Venture Corporation Ltd - Recovery slower than expected

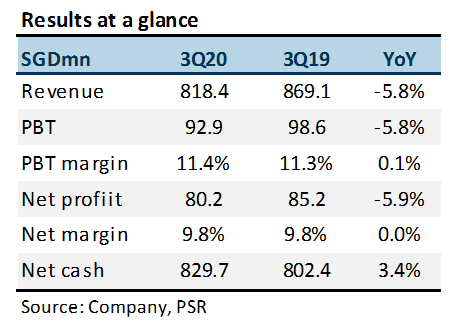

9 Nov 2020- 3Q20 PATMI dropped 5.9% YoY to S$80.2mn – 14% below our forecast.

- We had expected 3Q20 to be stronger due to orders carried over from Q2 when facilities were partially shut because of lockdown.

- Maintain NEUTRAL. FY20e could be 3rd consecutive year of earnings decline since peaking in FY17. New projects are limited. We cut FY20e earnings by 12%. We roll over TP to 16x FY21e from FY20e, still based on its average PE in the past five years. Our TP climbs to S$18.60 from S$18.40. Net cash of S$829mn, yields of 4% and ROEs of 13% are expected to provide support.

The Positive

+ Margins stable. PBT margin was stable YoY at 11.4% despite lower revenue. The was likely due to a higher mix of products in life science & genomics, medical devices and healthcare & wellness. There was strong demand for essential healthcare products such as ventilators and PCR equipment.

The Negative

+ Revenue weaker than our expected +12% YoY rise. We had expected a spillover of revenue from 2Q20 when factories were closed because of lockdown. It seems orders in 3Q20 were softer than expected, likely due to macro headwinds.

Outlook

VMS guided that 2H20 will be stronger than 1H20. This is to be expected since 1H20 earnings collapsed 28% YoY. Moving into 2021, we anticipate a recovery led by new products that VMS mentioned would be released by customers. These will likely be in the healthcare sector, including Covid-19 related detection, testing and diagnostic products. Another driver of growth could be an improvement in macro conditions.

Maintain NEUTRAL with higher TP of S$18.60, from S$18.40

We cut FY20e/FY21e PATMI by 12%/10% to S$293mn/S$338mn following lower-than-expected sales. Recovery is slower than expected but net cash of S$829mn, yields of 4% and ROEs of 13% are expected to provide share-price support.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU