City Developments Limited - Anticipating stronger growth in hospitality

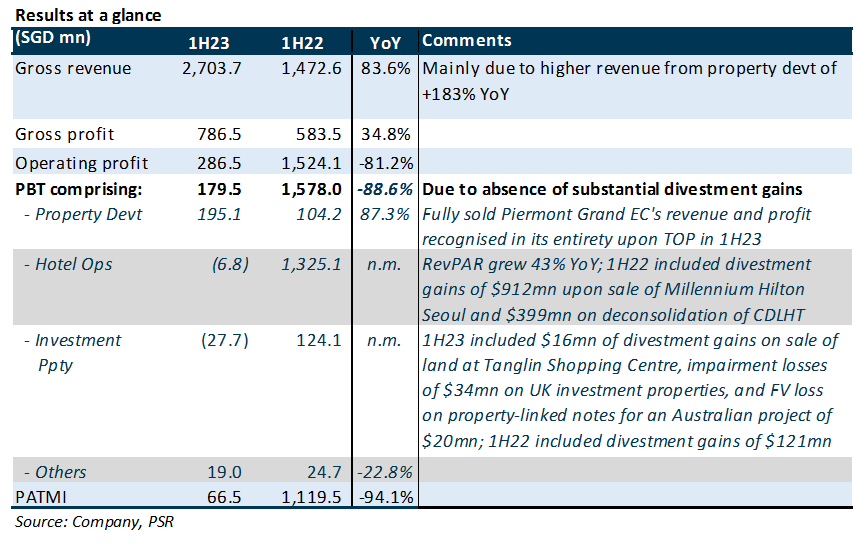

16 Aug 2023- 1H23 revenue of S$2.7bn (+83.6% YoY) was in line and formed 71% of our FY23e forecast due to the full revenue recognition of Piermont Grand Executive Condominium (EC) upon completion in 1H23. PATMI underperformed at S$66.4mn (-94.1% YoY) due to the absence of divestment gains in 1H22, as well as higher financing costs and impairment/ fair value losses in 1H23.

- Excluding divestment gains and impairment losses, EBITDA and PBT increased 48%; PATMI increased 1% YoY to S$104.3mn.

- Upgrade to BUY with a lower RNAV-derived TP of $8.22 from $8.33, a 45% discount to RNAV of S$14.94. We view CDL as a proxy for the Singapore residential market and hospitality recovery. Asset monetisation, unlocking value through AEIs and redevelopments, establishing a fund management franchise, and faster-than-expected recovery in the hospitality portfolio are potential catalysts for CDL, which could help narrow the discount between CDL’s share price and RNAV. CDL declared a special interim dividend of 4 Singapore cents per share.

The Positives

- Singapore residential market remains resilient despite cooling measures. In 1H23, the group and its joint venture associates sold 508 units with a total sales value of S$1.1bn (1H22: 712 units with a total sales value of S$1.6bn). Sales picked up in 2Q23 with the launch of the 638-unit Tembusu Grand in April with 58% of units sold to date. In July, the Group launched The Myst, a 408-unit development at Upper Bukit Timah and it is 32% sold to date at an ASP of S$2,057 psf. Looking ahead, the Group will be launching a 512-unit EC at Bukit Batok West Avenue 5 in 1Q24 and we anticipate strong demand for this project as it is near three MRT stations and the new Anglo-Chinese School (Primary), which is relocating to Tengah in 2030.

- Hospitality segment remains robust. Excluding divestment gains and impairment losses, EBITDA grew 69% due to stronger RevPAR performance across the portfolio (+42.7% YoY to S$151.5). It was driven by both an 18.3% increase in average room rates to S$216.8 and an 11.9% points (69.9% from 58%) increase in occupancy. Compared with pre-COVID 1H19, RevPAR grew 17.2%. We expect RevPAR to continue growing in 2H23, albeit at a slower pace. However, this segment reported a loss before tax of S$6.8mn, due to one-off expenses and higher interest expense. The group’s strategic expansion of its hotel portfolio continues as it recently completed the acquisition of the 408-room Nine Tree Premier Hotel Myeongdong II in Seoul in July 2023 for KRW140bn. Furthermore, the group has entered into a significant agreement to purchase the 416-room Sofitel Brisbane Central hotel in Australia for A$177.7mn, or about A$427,000 per key.

The Negatives

- Borrowing costs rose sharply to 4.1% for 1H23 compared with 2.4% for FY22. Consequently, net finance cost rose 3.8x YoY to S$147mn. Net gearing (including fair value on investment properties) also increased to 57% from 51% as at Dec22.

- Sizable impairment/ fair value losses on investment properties of $54mn. There were impairment losses of $34mn on UK investment properties due to a 30-50bps expansion in cap rates, leading to a drop in valuations. There was also a fair value loss on property-linked notes for an Australian project of $20mn.

About the author

Darren Chan

Research Analyst

PSR

Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.

About the author

Darren Chan

Research Analyst

PSR

Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments