City Developments Limited - Hospitality lifts overall profitability

7 Dec 2022- Copen Grand Executive Condominium (EC) fully sold within a month of launch. The recent launch of its 639-unit EC was well received. We estimate the Group achieved a comfortable ~25% profit margin on the project.

- Hospitality segment continues to benefit from pent-up demand. RevPAR surged 110% YoY, driven by increases in room rates and occupancy in Singapore, US and London.

- Maintain ACCUMULATE with unchanged RNAV-derived TP of $8.86, a 35% discount to RNAV of S$13.64. We view CDL as a proxy for the Singapore residential market and hospitality recovery. Asset monetisation, unlocking value through AEIs and redevelopments, and faster-than-expected recovery in the hospitality portfolio are potential catalysts for CDL, which could help narrow the discount between CDL’s share price and RNAV.

The Positives

- Copen Grand EC fully sold within a month of launch. The recent launch of its 639-unit Copen Grand EC in Oct 2022, at $1,300psf, was well received and the project was fully sold within a month of launch. We estimate the breakeven price for the development to be at $1,050-$1,100psf. The price of $1,300psf therefore gives it a comfortable ~25% profit margin.

- Hospitality segment continues to benefit from pent-up demand. RevPAR surged 110% YoY, driven by a 46% increase in average room rate and 15.9% points (71% from 55.1%) increase in occupancy. Hotels in Singapore, US and Europe continued to recover faster than those in Asia, though average room rates increased across all regions, signalling a strong recovery momentum.

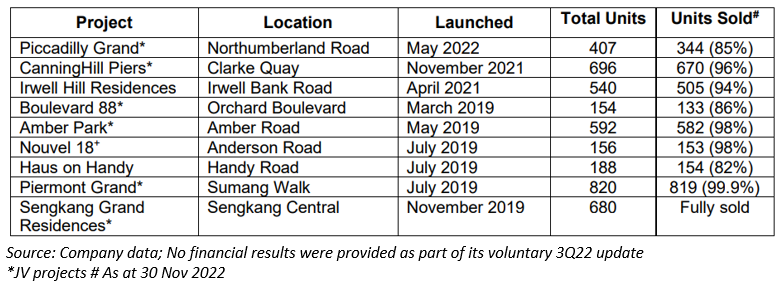

- Healthy gearing levels boost ability of the Group to replenish landbank. The Group’s net gearing levels remain stable at ~83% for 3Q22 (83% for 1H22) with interest cover at 12.1x (16.5x for 1H22). With its strong cash reserves and available undrawn committed bank facilities totalling $4bn, we believe this gives the Group sufficient capacity to replenish its landbank with its existing inventory levels now at lower levels as most of its launched projects have been substantially sold.

The Negative

- Residential sales slowed in 3Q22 as lower inventory weighed. Residential sales declined in 3Q22 as lower inventory and the absence of new launches in 3Q22 weighed. CDL sold 95 units with total sales value of $281mn vs. 414 units with total sales value of $784.4mn in the same period last year.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments