Netflix Inc. - Paid sharing driving most of the gains

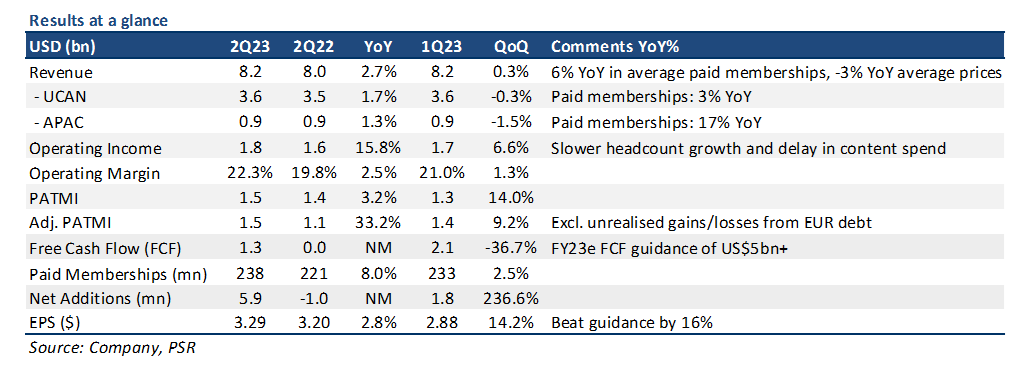

24 Jul 2023- 2Q23 results were in line with our estimates. 1H23 revenue/PATMI at 48%/51% of our FY23e forecasts. Currency continued to be a 3% point drag to revenue growth.

- Positive results on its two key initiatives: 1) Paid sharing driving majority of membership/revenue growth in 2Q23; 2) Ad-supported memberships doubled from 1Q23. Expect acceleration in revenue growth in 2H23e.

- Writer and actor strikes a positive for FY23e FCF due to delays in content spend. FY23e FCF is raised by 37%.

- We reduce our FY23e content spend by 12%. Longer-term content spend growth is also lowered by 2% to be more in line with revenue growth. We also nudge FY24e revenue/PATMI up by 3% to reflect stronger revenue trends from Paid Sharing and advertising. FY23e revenue/PATMI remain unchanged. We maintain our NEUTRAL recommendation with a raised DCF target price of US$446.00 (prev. US$388.00). Our WACC and growth rate assumptions remain the same at 12.2% and 3% respectively.

The Positives

+ Key initiatives showing positive results. NFLX’s new Paid Sharing initiative has almost fully taken off and is now implemented in >100 countries (>80% of total revenue contributions). Initial results have been positive, revenue and membership numbers are better now vs prelaunch. Paid membership growth was broad-based, with all regions gaining at least 1mn new members. Most of NFLX’s revenue growth was attributed to Paid Sharing, with the expectation of a gradual positive business impact in the near term as borrowers continue to convert over the next few quarters. Paid memberships for NFLX’s ad-supported plan is also ramping up, with memberships doubling from 1Q23 to 2Q23. Revenue from this plan is still marginal, but each ad-supported member is margin accretive.

+ Positive guidance for 3Q23e with revenue growth expected to accelerate to 8%. After 3 consecutive quarters of relatively flat growth, NFLX guided to slightly more positive revenue growth of 8% YoY for 3Q23e, citing increasing monetization from its Paid Sharing initiative and advertising growth. Growth is expected to further accelerate into 4Q23e as more account borrowers convert into paid memberships.

The Negative

– Writer/Actor strikes a temporary positive for margins. Hollywood actors and writers continued to go on strike after failing to reach an agreement with major studios and streaming companies over better compensation and job security. Although this cast some negative publicity for streaming companies like NFLX, the strikes actually benefitted the company’s financials for the quarter. Operating margins beat guidance by 17%, coming in at 22.3% for 2Q23, as the strikes delayed planned content spend into future quarters.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Advanced Micro Devices Inc. - More demand for AI

Advanced Micro Devices Inc. - More demand for AI Phillip Singapore Monthly Apr24 - Reflation winner

Phillip Singapore Monthly Apr24 - Reflation winner Venture Corporation Limited - Worst performance since 2016

Venture Corporation Limited - Worst performance since 2016 Elite Commerical REIT - Valuation upside from redevelopment

Elite Commerical REIT - Valuation upside from redevelopment