Netflix Inc. - Gaining subscriber momentum

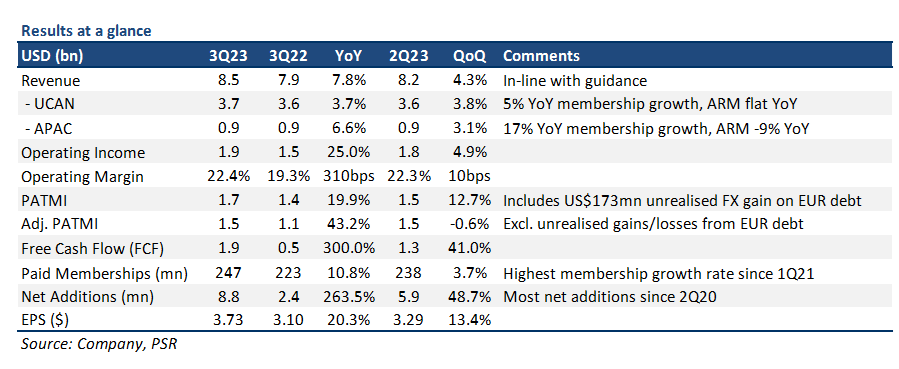

20 Oct 2023- 3Q23 results were in line with our estimates. 9M23 revenue/PATMI at 72%/82% of our FY23e forecasts. Paid memberships grew 11% YoY, its highest growth rate since 1Q21.

- 8mn net additions were the most in 3 years for a quarter, mainly due to the conversion of password borrowers. NFLX ended 3Q23 with 247mn paid memberships.

- Guided acceleration in revenue growth of 11% YoY for 4Q23e on the back of continued success of its Paid Sharing program, and price increases in its US/UK/FR markets.

- We nudge our FY24e EBITDA by 3% on higher content amortization, and upgrade to an ACCUMULATE recommendation from NEUTRAL with a raised DCF target price of US$455.00 (prev. US$446.00). NFLX remains our top choice for streaming entertainment given its pricing power, growing membership base and quality content. Our WACC/growth rate assumptions remain the same at 12.2%/3% respectively.

The Positives

+ Most membership additions in a quarter since 2Q20. NFLX added 8.8mn new members to its platform, the most in a quarter since 2Q20, and the most for a 3Q in 6 years. A bulk of this was attributed to the success of NFLX’s Paid Sharing program as it converts password borrowers into paying members. There is also an expectation for incremental membership additions from Paid Sharing to continue into the next few quarters, alleviating concerns on near-term growth. NFLX ended the quarter with 247mn paid memberships (11% YoY growth).

+ Guiding acceleration in revenue growth for 4Q23e; margins to also expand moving into FY24e. NFLX issued very encouraging guidance for 4Q23e, with revenue growth accelerating to 11% YoY on the back of growing paid memberships and increasing monetisation. Additionally, the company expects FY23e operating margin to be at the top end of their 18%-20% range, with further margin expansion into FY24e by another 200bps. FY23e Free Cash Flow (FCF) was also increased by US$1.5bn to US$6.5bn – supported by healthier cash flow generation and ~US$1bn in lower content spend due to writer/actor strikes.

+ Price hikes in developed markets continue to show pricing power. NFLX announced that it would be raising prices for some of its subscription plans in the US/UK/FR. In the US, its basic plan will see a price increase of US$2 to US$11.99, while its premium plan will be costlier by US$3 at US$22.99. With the price adjustments, churn rates are still expected to be relatively low – in-line with similar adjustments in the past, and should immediately benefit the company’s bottom-line. This is the first price hike for NFLX in >18 months.

The Negative

– Nil.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Advanced Micro Devices Inc. - More demand for AI

Advanced Micro Devices Inc. - More demand for AI Phillip Singapore Monthly Apr24 - Reflation winner

Phillip Singapore Monthly Apr24 - Reflation winner Venture Corporation Limited - Worst performance since 2016

Venture Corporation Limited - Worst performance since 2016 Elite Commerical REIT - Valuation upside from redevelopment

Elite Commerical REIT - Valuation upside from redevelopment