Thomson Medical Group - Stock Analyst Research

| Target Price* | 0.66 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 25 Mar 2024 |

*At the time of publication

Thomson Medical Group Ltd - Building a regional healthcare footprint

- The 70%-owned listed TMC Life Sciences Bhd is recording record earnings and growth from an increase in beds, higher patient load and larger bill size. It has grown its pool of domestic and foreign patients, drawn by improved service standards, relatively lower costs, and weak Ringgit.

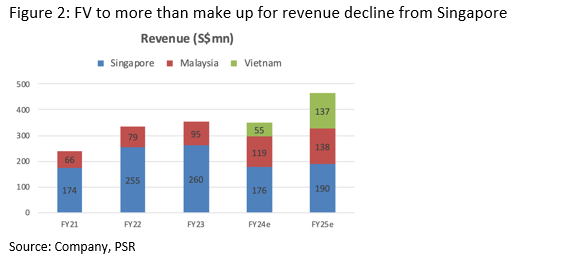

- Earnings contribution from Franco-Vietnam Hospital, acquired at end 2023, will more than offset the absence of government contract for Covid-related work in Singapore. FV extends its geographical reach to a population of 120mn people in Vietnam, Cambodia, and Laos.

- We estimate the development of the Iskandar landbank could yield a development gain of S$1.1bn. The value of real estate could rise with the completion of the railway link between Singapore and Johor Bahru and the setting up of a free trade zone in the area. We initiate coverage with a BUY recommendation and SOTP TP of S$066.

Background

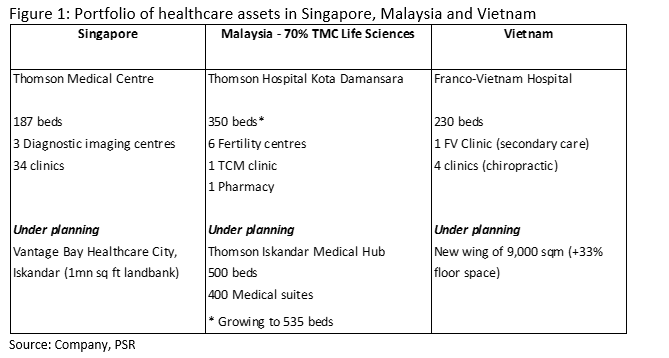

Thomson Medical Group (TMG) is a regional healthcare group that operates 3 tertiary hospitals with 757 licensed beds in Singapore, Malaysia and Vietnam. It also runs specialist medical clinics and diagnostic imaging centres in Singapore and Malaysia. TMG owns 1mn sq ft freehold land in Johor Bahru, Malaysia, which could be developed into an integrated health and wellness city, including a medical hub under 70%-owned TMC Life Sciences Bhd (TLS).

Highlights

- Malaysian operations are the key growth engine. Bursa-listed TLS has enjoyed strong growth since FY20, led by increased bed count, higher patient load, and bigger bill size with a larger scope of treatment. Improved quality of healthcare services and a weak Ringgit are drawing both domestic and foreign patients to seek treatment in Malaysia. TLS has room to increase bed count by more than 50%, from 350 currently.

- Franco-Vietnam Hospital (FV) extends TMG’s geographical reach to the burgeoning economies of Vietnam, Cambodia, and Laos, with a combined population of 120mn. A full-year contribution from FV in FY25e could lift EBITDA to 12.6% above that of FY23. Founded in 2003, FV is one of Vietnam’s six Joint Commission International (JCI) accredited hospitals. It has 200 doctors offering more than 30 specialties. FV is adding a new wing to raise floor space by 33% from FY26e.

- Expect a dip in FY24e net profit. Singapore government contracts for Covid-related work, such as managing the vaccination centres and the Transitional Care Facilities, tapered off in 2023. The absence of this income stream and cost incurred in FV purchase could lead to a 65% decline in FY24e net profit but +157% rebound in FY25e with FV contributions.

- Unlock the value of the Iskandar landbank. The land in Iskandar has a book value of S$91mn as at Jun 23. At current real estate prices, we estimate it could yield a gross development value of S$3.6bn and a development gain of about S$1.1bn when fully developed. Johor’s state government has proposed that Iskandar Malaysia be designated a special economic zone with Singapore. The completion of the Johor Bahru-Singapore Rapid Transit System Link (RTS) at the end of 2026 could revitalise the region and lift the value of the real estate.

Initiate coverage with a Buy recommendation and TP of S$0.066

Our TP is based on the sum-of-the-parts valuation methodology. The healthcare operations are valued at an industry average of 12.5x FY25e EV/EBITDA. We estimate the 1mn sq ft of freehold land at Iskandar, Malaysia, could reap a development gain of S$1.1bn.

Background

TMG owns and operates three tertiary hospitals. These include the flagship women hospital, Thomson Medical Centre (TMC) in Singapore, Thomson Hospital Kota Damansara in Kota Damansara, Malaysia held under 70%-owned TMC Life Sciences Bhd (TLS), and Franco-Vietnam Hospital (FV) in Ho Chi Minh City, Vietnam which was acquired in Dec 2023. The hospitals have a total 757 licensed beds.

It also runs a chain of specialist medical centres and diagnostic centres in Singapore, fertility centres in Malaysia, and chiropractic clinics in Vietnam.

TMG owns 1m sq ft of freehold land in Iskandar, Malaysia, and Johor Bahru City Centre. It plans to develop these areas into an integrated health and wellness city. TLS also plans to develop Thomson Iskandar Medical Hub with 500 beds in Iskandar.

Singapore

Established in 1979, Thomson Medical Centre is one of the largest private providers of healthcare services for women and children in Singapore. It also operates a network of specialist medical clinics and facilities providing diagnostic imaging, gynaecological oncology, specialist dermatology and Traditional Chinese Medicine.

Singapore has been the key earnings pillar, with the highest healthcare expenditure per capita in Southeast Asia and growing at a 5-year CAGR of 5.7% (Figure 9 & Figure 10). TMG also enjoyed a bump in profits in the last two years from government contracts to manage vaccination centres and Transitional Care Facilities. These jobs tapered off at end-2023. We expect Singapore’s FY24e revenue to return to FY21’s level.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU