US Banks - Industry leaders to benefit from peak rates

25 Mar 2024- JP Morgan, Bank of America and Wells Fargo are leaders in the US banking sector, with 40% of total assets and 32% of total deposits.

- Peak rates will boost the banks’ funding costs, as loan and security repricing is set to overtake deposit repricing. This shift will drive net interest income going forward. Credit losses have normalised to pre-pandemic levels with no alarming credit deterioration, and specific reserves for commercial real estate losses have been set aside.

- Initiate coverage on JP Morgan Chase & Co (BUY; TP US$231.19), Bank of America Corporation (ACCUMULATE; TP US$40.82) and Wells Fargo & Company (ACCUMULATE; TP US$60.83).

Investment Merits

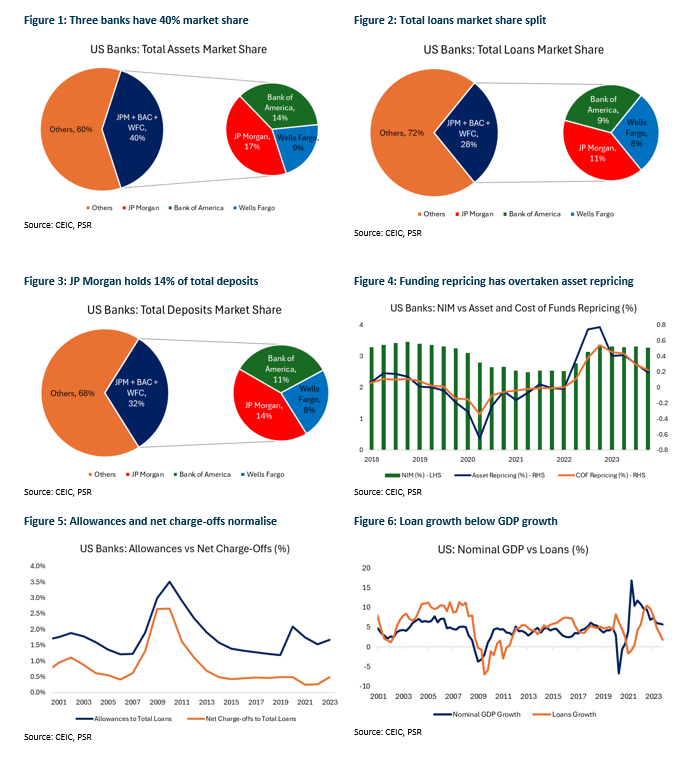

- Exceptional market share. JP Morgan, Bank of America, and Wells Fargo are the leading banks in the US, holding about 40% of the total assets in the sector (Figure 1). As of FY23, JP Morgan has the largest market share (17%), followed by Bank of America (14%) and Wells Fargo (9%). These banks also lead in loans and deposits, holding 28% (Figure 2) and 32% (Figure 3) of the market, respectively. The bank failures in 2023 increased their presence, with their share of total assets and deposits rising from 38% and 31%, respectively, in FY22. Their dominance allows them to handle a significant number of transactions and deposits across all business segments.

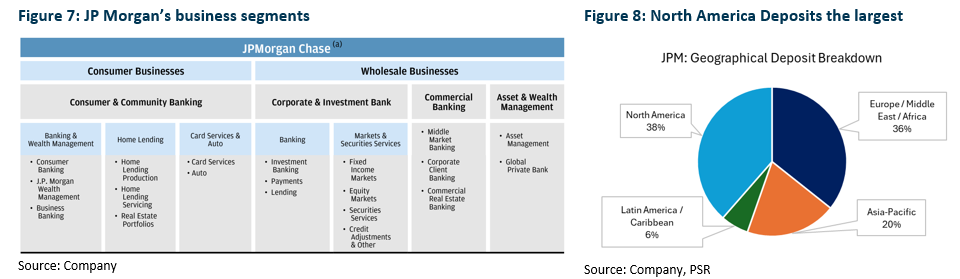

- Peaked rates a catalyst. The Federal Reserve’s pivot from an aggressive rate-hiking cycle to a potential rate-cutting stance in 2024 is a significant catalyst. When the Fed raised rates aggressively in early 2022, the banks were immediate beneficiaries as assets tied to benchmark lending rates were repriced to pay the banks higher rates almost immediately, and bank deposit costs lagged, resulting in higher margins at no cost. However, this reversed in 2023 as the cost of funds repricing exceeded asset repricing, resulting in dropping margins across the sector (Figure 4). With the rate reaching peak levels and potential rate cuts in 2H24, we expect asset repricing to retake the lead from deposit repricing for most banks in 2024. Lower rates can also support valuations.

- Benign provisioning cycle. Banks’ management of credit losses has normalised from the unusually low levels during the pandemic (Figure 5), with no signs of significant credit quality deterioration. Some losses are anticipated from the commercial real estate sector, but banks have been monitoring these portfolios and have set up specific loan loss reserves. Additionally, there was no over-lending in 2023, as nominal GDP growth outpaced loan growth (Figure 6).

Investment Actions

Initiation on the US Banking sector:

- BUY on JP Morgan Chase & Co (TP: US$231.19)

- ACCUMULATE on Bank of America Corporation (TP: US$40.82)

- ACCUMULATE on Wells Fargo & Company (TP: US$60.83)

JP Morgan, the largest US bank, has a diverse business portfolio and the highest international presence among the three. Its revenue is split between net interest income (56%) and non-interest income (44%). Bank of America, the second largest, leans more towards net interest income (58%) and has a predominantly US-based asset distribution (87%). Wells Fargo, the third largest by market share, stands out with its extensive branch network and a significant revenue contribution from net interest income (63%). Despite having half the assets of JP Morgan, it has nearly as many branches, indicating a strong middle-market presence and potential for deposit growth.

Comparison of the three banks (JP Morgan, Bank of America and Wells Fargo)

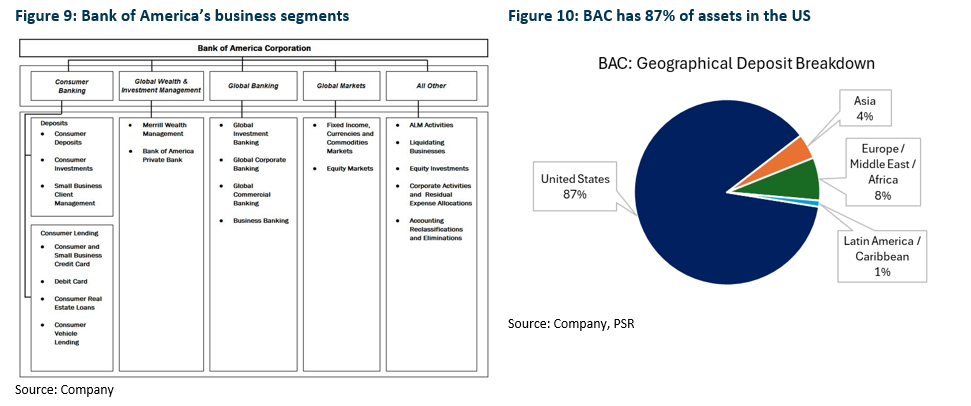

JP Morgan is the largest US bank and has held that position for more than 10 years. The bank has two main businesses: consumer businesses comprising Consumer & Community Banking (CCB), and wholesale businesses comprising Corporate & Investment Bank (CIB), Commercial Banking (CB), and Asset & Wealth Management (AWM) (Figure 7). The largest segment is CCB (43% of FY23 revenue), followed by CIB (30%), AWM (12%), and CB (10%). Net interest income makes up the majority of revenue at 56%, while non-interest income makes up 44% of FY23 revenue. JP Morgan has the highest presence outside of the US amongst the three banks; the majority of deposits are in North America (38%), with Europe/Middle East/Africa closely behind (36%), and the rest from Asia-Pacific (20%) and Latin America/Caribbean (6%) (Figure 8).

Bank of America (BAC) is the second largest US bank by total asset size. The bank has four main business segments: Consumer Banking (CB), Global Wealth & Investment Management (GWIM), Global Banking (GB), and Global Markets (GM) (Figure 9). The largest segment is CB (43% of FY23 revenue), followed by GB (25%), GWIM (21%), and GM (20%). The revenue split is leaning towards net interest income, which makes up 58% of revenue, while non-interest income makes up 42% of FY23 revenue. As for geographical segmentation, the majority of assets are in the US (87%), with the remaining 13% of assets from Europe/Middle East/Africa closely behind (8%), Asia (4%), and Latin America/Caribbean (1%) (Figure 10).

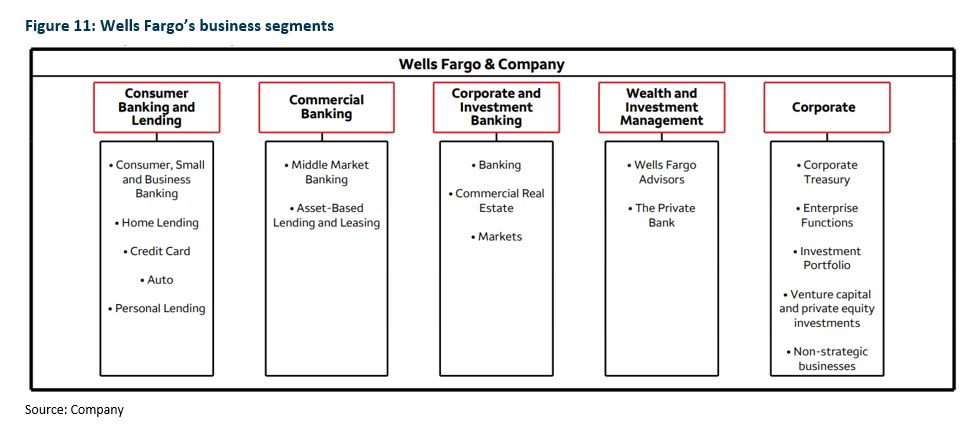

Wells Fargo is the third largest by market share and fourth largest US bank by total asset size. Wells Fargo stands out from its peers due to its extensive branch network. Despite having half the consolidated assets of JP Morgan (US$1.93tn vs US$3.88tn), Wells Fargo has nearly as many branches (4,700 vs 4,800). This large network has given Wells Fargo two major advantages: a well-established brand in the middle-market space and significant potential for deposit growth among customers. The bank has four main business segments: Consumer Banking and Lending (CBL) – 46% of FY23 revenue, Commercial Banking (CB) – 16%, Corporate and Investment Banking (CIB) – 23% and Wealth and Investment Management (WIM) – 18% (Figure 11). Revenue consists mainly of net interest income, which makes up 63% of FY23 revenue, while non-interest income makes up 37% of revenue. Wells Fargo’s exposure is mainly in the US, with the top 20 country exposure outside of the US totalling US$108bn, or less than 6% of total assets.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU