Silverlake Axis Ltd - Earnings hurt by project-related revenue

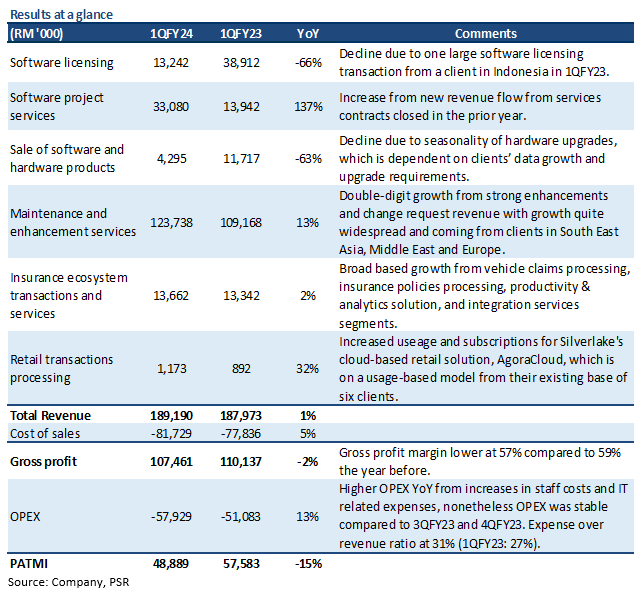

20 Nov 2023- 1QFY24 earnings of RM48.9mn were slightly above our estimates. 1QFY24 earnings were at 27% of our FY24e. The 15% YoY dip in earnings came from lower-than-expected project-related revenue and higher-than-expected OPEX.

- 1QFY24 recurring revenue comprising maintenance and enhancement services, insurance ecosystem transactions and services, and retail transactions processing revenue grew 12% YoY, while project-related revenue comprising software licensing and software project services fell 12% YoY. Orderbook is RM720mn-730mn with the total deals pipeline at RM1.8bn. One new Indonesian bank secured for SIBS with two potential new banks to be secured in FY24.

- Maintain BUY with an unchanged target price of S$0.38. Our FY24e estimates remain unchanged. Silverlake’s recurrent revenue continues to build up from new products (MOBIUS, Symmetri) and maintenance revenue expanding with rising security enhancement of core SIBS software. Our target price is pegged to 20x P/E FY24e. We expect MOBIUS and the recovery in bank IT spending after two cautious pandemic years to be the key growth drivers for the company.

The Positives

+ Recurring revenue rose 12% YoY. Recurring revenue comprises maintenance and enhancement services, insurance ecosystem transactions and services, and retail transactions processing revenue. Maintenance and enhancement services grew 8% YoY to RM124mn from strong enhancements and change request revenue as Silverlake continues to guide its customers in modernising their core platforms with growth coming from clients in Southeast Asia, the the Middle East and Europe. Silverlake expects this segment to continue to grow as new maintenance contracts and support will commence when current projects are completed and successfully handed over to clients. Insurance ecosystem transactions and services revenue increased 2% YoY as there was broad-based growth across all segments, from vehicle claims processing, insurance policies processing, productivity and analytics solutions, and integration services. Revenue from retail transactions processing grew 32% YoY mainly due to increased usage and subscriptions to new modules for Silverlake’s cloud-based retail solution, AgoraCloud. As this is a usage-based model, Silverlake has seen increased usage from its existing base of six clients.

+ Order backlog healthy. Silverlake has a long track record and a proven client base in Southeast Asia. Three of the 5 largest Southeast Asia-based financial institutions use its core banking platform, and it has largely retained all its clients since bringing them on board its platform. Silverlake’s project pipeline is healthy, at RM1.8bn (4QFY23: RM1.5bn), with contract wins of RM125mn in 1QFY24 and an order backlog of RM720mn-730mn going into the rest of FY24. Furthermore, Silverlake expects revenue from the multi-million 10-year core and channels digital banking MOBIUS deal with a client in Malaysia to come in FY24. Silverlake is beginning to close more deals and is witnessing an uptick in inquiries about its financial services market solutions and capabilities.

The Negatives

– OPEX rose 13% YoY. Operating expenses were 13% higher YoY mainly due to annual salary increment post-pandemic, effected in 3QFY23 and new headcounts added to support business development and business expansion, sales and market coverage. Other OPEX increases include IT-related expenses particularly in software subscription and support as well as laptop leasing for new headcounts and business travels due to economic recovery post-pandemic. As a result, the expense over revenue ratio rose to 31% (1QFY23: 27%). Nonetheless, OPEX was stable when compared to 3QFY23 and 4QFY23, and management does not expect OPEX to increase QoQ going into the rest of FY24 with no current plans for further headcount increases.

– Project-related revenue falls 12% YoY. Project-related revenue comprises software licensing and software project services. Software licensing revenue fell 66% YoY as 1QFY23 included one large software licensing transaction from a client in Indonesia. Nonetheless, there were major contributions from professional services from key core banking projects secured in FY23 – namely new MÖBIUS, SIBS and Symmetri core banking installations in Malaysia, Thailand, the Middle East, and South Asia. The decline was slightly offset by software project services revenue increasing 137% YoY as a result of new revenue flow from services contracts closed in FY23.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

PayPal Holdings Inc - Consumer spending remains resilient

PayPal Holdings Inc - Consumer spending remains resilient Cromwell European REIT - A resilient 1Q24

Cromwell European REIT - A resilient 1Q24 Amazon.com Inc.- More AWS growth ahead

Amazon.com Inc.- More AWS growth ahead Alphabet Inc. - Growth accelerating across all segments

Alphabet Inc. - Growth accelerating across all segments