Property Guru - Stock Analyst Research

| Target Price* | 5.20 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 6 Mar 2023 |

*At the time of publication

PropertyGuru Group Ltd. - Improvements in profitability

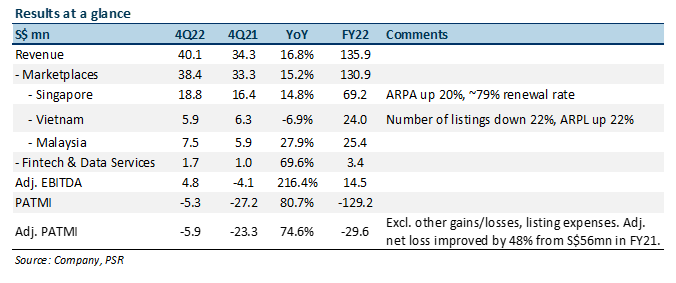

- Revenue was in line with expectations while earnings was a miss. FY22 revenue at 99% while adj. net loss came in at 120% of our forecasts due to higher-than-expected expenses.

- Singapore/Malaysia revenue grew 15%/28% while Vietnam declined 7%. ARPA/ARPL increased by 20%/22% with ~79% renewal rate. FY22 adj. net loss improved by 48%, excluding other gains/losses and share-listing expenses.

- We maintain ACCUMULATE with a lower DCF target price of US$5.20 (prev. US$5.30), on a WACC of 10.1% and g of 3%. We expect near-term growth challenges from Vietnam’s credit restriction policy. However, we expect growth to re-accelerate in 2H23 and PGRU’s profitability improvements to continue as it increases operating leverage.

The Positives

+ Revenue met company guidance. 4Q22 revenue grew 17% YoY to S$40mn despite the decline in the Vietnam market. Singapore Marketplaces revenue increased 15% to S$19mn with average revenue per agent (ARPA) up 20% while also maintaining a high renewal rate of 79%. The number of subscribing agents in the country also increased to ~15,500 from ~15,300 in 3Q22. Vietnam revenue declined by 7% YoY to S$6mn as the number of listings were down 22% in 4Q22 due to the credit tightening policy by the government. However, average revenue per listing (ARPL) increased by 22% to S$3.25 as a result of increased premium product adoption and longer listing period.

+ Improvements in profitability. Net loss for the quarter improved by 81% to S$5mn compared with 4Q21, bringing the FY22 total net loss to S$129mn, 31% lower than the net loss of S$187mn in FY21. Excluding other gains/losses from fair value changes and one-off IPO expenses, adj. net loss was cut by 48% from S$56mn in FY21 to S$29mn in FY22, demonstrating PGRU’s increasing operating leverage. We expect these costs to remain stable and PGRU to further increase its operating leverage as revenue grows.

The Negatives

– FY23 revenue guidance below our forecast. Management has guided for FY23e revenue to be S$160mn-S$170mn, a growth of 18-25% as PGRU continues to expect challenges from macroeconomic uncertainties in Vietnam and Malaysia. Specifically for Vietnam, PGRU expects the credit restriction policy to remain in place in 1Q23 with hopes of it easing in 2Q23. As such, PGRU is expecting a softer 1H23 for the Vietnam market with growth re-accelerating in 2H23. Meanwhile, the Singapore property market remains strong as prices increased despite a QoQ decline in transaction volume. It also has a strong supply pipeline in FY23.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU