StarHub Limited - Border closure still hurts

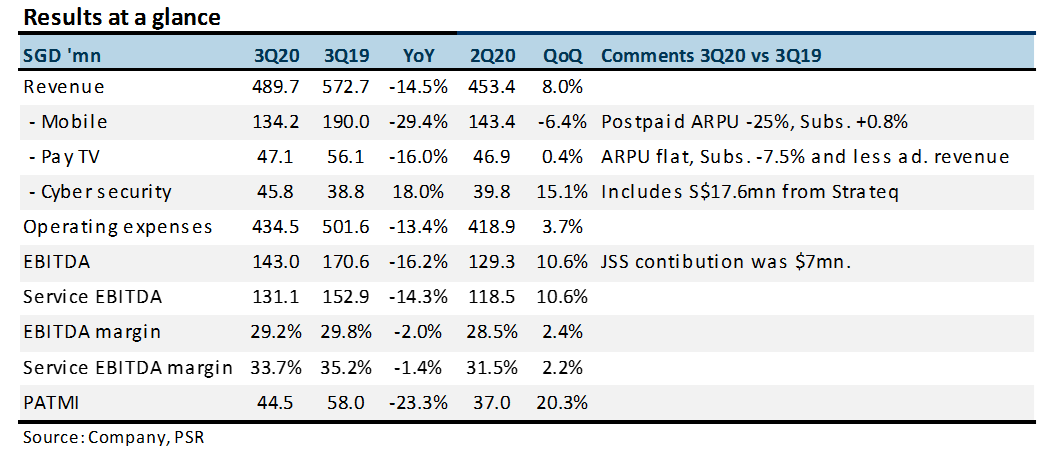

9 Nov 2020- 3Q20 EBITDA was within expectations, excluding government grants. YTD20 EBITDA was 76% of our FY20e forecast.

- Mobile revenue was down a hefty 29% YoY. This was due to a 25% fall in postpaid ARPU to S$29, a record low. Prepaid subscribers shrank 33% YoY.

- Border closure and loss of roaming revenue to continue to depress earnings. We do see some bright spots. ARPUs for broadband and Pay TV climbed QoQ as promotions ended.

- Maintain NEUTRAL and TP of S$1.24. TP is set at historical 6x EV/EBITDA excluding other income. We raise FY20e EBITDA by 5% to account for another S$15mn in grants in 2H20 and stronger PayTV and broadband businesses. A significant resumption of international travel is key to its earnings recovery. There are little signs yet.

Positive

+ Better QoQ ARPUs for PayTV and broadband. ARPUs for PayTV and broadband rose 2.5% and 7.1% respectively QoQ. Reduced discounts and promotions helped. Revenue for both expanded QoQ due to their better ARPUs.

Negative

– Mobile its Achilles heel. Without roaming revenue, mobile ARPU dived to a record low. Postpaid ARPU was down 25% YoY. Prepaid subscribers shrank by 108k or 33% YoY. There was less demand with fewer tourist arrivals.

Outlook

We lower revenue by 5%. Our forecast for equipment sales was too bullish. We also incorporate revenue from its new acquisition, Strateq. Our EBITDA is raised by 5% to include government grants and an expected uptick in its broadband and PayTV businesses. Enterprise division should enjoy a gradual recovery as projects resume and economic conditions recover. Separately, the launch of non-standalone 5G has garnered a better-than-expected response. Customers are transitioning faster to 5G phones. Faster speeds, lower latency and bundled content subscription have encouraged take-up by niche customers such as gamers and other heavy-content users.

Maintain NEUTRAL and TP of S$1.24

Our valuation is based on 6x FY20e EV/EBITDA. We exclude other income in our EV/EBITDA valuation as it is non-recurring.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained