DBS Group Holdings Ltd - Growth across the board offset by allowances

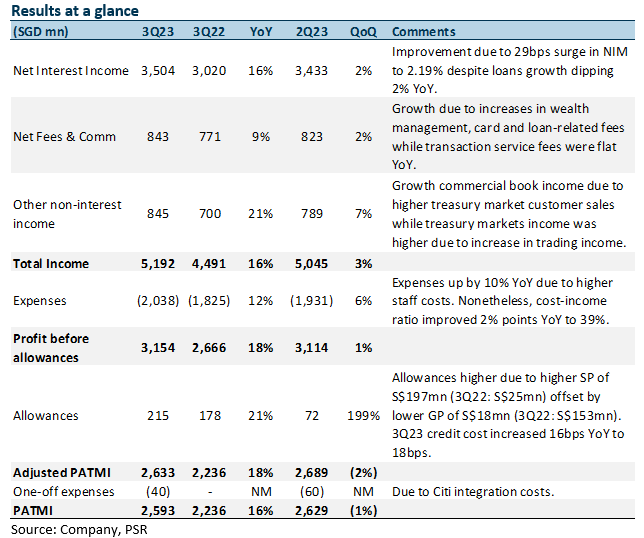

7 Nov 2023- 3Q23 adjusted PATMI of S$2.63bn was above our estimates due to higher NII, fee income and other non-interest income offset by higher allowances. 9M23 adjusted PATMI is 78% of our FY23e forecast. 3Q23 DPS is raised 14% YoY to 48 cents.

- NII rose 16% YoY on NIM expansion of 29bps despite loan growth dipping slightly. Fee income rose 9% YoY, while other non-interest income grew 21% YoY. DBS has maintained its FY23e guidance. It provided FY24e guidance of double-digit fee income growth (from wealth management and credit card fees), stable NII as higher NIMs from higher-for-longer rates will be offset by lower loan growth and total allowances to normalise to 17-20bps of loans. FY24e PATMI to be maintained at around the current levels in FY23.

- Maintain BUY with an unchanged target price of S$41.60. Our FY23e estimates remain unchanged. We assume 1.90x FY23e P/BV and ROE estimate of 16.6% in our GGM valuation. Continued NIM growth from higher-for-longer interest rates and a recovery in fee income will sustain earnings momentum.

The Positives

+ NIM and NII continue to increase YoY. NII rose 16% YoY to S$3.5bn due to a 29bps NIM increase to 2.19% (2Q23: 2.16%) as interest rates continue to remain high, despite loan growth dipping 2% YoY. Loan growth dipped due to a decline in customer and trade loans due to unattractive pricing while non-trade corporate loans were lower due to higher repayments. Nonetheless, the Citi Taiwan consolidation contributed S$10bn to loans.

+ Fee income continues to grow. Fee income rose 9% YoY to S$843mn. WM fees increased 22% YoY from higher bancassurance and investment product sales, while card fees grew 21% YoY from higher spending and the integration of Citi Taiwan. Loan-related fees rose 12% YoY, while transaction fees were flat YoY. These increases were moderated by a 16% YoY decline in investment banking fees due to slower capital market activities.

+ Other non-interest income rose 21% YoY. Other non-interest income rose 21% YoY mainly due to an increase in net trading income from higher trading gains and an increase in treasury customer sales to both wealth management and corporate customers. Notably, commercial book accounts for majority of other non-interest income was at 59%, while treasury markets accounts for 41%.

The Negatives

– Allowances rose 21% YoY. 3Q23 total allowances were higher 21% YoY due to higher SP of S$197mn (3Q22: S$25mn). Resultantly, 3Q23 credit costs rose to 18bps, with 9M23 credit costs at 11bps. The rise in SP was due to allowances being prudently taken for exposures linked to the recent money laundering case in Singapore. The NPL ratio rose slightly to 1.2% (3Q22: 1.1%), while GP reserves were stable YoY at S$3.91bn.

– CASA ratio decline continues. The Current Account Savings Accounts (CASA) ratio fell 12.5% points YoY to 47.8%, mainly due to the high interest rate environment and a continued move towards fixed deposits (FDs). Resultantly, total customer deposits were flat YoY at S$531bn as the decline in CASA deposits were partially offset by growth in FDs.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Wells Fargo & Company - NII decline hurt earnings

Wells Fargo & Company - NII decline hurt earnings Bank of America Corporation - Earnings hurt by NII and FICC

Bank of America Corporation - Earnings hurt by NII and FICC CapitaLand Investment Limited - Capital recycling picks up pace

CapitaLand Investment Limited - Capital recycling picks up pace Sheng Siong Group Ltd - Seasonal and base effect bump

Sheng Siong Group Ltd - Seasonal and base effect bump