NVIDIA Corporation - AI turbocharged guidance

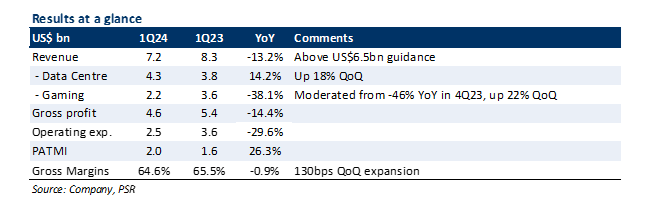

29 May 2023- 1Q24 results were within expectations. Revenue/PATMI was at 24% of our FY24e forecasts.

- Revenue beat guidance due to growth in the Data Centre segment. 2Q24 guidance of a 64% YoY growth in sales, largely driven by steep demand in Generative AI and LLMs across its customer base.

- Sales for Gaming, and Professional Visualisation continued their YoY contraction but moderated compared to their YoY decline in 4Q23. Revenue for both segments were up QoQ as NVDA ramps its new Ada Lovelace-based GPUs.

- We increase our FY24e revenue/PATMI by 30%/52% to account for the higher-than-expected growth in Data Centre business and lower-than-expected operating expenses. We downgrade from BUY to ACCUMULATE rating with an increased target price of US$440.00 (prev. US$315.00), with a WACC of 6.8%, and a terminal growth rate of 4.5%, due to the recent share price performance.

The Positives

+ Revenue beat company guidance. Revenue was down 13% YoY to US$7.2bn, but this was above company guidance of US$6.5bn. The better-than-expected performance was driven by 14% YoY growth in Data Centre sales, which set a new record of US$4.3bn. NVDA attributed the growth to the surge in demand across its customer base (cloud service providers, consumer internet, and enterprises) who are looking to harness the technology of generative AI and large language models (LLMs) that use the company’s Hopper and Ampere GPUs.

+ Strong 2Q24 guidance. NVDA guided for a revenue of US$11bn (+/- 2%), which is ~53% above consensus estimates of US$7.2bn, and represents a 64% YoY growth, following YoY sales contraction since 3Q23. The company said the growth will largely be driven by its Data Centre business benefiting from the steep increase in demand related to Generative AI and LLMs. NVDA said this allowed it to extend its visibility of the segment’s business out a few quarters. Although no guidance was provided beyond 2Q24, NVDA noted that it will be procuring a significantly higher level of supply for 2H24, where it indicated that sales will be higher than that of 1H24. Gross margin is expected to be 68.6%, indicating a potential 25% YoY expansion (6.6% on a normalised basis as NVDA incurred a US$1.2bn inventory charge in 2Q23) as it sells more of its new H100 data centre GPUs, where we believe the price difference is as much as 200% compared to its previous A100.

The Negatives

– Gaming, Professional Visualisation contraction continues. Gaming/Professional Visualisation revenue declined 38%/53% YoY as both businesses continue to face macroeconomic headwinds and lower sell-in to normalise channel inventory. However, the contraction has moderated compared to 4Q23 where they declined 46%/65% YoY, and sales were up QoQ by 22%/31% as NVDA ramps its new GPUs based on Ada Lovelace architecture.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments