Lendlease Global Commercial REIT - Higher reversion for longer

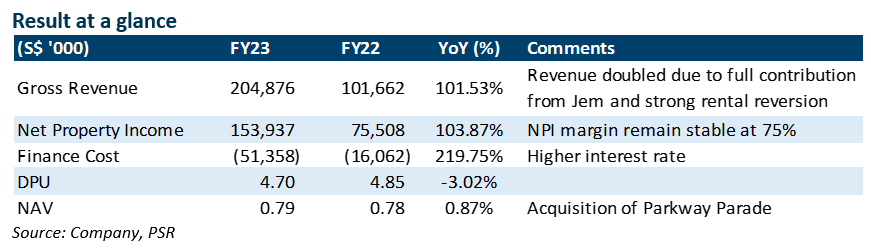

15 Aug 2023- FY23 revenue and NPI doubled to S$204.9m and S$153.9m, respectively, and were below our expectations at 94% and 91%. Healthy retail rental reversion of 4.8% and increasing contribution from Jem were the main driving factors. We anticipate these trends to continue in FY24e, with additional upside potential from 313@somerset.

- FY23 DPU was at 101.5% of our expectations. DPU decreased to 4.7 cents (-3.2% YoY) due to rising interest costs at 2.69% (+1% YoY).

- We reiterate our BUY recommendation with a decrease in FY24e-25e DPU forecasts to S$4.38 – 4.63 cents on the back of rising interest rates. Our DDM-TP adjusted down to S$0.86. We expect FY24e earnings will be supported by stronger rental reversion and potential inorganic growth.

The Positives

+ Strong rental reversion continues in FY24e, with LREIT achieving an overall retail rental reversion of 4.8%, driven by Jem’s improved performance. The Sky Complex in Milan (tied to the CPI index) experienced a 5.9% rental escalation. Tenant sales at the portfolio level increased 2.5 times, surpassing pre-COVID levels by over 16% in Jun23 while Footfalls have normalized to 100%. We expect the rental trend of Jem to stabilize in 2H23, while 313@somerset’s rental is projected to gradually increase as international visitors return.

+ Portfolio occupancy stays at 99.9% as of Jun23 and tenant retention at 82.4%. Thanks to healthy operating metrics, the portfolio valuation experienced a 1.4% uplift, driven by Jem (+2.5% YoY) and 313@somerset (+4.0% YoY). The Sky Complex in Milan was the main setback (-9.2% YoY), attributed to a 0.75% increase in the terminal cap rate due to inflation and rising interest rates.

The Negative

– Gearing nudged up to 40.6% (+1.3% QoQ) upon completion of the Parkway Parade (PP) acquisition (7.7% stake). Rising borrowing costs are expected to continue into FY24e. LREIT has already refinanced the €285m Loan in Aug23, which accounts for one-third of its total borrowing. With the new rate taking effect, the interest rate for FY24e is expected to be around 3.5%.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

Advanced Micro Devices Inc. - More demand for AI

Advanced Micro Devices Inc. - More demand for AI Phillip Singapore Monthly Apr24 - Reflation winner

Phillip Singapore Monthly Apr24 - Reflation winner Venture Corporation Limited - Worst performance since 2016

Venture Corporation Limited - Worst performance since 2016 Elite Commerical REIT - Valuation upside from redevelopment

Elite Commerical REIT - Valuation upside from redevelopment