SEA LTD - Improving unit economics

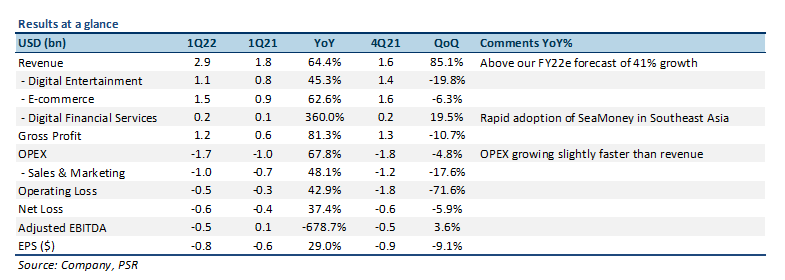

23 May 2022- 1Q22 revenue was in line, at 21% our FY22e forecasts. Net loss slightly underperformed, at 30% of our FY22e forecasts due to higher operating expenses and tax rate. EPS of -US$0.80 beat consensus estimates of -US$1.15 by 31%.

- Revenue growth led by 64%/360% YoY growth in Shopee and SeaMoney.

- FY22e revenue guidance for e-commerce widened on the bottom-end by US$0.4bn

- We maintain a BUY recommendation with a lowered DCF target price of US$150.00 (previous US$196.00), with a WACC of 6.9%, and a lowered terminal growth rate of 3.0%.

The Positives

+ 1Q22 revenue in line with our forecasts, EPS of -US$0.80 in line with our estimates. SE recorded 1Q22 revenue of US$2.9bn, beating consensus estimates for its top line by 5%, and was in line with our estimates. Revenue grew 38% YoY, driven by a 64% growth in Shopee, and a 360% growth in SeaMoney, as these segments continued riding digitalization tailwinds in Southeast Asia. SE also posted EPS of -US$0.80 for 1Q22, comfortably beating estimates of -US$1.15 by 31%.

+ Shopee closer to profitability in mature markets. SE’s e-commerce business, Shopee, saw YoY improvement in its gross profit margin, led by strong growth of higher margin services like advertising and transaction-based fees. Shopee is also on track for a positive adjusted EBITDA before HQ costs in Southeast Asia and Taiwan, with this number at -US$0.04 for 1Q22, compared to -US$0.12 in 1Q21. Globally, Shopee continues its top rank in its Shopping category on the Google Play Store for most downloads and total time spent in app, and ranked 2nd for average monthly active users.

+ Rapid growth of SeaMoney due to increased adoption of digital payments in Southeast Asia. SE’s digital financial services business, SeaMoney, posted 1Q22 revenue of US$236mn, a YoY increase of 360%, led by increasing consumer adoption of digital payments in Southeast Asia – particularly in Indonesia, as well as the company’s expansion of credit products into more markets. Quarterly active users (QPU) grew 78% YoY, while total payment volume (TPV) was up 49% YoY.

The Negative

– Reduced its bottom-end range for Shopee FY22e revenue guidance. SE adjusted its FY22e revenue guidance for its e-commerce business, Shopee, from US$8.9-9.1bn, to US$8.5-9.1bn. A more uncertain macroeconomic environment was the main reason with this change. Taking the midpoint of US$8.7bn would represent a 72% YoY increase, compared to 76% previously.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU