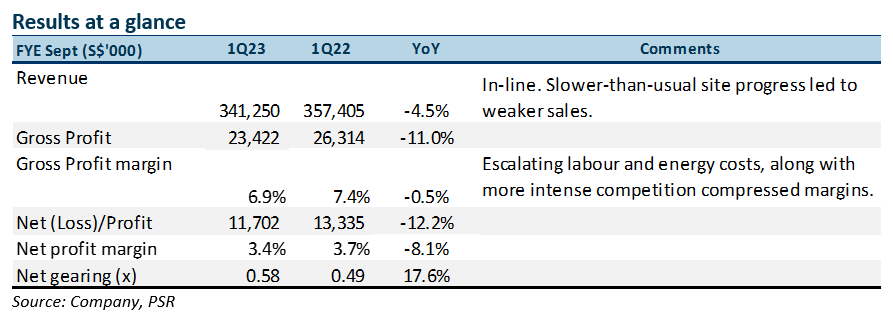

16 Feb 2023- 1Q23 net profit was below our expectations at 11% of our FY23e forecasts. Earnings were below expectations even as we accounted for a seasonally weaker 1H as margins weighed from the more intense competition in the sector.

- Group to see slower 9M23 from Heightened Safety period extension by the Ministry of Manpower (MOM) by another three months till end-May.

- Local construction demand remains robust with the Building and Construction Authority (BCA) projecting total construction demand for 2023 to be between $27-32bn (unchanged from 2022).

- Maintain BUY with a lower target price of $2.14 (prev. $2.30). We trim FY23e earnings by 9.8% as we expect the construction recovery to take longer than expected as it grapples with near-term headwinds. Our TP is lowered to $2.14, still based on 7x FY23e P/E, 15% discount to its 10-year average, on account of the uncertain external environment. Catalysts expected from an end to the Heightened Safety period.

The Negatives

– 1Q23e earnings below expectations, at 11% of our estimates. Revenue was in line with our estimates, as we accounted for a seasonally weak 1H23 that was further weighed down by the Heightened Safety period that was in place. Margins however, were ~1% below our estimates as escalating costs, particularly for labour and energy weighed along with more competition for new contracts, as the industry competed to overcome the shortfall in delivery volumes.

– Heightened Safety period extended by another three months. As a result of the Heightened Safety period imposed by the MOM, local construction projects are, in general, progressing slower than expected. The time-outs and punitive measures imposed on the sector have slowed construction progress. We expect the Heightened safety period to continue to weigh on earnings for 9M23 after the MOM extended the Heightened Safety period by another three months till end-May.

The Positive

+ Construction order book remained healthy at $1.4bn (vs $1.4bn in 4Q22), above our $1.35bn estimates. Strong demand for public housing and infrastructure projects in Singapore continued to boost the Group’s order books. BRC Asia is benefitting from the backlog of projects that were postponed during the Covid-19 pandemic and the higher number of public housing projects that are being launched to meet demand. The construction sector is also recovering at a faster pace with 4Q22’s growth at 10.4% YoY vs 7.8% in the preceding quarter. We estimate that half of its order book will be fulfilled within the next 15-18 months.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments