NikkoAM-STC Asia REIT - Stock Analyst Research

| Target Price* | 0.820 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 24 Apr 2024 |

*At the time of publication

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

- We value NikkoAM-StraitsTrading Asia ex Japan REIT ETF (AXJREITS) using a combination of historical dividend yield spread and price-to-book ratios. Using these two valuation methods, the target price are S$0.80 and S$0.84, respectively. Applying equal weightage to both valuations, we initiate coverage with an ACCUMULATE recommendation and target price of S$0.82.

- AXJREITS gives exposure to 44 REITs across the Asia ex-Japan region. It is the largest REIT ETF listed in Singapore in terms of market cap and the only Singapore REIT ETF that pays dividends quarterly. This ETF offers investors stable income, attractive book value, and diversified, convenient, and efficient access to REITs across the Asian markets.

- We expect dividends from REITs to remain under pressure from higher interest rates. Due to interest rate hedges, effective interest rates will still creep up until 2025. In contrast, property valuations in Singapore have been stable, supported by transaction prices. Interest rate cuts can provide REITs the triple benefit of a yield that is more attractive to bonds, lower interest expenses, and increase valuations as cap rates compress. Hong Kong retail spending is recovering, supporting tenant sales and improving rent. However, the office market in Hong Kong remains challenging, with vacancies jumping to record levels. Rental reversion for offices in Hong Kong is expected to be negative in 2024.

ETF Background

The AXJREITS is an investment product that provides investors with exposure to a diversified portfolio of Real Estate Investment Trusts (REITs) listed across developed and emerging economies in Asia, including Singapore (73.6% of portfolio), Hong Kong (13.5%) and India (6.8%). It closely replicates the performance of the FTSE EPRA Nareit Asia ex Japan REIT 10% Capped Index. Established in 2017, AXJREITS comprises of 44 securities with a market cap of S$350 mn as of 18 Apr 2024. Among the five REITs ETFs in Singapore, it is the largest in terms of market cap.

Investment Merits

- Investors gain the opportunity to participate in the potential income and capital appreciation generated by the Asian markets, offering convenient and efficient access to this segment of the real estate sector.

- Sustainable income over the years (Figure 2). AXJREITS dividends have been stable since its IPO, maintaining around 4 to 6 cents.

- The book value of the ETF has become more attractive over the last two years (Figure 6). It historically traded at a high of 1.2x price to book but now trades at a 10% discount to book.

ETF Benchmark

AXJREITS replicates as closely as possible the performance of the FTSE EPRA Nareit Asia ex Japan REITS 10% Capped Index, which is designed to track the performance of REITS in both developed and emerging markets in Asia excluding Australia, New Zealand, and Japan.

Valuation

Dividend Yield Spread valuation

Dividend Yield measures the annual value of dividends received relative to the market price per unit of the ETF. To value AXJREITS, we will use the average dividend yield spread to a 10-year bond (Figure 4). Since its inception, AXJREITS has had an average 2.37% spread to a 10-year bond. The three-year average is 2.64%, and the current spread is 3.17%.

We value AXJREITS at S$0.80 at a 2.64% dividend yield spread, its 3-year average spread. We believe that is appropriate given the recent rise in interest rates.

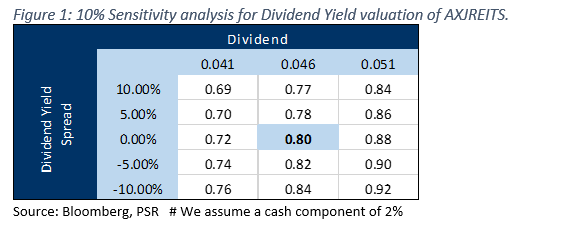

To determine the range of valuations, we applied a 5% and 10% discount and premium to both Dividend Yield Spread and Forward Dividend (Figure 1). At the bottom end of our valuation range, with a 10% higher projected dividend yield spread and a 10% lower forward dividend, the ETF price is S$0.69 (Figure 1). At the top end of our valuation range, we use a 10% lower projection of Dividend Yield Spread and a 10% higher Forward Dividend, and the ETF price is S$0.92.

About the author

Helena Wang

Research Analyst

PSR

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master degree in Financial Technology from Nanyang Technological University

About the author

Helena Wang

Research Analyst

PSR

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master degree in Financial Technology from Nanyang Technological University

Advanced Micro Devices Inc. - More demand for AI

Advanced Micro Devices Inc. - More demand for AI Phillip Singapore Monthly Apr24 - Reflation winner

Phillip Singapore Monthly Apr24 - Reflation winner Venture Corporation Limited - Worst performance since 2016

Venture Corporation Limited - Worst performance since 2016 Elite Commerical REIT - Valuation upside from redevelopment

Elite Commerical REIT - Valuation upside from redevelopment