Lendlease Global Commercial REIT - High rental reversion could hold up valuation

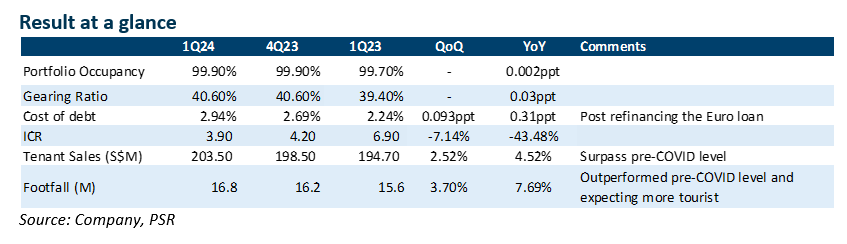

9 Nov 2023- No financials were provided for 1Q24. Portfolio committed occupancy remains high at 99.9%, with strong rental reversion of 16.3%. We expect the momentum to continue for the rest of FY24, with 313@Somerset leading the performance as international travellers return.

- Inorganic growth in the near term is off the table and LREIT has no plan for equity fund raising (EFR).

- We reiterate our BUY recommendation with an unchanged DDM-TP of S$0.86 and FY24e-25e DPU forecasts of S$4.38 – 4.63 cents. We expect FY24e earnings will be supported by strong rental reversion and fading headwinds from the interest rate hike.

The Positives

+ Robust rental reversion of 16.3%, with 313@somerset achieving c.20%, and Jem achieving high single digits. In FY24, 7.8% of leases by gross rental income (GRI) are set to expire, and we anticipate the momentum of high reversion to persist, with 313@somerset benefiting from the return of tourism and Jem maintaining stability.

+ Healthy operating metrics. Portfolio occupancy remains high at 99.9%, with 313 experiencing a slight 10bps decrease to 98.9%, Sky Complex in Milan and Jem remained at 100%. The Milan asset has been efficiently utilized, achieving a physical occupancy rate of c.70% following tenant footprint consolidation.

+ Resilient valuation. There is no downward pressure on the valuation in the Singapore market and the portfolio valuation remained unchanged compared to 4Q23. Jem has seen a 2.5% increase in valuation due to healthy rental reversion and a stable occupancy rate. The valuation of 313@Sommerset improved by 4% YoY as a result of the development of the multifunctional event space (Live Nation), which is expected to be in operation in 2025. The stress is more visible in overseas assets. SKY Complex in Milan is valued down by 10.5% due to a terminal cap rate expansion of 75bps as the rental is under the market rate.

The Negative

– Cost of borrowing inched up to 2.94% (+25bp QoQ) upon refinancing of the Euro loan. With the new rate taking effect, the interest rate for FY24e is expected to be around the low 3% which is in line with our forecast.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

Advanced Micro Devices Inc. - More demand for AI

Advanced Micro Devices Inc. - More demand for AI Phillip Singapore Monthly Apr24 - Reflation winner

Phillip Singapore Monthly Apr24 - Reflation winner Venture Corporation Limited - Worst performance since 2016

Venture Corporation Limited - Worst performance since 2016 Elite Commerical REIT - Valuation upside from redevelopment

Elite Commerical REIT - Valuation upside from redevelopment