DBS Group Holdings Ltd - Dividends to increase by 24 cents per year

25 May 2023We attended DBS’ Investor Day on 22 May 2023 where management shared their digital-led strategy in growth markets, how new businesses with potential have evolved from the previous Investor Day in 2017 and addressed some of the questions from investors and analysts. The key takeaways from DBS Investor Day 2023 are:

- Guidance of a medium-term (3 to 5 years) ROE of 15-17% and a baseline for dividends to increase by 24 cents per year. Further upside of S$3bn based on optimal CET-1 operating range which could be distributed in further ordinary dividend step-up, special dividend or share buyback.

- Technology has transformed the way they manage with the use of a hybrid multi-cloud strategy with in-house infrastructure as a service. Other business segments such as Consumer and SME, Private banking, Global transaction services, and Treasury markets have also benefited from the digital transformation.

Group Financials

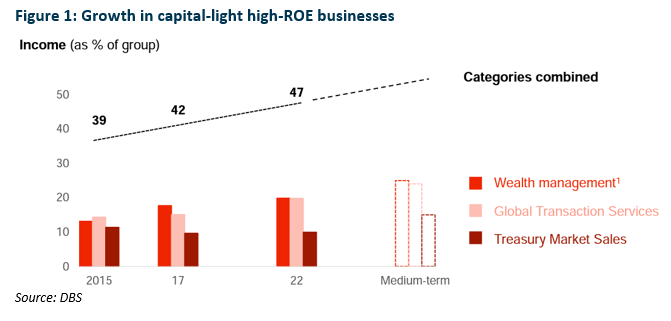

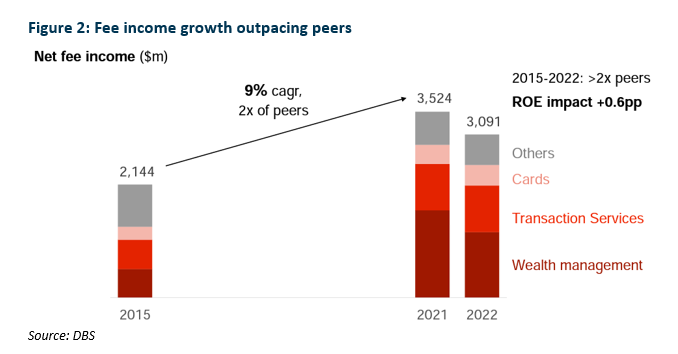

- Medium-term ROE of 15-17%, dividends to increase by 24 cents per year. DBS has guided for a medium-term ROE of 15-17%, with the uplift coming from: (a) faster growth in capital-light high-ROE businesses such as wealth management, global transaction services and treasury market sales; (b) increasing ROE with scale in growth markets such as transaction banking, wealth management, SME lending and unsecured retail lending, and; (c) capital headroom to support profitable growth and higher distributions. Notably, ordinary dividends would be lifted by 24 cents to S$1.68 in 2023. There is also a further upside of S$3bn based on the optimal CET-1 operating range of 12.5-13.5% (1Q23: 14.1%), which could be distributed in further ordinary dividend step-up, special dividend or share buyback.

- Group ROE structurally improved by 250bps. ROE improved by 380bps to 15.0% in 2022 (2015: 11.2%) from a 220bps uplift in external drivers and a 250bps increase in structural drivers offset slightly by a 90bps dip in financial leverage. External drivers include higher interest rates, credit cycle and market growth. Structural drivers include extended superior deposit franchise to foreign currency, growth in high-ROE fee income and new capabilities in credit risk management.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Wells Fargo & Company - NII decline hurt earnings

Wells Fargo & Company - NII decline hurt earnings Bank of America Corporation - Earnings hurt by NII and FICC

Bank of America Corporation - Earnings hurt by NII and FICC CapitaLand Investment Limited - Capital recycling picks up pace

CapitaLand Investment Limited - Capital recycling picks up pace Sheng Siong Group Ltd - Seasonal and base effect bump

Sheng Siong Group Ltd - Seasonal and base effect bump