Fortress Minerals Ltd – Hit by production disruptions

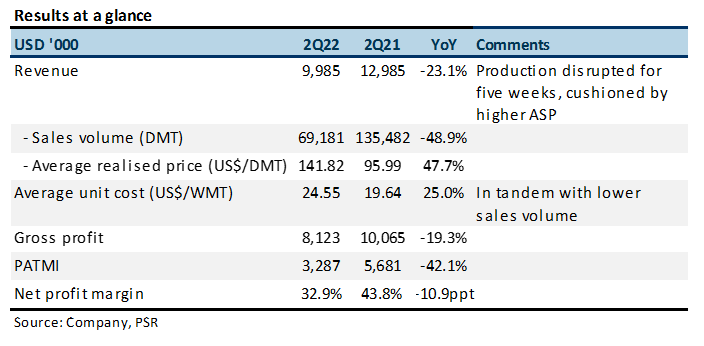

15 Oct 2021- 2Q22 results were below expectations. 1H22 revenue and PATMI at 39%/34% of our forecasts. Sales volume was lower than expected. ASP of US$141.82/DMT in line with our forecast of US$140/DMT.

- Production disruptions at Bukit Besi Mine during Phase 1 nationwide Total Lockdown under National Recovery Plan, which lasted for approximately five weeks.

- Downgrade to ACCUMULATE with lower TP of S$0.51. Our FY22e PATMI has been lowered by 22% to US$23.9mn as we decrease our sales volume forecast by 8.6% to 455,020 DMT. Iron ore prices are expected to remain weak around US$140/DMT, with continued steel production cuts in China. As such, we lower our ASP forecast to US$120/DMT for FY22e.

The Positives

+ Higher iron ore prices. 2Q22 revenue was down 23% YoY due to a 49% collapse in production. The 48% YoY improvement in selling prices offset some of the revenue weakness.

+ Operating cash flow increased. Operating cash flow catapulted from US$54k in 2Q21 to US$6.3mn in 2Q22, with the help of lower working capital. FCF turned positive to US$2.2mn, from US$495k, even with capex increasing to US$4.2mn, from US$549k.

The Negatives

– Lower sales volume. Sales volume was negatively impacted by the production disruptions at Bukit Besi Mine. Mining and processing activities have since resumed on 5 July 2021 at 80% capacity. Average unit cost rose due to the fall in production.

– Higher net debt. Bank borrowings increased from US$166k to US$22.9mn for the acquisition of Fortress Mengapur which was completed in April 2021 and purchase of equipment. Net debt increased further to US$14.7mn since 1Q22.

Updates

FML announced on 12 October 2021 that its subsidiary, Fortress Resources Pte Ltd, has entered into a new offtake agreement with a third-party domestic steel mill in Malaysia. Fortress Resources will deliver 375,000 WMT of iron ore to this customer over a 15-month period from 11 October 2021 to 31 December 2022 (3QFY22 to 4QFY23). The total volume of iron ore concentrate delivered in FY21 was 497,369 WMT.

Wells Fargo & Company - NII decline hurt earnings

Wells Fargo & Company - NII decline hurt earnings Bank of America Corporation - Earnings hurt by NII and FICC

Bank of America Corporation - Earnings hurt by NII and FICC CapitaLand Investment Limited - Capital recycling picks up pace

CapitaLand Investment Limited - Capital recycling picks up pace Sheng Siong Group Ltd - Seasonal and base effect bump

Sheng Siong Group Ltd - Seasonal and base effect bump