Singapore Exchange Limited - Thriving on volatility

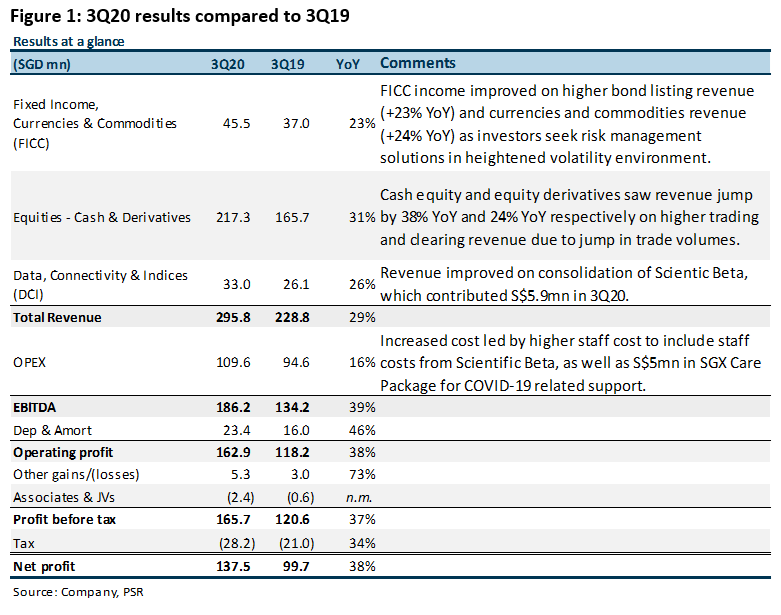

27 Apr 2020- SGX beat our earnings expectations by 34% for 3Q20.

- Key business segments saw stellar growth amidst heightened market volatility – FICC grew 23% YoY and Equities grew 31% YoY, contributing to a net profit increase of 38% YoY.

- SGX maintained a quarterly dividend of 7.5 cents per share in 3Q20.

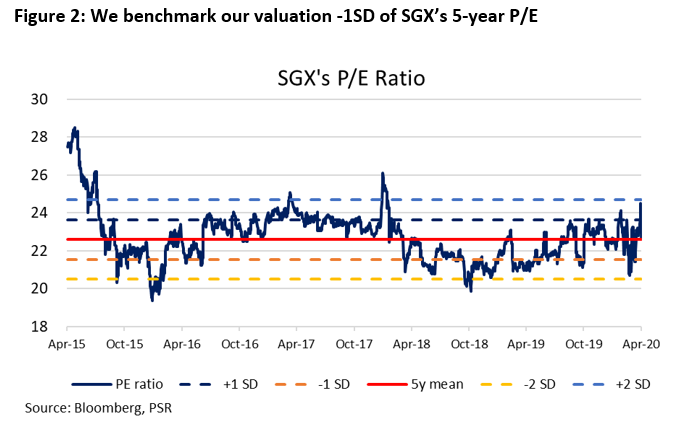

- We maintain our NEUTRAL call with a revised TP of S$9.28. We peg our TP to 21.4x P/E, 1 SD below SGX’s 5-year mean. We revise our FY20e earnings forecast upwards by 8% on stellar 3Q20 results as SGX continues to benefit from market volatility as a result of the COVID-19 pandemic.

The Positives

+ Derivatives business makes a splash in high volatility environment, raking in S$147.5mn, an increase of 24% YoY from S$119mn a year ago. SGX’s effort in developing its derivatives business was also evident, with non-Asian-hour trading activity contributing to 20% of total derivatives volume, a stark increase from less than 10% of total volume from three years ago.

Currencies and commodities derivatives revenue increased 23% with trading and clearing revenue chalking up S$28.8mn, an improvement of 29% YoY on higher volumes. Currency and commodities futures recorded 14.8mn contracts, an increase of 38% across the same period last year.

Revenue increased 24% from equities derivatives, led by higher trading and clearing revenue of S$65.0mn (+26% YoY from $51.6mn) from a 24% increase in trading volume to 61.5mn contracts (3Q19: 49.5mn contracts). Among which, SGX saw higher interest in Nikkei 225 MSCI Taiwan and Nifty 50 index futures (+85%, +44% and +39% YoY respectively).

+ Cash equities business enjoy revitalised interest from dormant retail investors. SGX noted an increase of 50% in accounts that traded in March alone which had no trading activity for the past one year. This propelled a 58% increase in SDAV YoY to S$1.61bn in 3Q20, leading to a 65% increase in trading and clearing revenue to S$67.9mn from S$41.1mn YoY. Settlement and depository management revenue also improved 21% from S$21.4mn to S$25.8mn as a result.

+ Consolidation of Scientific Beta contributed to growth in the DCI business, adding S$5.9mn to the segment as DCI revenue grew 26% YoY from S$26.1mn to S$33.0mn.

The Negatives

– Equity listing and corporate actions revenue fell 4% YoY on poorer market sentiments. While primary and secondary funds raised in the first three quarters exceeded entire FY19 (primary listing: S$2.2bn vs FY19 of S$1.7bn and secondary listing: S$7.6bn vs FY19 of S$4.7bn), capital-raising activity is expected to slump on weaker market valuations in the current climate.

Outlook

The persistence of the COVID-19 will continue to heighten market volatility and benefit SGX’s business. In 3Q20, SGX observed large amounts of funds from institutional investors exiting the market that was matched by fresh funds from retail investors. However, the large amount of fresh funds invested into the bourse is unlikely to be sustainable in subsequent quarters with April’s SDAV standing at around 30% of March’s heightened level.

Investment Actions

We maintain our NEUTRAL recommendation with an upward revision of our TP to S$9.28 on a stellar 3Q20 earnings. Our TP is pegged to 21.4x P/E, 1 SD below SGX’s 5-year mean. Quarterly interim dividend held consistent at 7.5 cents per share also leads to lesser attractiveness in terms of yield (c.3.4%).

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU