Amazon.com Inc. - Margins expansion still the main story

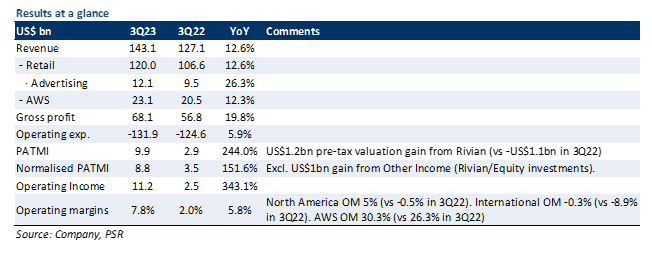

30 Oct 2023- 3Q23 revenue was in line with our expectation, while earnings exceeded. 9M23 revenue/PATMI was at 73%/98% of our FY23e forecasts. Earnings outperformance was due to higher-than-expected gross margins and lower-than-expected operating expenses.

- Operating income more than tripled YoY due to the benefits of network regionalisation in the US, easing inflation, strong advertising growth, and lower headcount. AWS growth has stabilised as the rate of customer cost-optimisation continues to attenuate.

- We maintain a BUY rating with an increased DCF target price of US$190.00 (prev. US$175.00), with a WACC of 6.4% and terminal growth rate of 5%. We increase our FY23e revenue/PATMI forecasts by 2%/31% to account for the higher-than-expected operating leverage.

The Positives

+ Margins continue to improve. Gross and operating margins expanded by ~300bps and ~600bps YoY, respectively. Operating income more than tripled YoY to a record level of US$11.2bn, beating the top-end of US$8.5bn company guidance. The retail business benefitted from the lower cost to serve because of its fulfillment network regionalisation initiative in the US, easing inflationary pressure in line-haul, ocean, and rail shipping rates, as well as the strong 26% YoY growth of its advertising business (7% of revenue). AWS operating margin also expanded by 600bps QoQ and 400bps YoY, back to the level last seen in 2Q22, primarily driven by headcount reductions in the business and lower energy costs.

+ AWS growth stabilised. Segment revenue was up by 12% YoY, in line with management’s guidance of stabilising growth. Despite customer cost-optimisation efforts being relatively elevated compared to 2022, it is starting to meaningfully attenuate as more companies shift their focus towards deploying new workloads. Management expects the rate of such optimisations will continue to ease in the next several quarters. Furthermore, AMZN indicated that it signed several deals with customers that will take effect in 4Q23, including those where existing customers expand their AWS deployments and move away from short-term contracts to commitments ranging between 1-3 years. Hence, we expect growth will start to re-accelerate in the near term.

+ Strong free-cash-flow. Trailing-twelve-months (TTM) FCF was US$21.4bn, tripling QoQ and a US$41bn improvement YoY. This was driven by the increased operating income in both retail and AWS segments, improved leverage on fixed costs and working capital efficiency.

The Negative

– Nil.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

Wells Fargo & Company - NII decline hurt earnings

Wells Fargo & Company - NII decline hurt earnings Bank of America Corporation - Earnings hurt by NII and FICC

Bank of America Corporation - Earnings hurt by NII and FICC CapitaLand Investment Limited - Capital recycling picks up pace

CapitaLand Investment Limited - Capital recycling picks up pace Sheng Siong Group Ltd - Seasonal and base effect bump

Sheng Siong Group Ltd - Seasonal and base effect bump