China’s Booming E-Commerce Sector January 18, 2021

What this report is about:

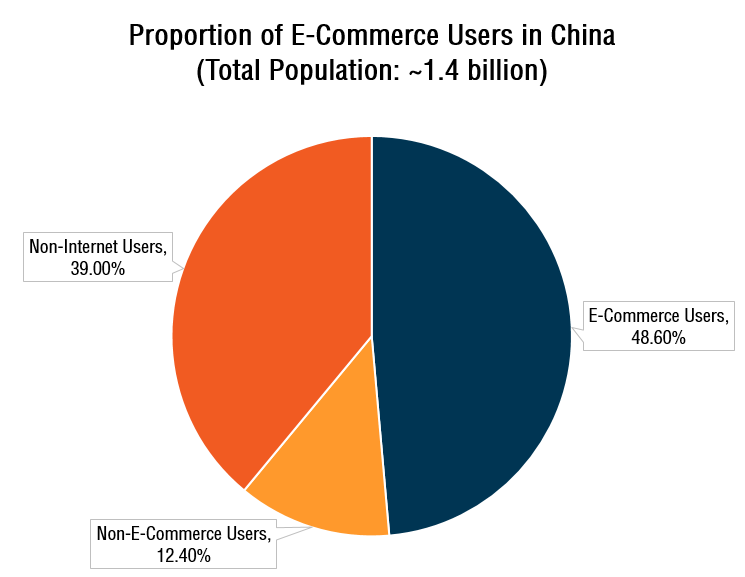

- With three times more Internet users than in the US, China’s e-commerce market is the largest in the world.

- However, e-commerce penetration in China is still hovering around 50%. This implies room for further growth.

- China’s population, online infrastructure, mobile usage and mass adoption of super-apps form a unique ecosystem well suited for e-commerce to thrive.

- Companies mentioned include Alibaba, JD.com and Pinduoduo.

- Investors can gain exposure to the country’s Internet, consumer discretionary and e-commerce sectors via ETFs like KWEB, KBUY, 2806.HK and 2812.HK.

Introduction

The world’s first e-commerce transaction was made in 1994 with the help of encryption technology.1 This historic event paved the way for the use of the Internet for the transactions of all sorts of goods and services.

Suffice to say, the industry has grown by leaps and bounds ever since. It has spawned conglomerates like Amazon (NASDAQ: AMZN) and Alibaba (NYSE: BABA), which have altered the face of the retail industry.

Today, online shopping is one of the most popular pursuits worldwide. Online retail sales are estimated to grow to US$6.54tr in 2022.2 COVID-19 has simply hastened e-commerce adoption, with US e-commerce sales surging 49% in April 2020 (after stay-at-home orders were effected).3

With three times more Internet users than in the US, China’s e-commerce market is the largest in the world. Its online sales amounted to US$1.94tr in 2019,4 up 27% year-on-year. The figure comprised 25% of the country’s total retail sales.

The middle kingdom’s suite of innovative digital applications – together with its strict censorship laws – have created a complex, massive and highly competitive e-commerce environment.

Even then, e-commerce penetration in China is still fluctuating at around the 50% mark – compared to US’s penetration rate of 77.2%.5 This signifies huge growth potential for China’s e-commerce industry in the future.

Structural Trends in China’s Internet Industry

Recall that in 2019, we discussed structural trends that allowed China Internet companies to rise to prominence. [“Rise of the China Internet Dragons”]

We highlighted that the exponential growth of these tech giants could be attributed to the following:

1. Rapid urbanisation

2. Ballooning middle and affluent classes

3. Ubiquity of smartphones and Internet infrastructure

Without stopping, technological advancements have enhanced Internet accessibility in China and expanded its Internet user base. Together with its population’s rising disposable income, condition remain ripe for China’s e-commerce sector to flourish.

China’s Tiered City System

China has 613 cities and they are classified into four tiers.6 The tier system effectively segments China’s population into different income groups and consumer behaviours, based on their geographical locations. This allows e-commerce companies to fine-tune their strategies to accommodate local demographics.

| Higher-Tier Cities | Lower-Tier Cities | |||

| Tier 1 | Tier 2 | Tier 3 | Tier 4 | |

| GDP | Over US$300bn | Between US$299bn and US$68bn | Between US$67bn and US$18bn | Below US$17bn |

| Politics | Directly controlled by central government | Provincial capital cities and sub-provincial capital cities | Prefecture capital cities | Country-level cities |

| Population | More than 15mn | Between 3mn and 15mn | Between 150,000 and 3mn | Less than 150,000 |

In China’s top-tier cities, e-commerce penetration is reaching saturation point. Around 89% of their Internet users are already online shoppers.7 Thus, companies’ emphasis in these cities is to increase order frequencies and average order values from existing shoppers to expand their revenue.

Take for example JD.com (NASDAQ: JD). It is the second largest e-commerce player in China with a fairly stable 20% market share. JD.com targets higher-tier cities with its high-quality services.8 To encourage repeat purchases and sales of higher-value merchandise to China’s affluent urbanites, JD.com has moved to fulfilling deliveries within 24 hours. It uses robots, artificial intelligence and other technologies in its logistics network to achieve this value proposition.

Nonetheless, significant growth opportunities remain in China’s lower-tier cities. Consumers in these cities are outspending their counterparts in top-tier cities despite having an e-commerce penetration rate of only 62% in 2017.

| Higher-Tier Cities | Lower-Tier Cities | |

| Share of National Gross Merchandise Value (GMV) | 49.9% | 50.1% |

| E-Commerce Penetration | 89% | 62% |

| Online Shopper Base | 183mn | 257mn |

| Online Shopper Growth | 43% | 61% |

In China’s lower-tier cities, price advantage is the main differentiator. This is because consumers here are highly sensitive to prices, given their lower income level.

Pinduoduo (NASDAQ: PDD) is China’s fastest growing e-commerce company, thanks to its cost leadership strategy. Since its launch in 2015, Pinduoduo has been focusing on smaller Chinese cities by offering the best deals on its platform. Its market share reached around 7.3%10 in 2020.

On its group-buying platform, groups of shoppers interested in the same products can team up to buy in bulk. This entitles to bulk discounts of as steep as 90%.

Pinduoduo is also China’s largest online seller of agricultural products. Its A.I.-powered Duoduo Farm helps farmers in impoverished counties sell online and improve their productivity.

One App to Rule It All: China’ Unique Super Apps

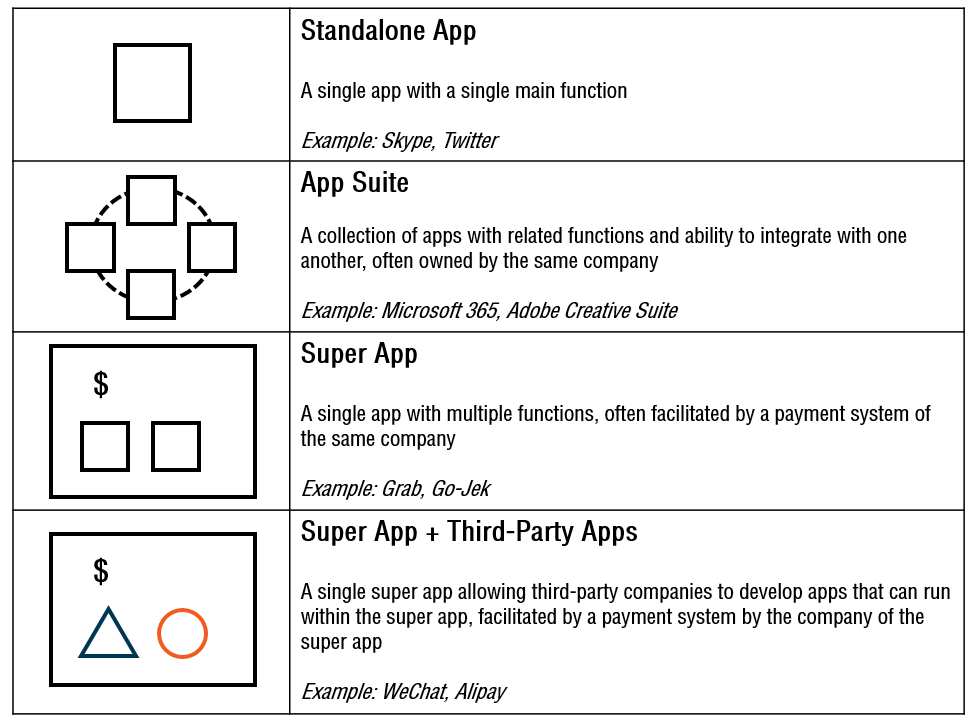

While most of us use dedicated mobile apps for specific tasks, mobile users in China are already accomplishing multiple unrelated functions with a single super app. Tencent Holding’s WeChat (HKEx: 0700) and Ant Financial’s Alipay are two examples of super apps.

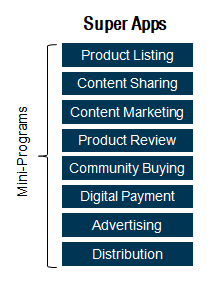

The super apps allow third-party companies to create apps within the super apps, giving users access to multifarious services without the need to download separate apps or leave the super apps. These “apps within an app” or “Mini-Programs” ensure utmost convenience for super apps users.11

Therefore, super apps simplify all aspects of transaction, from discovery to payment and fulfilment. Transaction costs are minimised and online shopping becomes virtually effortless.

WeChat, for one, has launched a shopping function that permits users to shop on JD.com via its search box and “Discover” tab. The strategic partnership between JD.com and Tencent lowers the search cost by expediting the product search and recommendation process for its users. In turn, the feature allows both companies to compete more effectively against Alibaba by utilising each other’s competitive advantages.13

Social Commerce

Super apps are also an important catalyst of growth in China’s social commerce industry. They provide a solid foundation for the integration of social media and e-commerce. It is estimated that China’s social commerce market will reach RMB2,419.4bn in 2022.14

Social commerce refers to the use of social-media platforms such as Facebook, Instagram and Twitter to promote and sell products and services.

Social media is an essential part of Chinese consumers’ lives. With 34% of all data traffic in China coming from WeChat and users spending an average of 66 minutes daily on WeChat, social media is one of the most important platforms for businesses in China.15

The Chinese super apps enable the verticalisation of businesses and provide opportunities for cross-ecosystem partnerships via their “Mini-Programs”.

To illustrate, WeChat is not only a platform for consumers to look for product information and share experience. It is also a popular marketplace for consumers. Through WeChat, Pinduoduo is able to introduce live streaming by Key Opinion Leaders (KOL) in a bid to boost growth with the use of content marketing.16

The growth of social commerce has transformed the landscape of China’s e-commerce sector. These can range from the way consumers shop to how brands market and sell their products. Social commerce is set to proliferate in super apps over the next few years and become a mainstream sales channel where content and commerce are perfectly fused.

Mobile First and Digital Payment

In 2017, Chinese consumers accounted for 1.1bn mobile Internet subscriptions, more than 2.5 times the number in the US.17 Just last year, around 99.3% of Internet users in China accessed the Internet with their smartphones.18

The ubiquity of low-cost smartphones and network infrastructures have given Chinese consumers the capacity of using their mobile devices to interact with brands and buy things at their convenience.

More importantly, their extensive smartphone usage has opened doors to a digital payment revolution in China. Alibaba and Tencent pioneered digital payment and helped shift the country into a cashless economy.

Digital payment apps serve as an entry point to a vast universe of online and offline goods and services. With a centralised digital payment system, stumbling blocks of online transactions such as a lack of trust, security issues and complex processes are resolved.

Today, Alipay and WeChat Pay dominate China’s digital payment sector with a 90-95% market share. The mobile payment industry in China is worth an estimated US$27tr.19

Exchange Traded Funds

There are various thematic Exchange Traded Funds that provide investors with diversified exposure to China’s Internet and e-commerce industries. These ETFs are convenient and low-cost vehicles for investors to invest top-down by theme. The ETFs identify those companies which are expected to benefit from China’s prospering e-commerce sector and ballooning middle class.

| ETF | KraneShares CSI China Internet ETF | KraneShares CICC China Consumers Leaders Index ETF | Global X China Consumer Brand ETF | Samsung CSI China Internet Dragon ETF |

| Ticker | KWEB | KBUY | 2806 (HK$)9806 (US$) | 2812 (HK$)9812 (US$) |

| Exchange | NYSE Arca | NYSE Arca | HKEx | HKEx |

| AUM | US$3.67bn | US$7.3mn | HK$958.08mn | HK$287.96mn |

| Expense Ratio | 0.73% | 0.69% | 0.68% | 1.50% |

| Number of Holdings | 44 | 30 | 29 | 31 |

| Top 3 Holdings |

|

|

|

|

ETF information accurate as of 11 January 2021.

Not Late to the Game

China’s large and diverse population continues to offer growth opportunities for its e-commerce sector. A growing middle class in its higher-tier cities and burgeoning e-commerce user base in its lower-tier cities present different prospects for the various e-commerce platforms.

Furthermore, China’s strict regulation of foreign competitors and continued investments in its IT infrastructure provide a hotbed for its e-commerce companies to grow.

Due to its unique circumstances, China’s e-commerce success via the use of super apps may not be easily replicated in other countries. Although super apps were originally conceived in the West, anti-trust regulation, privacy law and cultural differences prevent the concept from taking off in the US, Europe or other developed nations.20

Hence, China’s population, logistics network, digital infrastructure and the mass adoption of super apps form an environment well suited for online shopping to continue to thrive in the coming years.

Reference:

- 1 https://www.nytimes.com/1994/08/12/business/attention-shoppers-internet-is-open.html

- 2 https://www.statista.com/statistics/379046/worldwide-retail-e-commerce-sales/

- 3 https://techcrunch.com/2020/05/12/us-e-commerce-sales-jump-49-in-april-led-by-online-grocery/

- 4 https://tenbagroup.com/12-china-e-commerce-market-trends-2021/

- 5 https://www.statista.com/statistics/302071/china-penetration-rate-of-online-shopping/

- 6 https://multimedia.scmp.com/2016/cities/

- 7 https://www.tradegecko.com/blog/b2b-ecommerce/ecommerce-in-china

- 8 https://www.globalxetfs.com.hk/research/ecommerce-extension/

- 10 https://supchina.com/2020/08/07/the-biggest-ecommerce-companies-in-china-a-brief-guide/

- 11 https://www.spglobal.com/marketintelligence/en/news-insights/blog/china-leads-rise-of-mobile-super-apps

- 12 https://www.spglobal.com/marketintelligence/en/news-insights/blog/china-leads-rise-of-mobile-super-apps

- 13 https://www.reuters.com/article/us-jd-tencent-hldg-idUSBREA2902T20140310

- 14 https://www.fbicgroup.com/sites/default/files/Social_commerce.pdf

- 15 https://www.thewechatagency.com/essential-wechat-statistics-for-2020/

- 16 https://technode.com/2019/11/28/pinduoduo-may-soon-add-livestreams-to-boost-growth/

- 17 https://www.forbes.com/sites/michelleevans1/2017/04/12/how-china-won-the-race-to-being-considered-a-mobile-first-commerce-nation/?sh=7ad5f4f31b49

- 18 https://www.statista.com/statistics/255552/penetration-rate-of-mobile-internet-users-in-china/

- 19 https://www.kapronasia.com/china-payments-research-category/is-the-alipay-wechat-pay-payments-duopoly-at-an-inflection-point.html

- 20 https://www.techinasia.com/deep-dive-super-app-booming-east-not-west

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Joel Lim

ETF Specialist

Joel is the ETF Specialist from the ETF desk in Phillip Securities. He helps to provide sales support and trading ideas to retail investors, remisiers, in-house dealers, and fund managers. Joel also works closely with ETF issuers on new product and business development projects.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile