SEA LTD - Growth drivers still performing

19 Aug 2022- 1H22 revenue was at 42% our FY22e forecasts. Net loss was worse than expected at 79% of our FY22e forecasts due to higher operating expenses and tax rate.

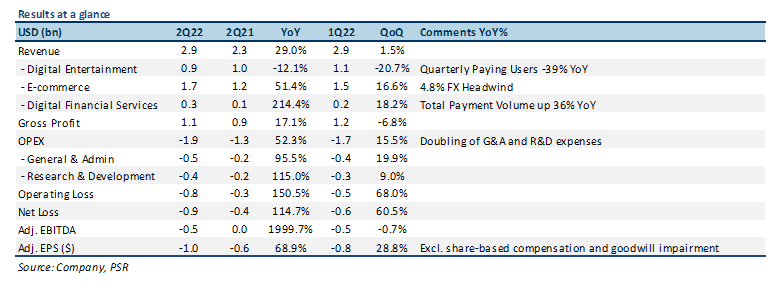

- 29% YoY revenue growth, with 51%/214% YoY growth in Shopee and SeaMoney. Shopee generated more international (ex-China) revenue than competitor, Alibaba, and was close to achieving positive adjusted EBITDA per order in APAC for the quarter.

- Net loss grew 115% YoY due to increasing expenses in G&A and R&D, and US$177mn goodwill impairment loss. Shopee revenue guidance for FY22e suspended due to uncertain macroeconomic environment, and shift in focus towards profitability metrics.

- We lower our FY22e revenue slightly to reflect weaker e-commerce growth, and we increase our net loss forecasts by 43% to reflect higher expenses. We maintain a BUY recommendation with a lowered DCF target price of US$110.00 (prev US$150.00), with an increased WACC of 7.6%, lower EBITDA and a terminal growth rate of 3.0%.

- 1H22 revenue was at 42% our FY22e forecasts. Net loss was worse than expected at 79% of our FY22e forecasts due to higher operating expenses and tax rate.

- 29% YoY revenue growth, with 51%/214% YoY growth in Shopee and SeaMoney. Shopee generated more international (ex-China) revenue than competitor, Alibaba, and was close to achieving positive adjusted EBITDA per order in APAC for the quarter.

- Net loss grew 115% YoY due to increasing expenses in G&A and R&D, and US$177mn goodwill impairment loss. Shopee revenue guidance for FY22e suspended due to uncertain macroeconomic environment, and shift in focus towards profitability metrics.

- We lower our FY22e revenue slightly to reflect weaker e-commerce growth, and we increase our net loss forecasts by 43% to reflect higher expenses. We maintain a BUY recommendation with a lowered DCF target price of US$110.00 (prev US$150.00), with an increased WACC of 7.6%, lower EBITDA and a terminal growth rate of 3.0%.

The Positive

+ Growth drivers still performing well, with Shopee close to positive adjusted EBITDA per order. SE recorded revenues of US$2.9bn for 2Q22, up 29% YoY. Shopee grew 51% YoY, with gross orders up 42% YoY, and gross margins improving sequentially QoQ as a result of faster growth in higher profit margin items like transaction-based fees and ad revenue. Shopee also generated more international (ex-China) revenue than e-commerce giant Alibaba for the first time. Adjusted EBITDA loss per order before HQ costs was >US$0.01, improving 95% YoY, with expectations that this would turn positive by year end. SeaMoney grew 214% YoY as a result of increasing synergies with Shopee, with Total Payment Volume (TPV) up 36% YoY. Quarterly Active Users (QAU) grew 53% YoY, with around 40% of buyers on Shopee using SeaMoney products.

The Negatives

– Wider-than-expected net loss, due to higher expenses and goodwill impairment loss. SE’s net loss for 2Q22 grew 115% YoY, largely due to a doubling of R&D and G&A expenses YoY, and a US$177mn goodwill impairment loss due lower valuations of prior acquisitions. G&A expense jumped 96% YoY, mainly due to higher allowances for credit losses from SeaMoney which was driven by loans growth. R&D expense increased 115% YoY as a result of increasing headcount growth due to expansion of tech capabilities. Net loss for 1H22 was at 79% of our FY22e forecasts.

– Shopee revenue guidance suspended for FY22e. SE suspended its Shopee revenue guidance for FY22e, with its original guidance in the range of US$8.5bn to US$9.1bn, stating increasing volatility, continuing macro uncertainties, and a strategic shift towards focusing on efficiency and optimization for the long-term as reasons for the suspension of guidance.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU