Alphabet Inc - Business resilient through macro uncertainty

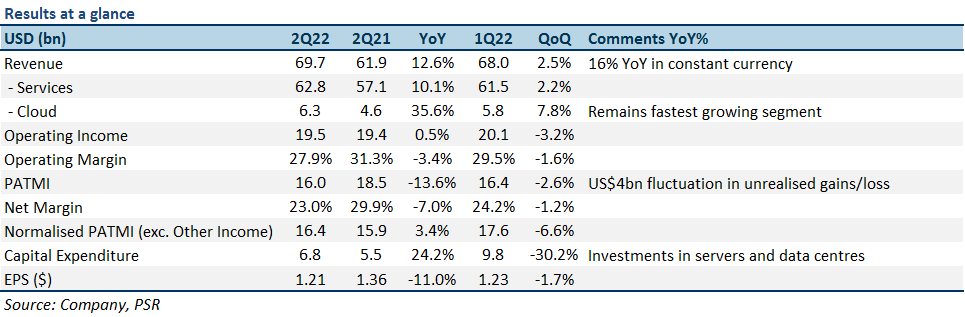

28 Jul 2022- 2Q22 revenue in line, but misses on earnings. 1H22 revenue/PATMI at 45/36% of our FY22e forecasts.

- Cloud continues to push ahead – 2Q22 revenue was at US$6.3bn, 35% YoY growth.

- Earnings miss was due to FX headwinds, and a one-off unrealized loss in debt/equity investments of -US$1.0bn for 2Q22.

- We lower our FY22e earnings forecast to account for the higher-than-expected unrealized loss, and also slightly increase expenses associated with investments in IT infrastructure. We maintain a BUY recommendation with a lowered DCF target price of US$139.00 (prev. US$144.00).

The Positives

+ 2Q22 revenue in line with forecasts. GOOGL met consensus estimates for its top line, posting US$69.7bn in revenue, representing a 13% YoY increase (16% YoY in constant currency). Revenue growth continued to be supported by growth in GOOGL’s Services (10% YoY) and Cloud (36% YoY) segments. The company also remains on track to hit our FY22e revenue estimates of US$303.4bn, even amidst near-term FX headwinds that are expected to continue.

+ Cloud continues to push ahead. Cloud remained GOOGL’s fastest growing segment, with 36% YoY growth in the quarter, crossing US$6bn in revenue for the first time. Growth was driven by continued corporate demand across Google Cloud Platform and Google Workspace, as companies leverage on Google Cloud’s Artificial Intelligence, Machine Learning, and Cybersecurity capabilities to optimize and safeguard operations. GOOGL also remains focused on working towards profitability in its Cloud segment, reducing losses QoQ.

The Negatives

– Higher-than-expected unrealized losses in debt/equity investments hurting bottom line. GOOGL’s net margin contracted from 30% a year ago, to 23% this quarter, hurt by an almost US$4bn fluctuation in unrealized gain/loss on debt/equity investments. Taking out these fluctuations, net margin for 2Q22 would be 24%, compared to 26% in 2Q21. If we normalize PATMI (exclude Other Income), 1H22 would be 43% of our normalized FY22e PATMI forecasts.

– Weak macroeconomic outlook and strengthening FX headwinds to continue. Pullback in spending by some advertisers across all verticals and industries in 2Q22 continue to reflect uncertainty regarding a weakening macroeconomic environment, with these challenges expected to continue in 3Q22. Also, a strengthening US dollar led to a 3.7% growth headwind for 2Q22, and is expected to worsen in 3Q22 given the strong quarter-to-date performance of the US dollar so far.

Outlook

We expect overall growth to be moderated compared to a particularly high growth period in FY21. Capital expenditure is expected to remain elevated as the company continues to invest in more servers and data centers. A weak macroeconomic environment and a strengthening US dollar is also expected to continue in the short-term, led by uncertainty over the severity of continued interest rate hikes and a possible recession.

Google Cloud continues to grow well, and we expect this to continue moving forward with increasing commitment from management to expand its scale and capabilities – increasing its focus on building up Artificial Intelligence, Machine Learning, and Cybersecurity technologies to support Cloud products. Corporate demand for Google Cloud’s products and services is also expected to remain resilient.

YouTube continues to see strong user engagement, with YouTube Shorts recording more than 30bn daily views, by over 1.5bn users each month. YouTube advertising continues to be an important tool for advertisers, with advertisers excited about YouTube’s reach and ability to drive results. YouTube is currently in its infancy stage as far as monetization, which we believe would be a huge additional driver of revenue growth moving forward.

GOOGL continues to generate strong Free Cash Flows (FCF) – US$12.6bn for 2Q22, and about US$65bn for the trailing 12 months. The company also bought back slightly more than US$15bn worth of shares – the most it has ever done in a single quarter, and also increased its share repurchase authorization for the year to US$70bn.

We reduce our FY22e PATMI forecasts by 10% on the back of higher-than-expected unrealized losses from debt/equity investments, and adjust total expenses forecast upwards slightly to account for increasing investments in IT.

Maintain BUY with a lowered target price of US$139.00 (prev. US$144.00)

We maintain a BUY rating with a lowered target price of US$139.00 (prev. US$144.00), with a WACC of 7.3%, and a terminal growth rate of 3.5%.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU