NVIDIA Corporation - Uncertainty over China; but demand still robust

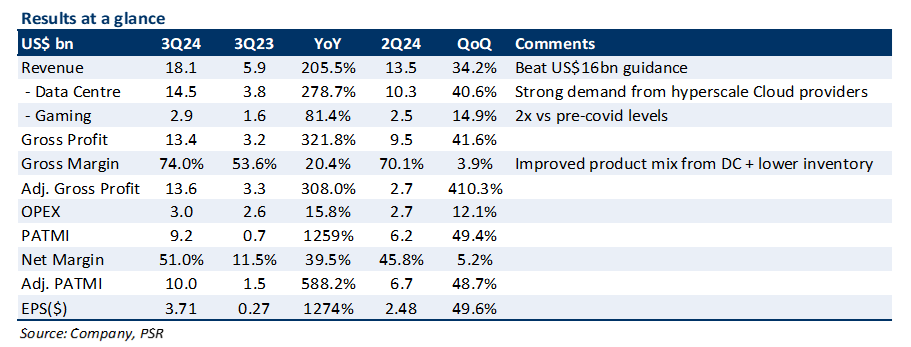

27 Nov 2023- 3Q24 results exceeded expectations. Revenue beat NVDA’s own guidance by 13%, with PATMI spiking 13x YoY. 9M24 revenue/PATMI was at 75%/80% of our FY24e forecasts.

- Data Centre (DC) revenue grew almost 4x YoY, driven by: 1) Enterprises and nations inferencing large language models (LLMs); 2) Cloud Service Providers (CSPs) expanding into new markets; 3) 5x YoY growth in demand for InfiniBand.

- Upbeat 4Q24e revenue guidance of US$20bn implies 231% YoY growth, and US$59bn for FY24e. US export controls to China remain an uncertainty, with revenue from China expected to decrease substantially in 4Q24e.

- We raised our FY24e revenue/PATMI by 13%/27% for the stronger demand of Data Centre products. NVDA dominates AI GPUs that is growing ~4x YoY. Demand is driven by a global shift to accelerated computing for generative AI applications, and inferencing LLMs. We maintain a BUY rating with a raised target price of US$685 (prev. US$645). Our WACC/g is unchanged (6.8%/4.5%).

The Positives

+ Demand for Data Centre GPUs still outpacing supply. DC growth continues to be driven by: 1) Increased investments from consumer internet companies into inferencing LLMs and generative AI applications; 2) Hyperscale CSPs expanding into new market opportunities; 3) 5x YoY increase in demand for InfiniBand (Networking >US$10bn annual run-rate). To meet the demand, NVDA has been increasing supply QoQ this year, and expects to continue this into FY25e. DC revenue spiked 280%/41% YoY/QoQ as a result. We expect near-term demand to remain strong given overflowing customer commitments.

+ 4Q24e revenue guidance implies 231% YoY growth. NVDA guided US$20bn (+/- 2%) in revenue for 4Q24e, implying further acceleration in revenue growth – above consensus estimates of US$18bn. Most of the growth is expected to be driven by DC demand, and takes into account a significant drop in revenue contribution from China due to US export controls. Taking this guidance, our FY24e revenue is raised 13% to US$59bn, implying a 118% YoY growth. 4Q24e gross margins are also expected to increase sequentially to 74.5% due to a favourable product mix as demand for higher margin DC products continue to expand, with NVDA ending FY24e with a 72% gross margin, 1500bps higher than FY23.

The Negative

– Export controls expected to impact China revenue in 4Q24e. US government export control regulations to China are expected to impact revenue from China moving forward, with limited visibility on its long term impact. NVDA is working on regulation-compliant products for the affected markets, although the contribution from these products is not expected to be meaningful in the near term. China revenue represents 20-25% of NVDA’s total revenue.

Outlook

Guidance: NVDA guided to 4Q24e revenue of US$20bn (+/- 2%), implying a further acceleration in YoY growth as demand for its DC products is extremely robust. NVDA also guided a gross margin of 74.5%, a sequential 50bps expansion due to a more favourable shift in mix to higher-margin DC products.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments