DBS Group Holdings Ltd Surge in net interest and other non-interest income

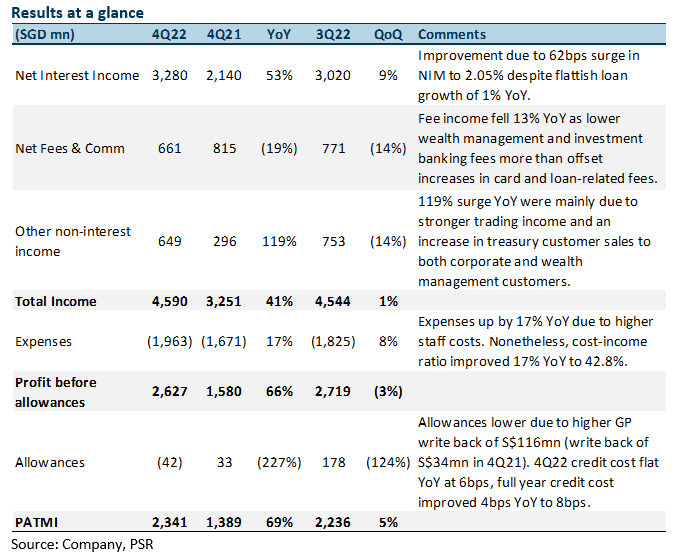

15 Feb 2023- 4Q22 earnings of S$2.34bn were above our estimates due to higher net interest income (NII) slightly offset by lower fee income. FY22 PATMI is 104% of our FY22e forecast. 4Q22 DPS was up 17% YoY to 42 cents with an additional special dividend of 50 cents; full-year FY22 dividend rose 67% YoY to 200 cents.

- NII surged 53% YoY to S$3.28bn on NIM expansion of 62bps to 2.05% despite flat loan growth of 1% YoY. Fee income fell 19% YoY due to weaker market sentiment, while other non-interest income surged 119% YoY. 4Q22 ROE increased 7.3% points YoY to 17.2%.

- Maintain BUY with an unchanged target price of S$41.60. We lower FY23e earnings by 3% as we lower NII estimates for FY23e due to lower loans growth, offset slightly by higher fee and other non-interest income. We assume 1.88x FY23e P/BV and ROE estimate of 16.5% in our GGM valuation. Expect another two quarters of strong NII growth. 1H22 NIM was only 1.52% compared to 4Q22’s 2.05%.

The Positives

+ NIM and NII continue to surge. NII spiked 53% YoY to S$3.28bn due to a NIM surge of 62bps YoY to 2.05% (1Q22: +3bps, 2Q22: +12bps, 3Q22: +32bps, 4Q22: +15bps) despite flat loan growth of 1% YoY. Increases in non-trade corporate, housing, and trade loans were offset by lower loans in other segments as some corporates shifted their borrowing to cheaper financing options or repaid opportunistic borrowing. Management has guided for a peak NIM of 2.25% for FY23e with a downside risk of 5-7bps due to outflows to T-bills, strengthening SGD and higher funding costs.

+ Other non-interest income spiked 119% YoY. Other non-interest income surged 119% YoY mainly due to an increase in treasury customer sales to both corporate and wealth management customers, and higher trading gains which more than offset a decline in gains from investment securities.

+ Asset quality stable; 4Q22 allowance write back of S$42mn. 4Q22 total allowances were lower YoY and QoQ due to a higher GP write-back of S$116mn for the quarter (4Q21: write- back of S$34mn, 2Q22: GP of S$153mn), with full-year allowances at S$237mn (FY21: S$52mn). 4Q22 credit costs were flat YoY 6bps while full-year credit costs improved by 4bps YoY to 8bps. GP reserves dipped slightly to S$3.7bn, with NPA reserves at 122% and unsecured NPA reserves at 215%. The NPL ratio declined to 1.1% (4Q21: 1.3%) as new NPA formation remained low and was more than offset by higher upgrades and repayments.

The Negatives

– Fee income fell 19% YoY. The fee income decline YoY was mainly due to weaker market sentiment affecting wealth management and investment banking which more than offset increases in card and loan-related fees. WM fees fell 31% YoY to S$262mn as weaker financial market conditions led to lower investment product sales. Investment banking fees fell by 64% YoY to S$23mn alongside a slowdown in capital market activities. Nonetheless, card fees improved 22% YoY to S$245mn as travel spending continued to recover towards pre-pandemic levels, while loan-related fees were stable at S$79mn.

– CASA ratio declined YoY. The Current Account Savings Accounts (CASA) ratio fell 21% YoY to 60.3% mainly due to the high interest rate environment and a move towards fixed deposits (FD). Nonetheless, total customer deposits increased 5% YoY to S$527bn. Management said that the drop in CASA was expected and that the increase in FDs was higher than the drop in CASA, hence a net increase in deposits.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Wells Fargo & Company - NII decline hurt earnings

Wells Fargo & Company - NII decline hurt earnings Bank of America Corporation - Earnings hurt by NII and FICC

Bank of America Corporation - Earnings hurt by NII and FICC CapitaLand Investment Limited - Capital recycling picks up pace

CapitaLand Investment Limited - Capital recycling picks up pace Sheng Siong Group Ltd - Seasonal and base effect bump

Sheng Siong Group Ltd - Seasonal and base effect bump