Amazon Inc. - Retail starting to recover

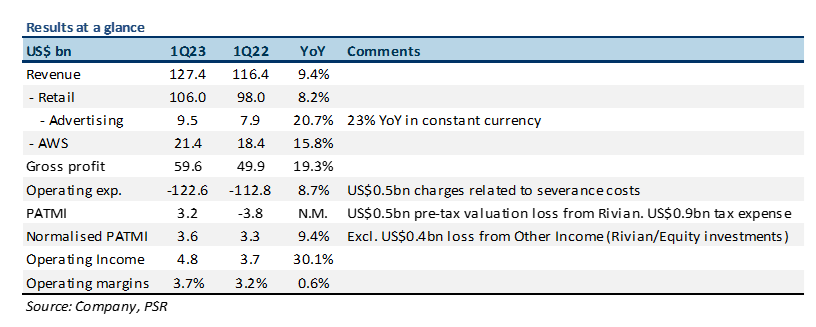

2 May 2023- 1Q23 results were within expectations. 1Q23 revenue/normalized PATMI was at 23%/25% of our FY23e forecasts, excluding a pre-tax valuation loss of US$0.5bn from investment in Rivian Automotive.

- Revenue grew 9.4% YoY, beating top-end of company guidance with margin improvements in North America and International segments. AWS was up 16%, but growth is expected to further decelerate to 11% in 2Q23.

- We maintain our ACCUMULATE recommendation with an increased DCF target price of US$120.00 (prev. US$117.00) using a WACC of 6.4% and g of 5%, taking into account a lower planned CAPEX spending.

The Positives

+ Revenue beats guidance. 1Q23 revenue grew 9.4% YoY (11% in constant currency) to US$127.4bn, above the top end of US$126bn company guidance. International segment revenue increased 1% YoY following negative growth since 4Q21 (-8% YoY in 4Q22 and -6% in 1Q22) as inflation in Europe starts to decline. Advertising revenue grew 21% YoY (23% in constant currency) to US$9.5bn (7.5% of total), reflecting continued strong demand for its advertising services. AWS was up 16% YoY, in line with guidance despite facing cloud spending optimisation efforts by customers.

+ Improvements in margins. Operating income was US$4.8bn, up 30% YoY and slightly above company guidance of US$4bn, as margins expanded by 190 bps QoQ and 60 bps YoY, despite incurring severance-related charges of US$0.5bn. North America segment posted an operating income of US$898mn (1.2% margins vs -2% in 1Q22) after recording losses since 4Q21, while International segment’s negative margins also declined QoQ to -4.3% from -6.5% in 4Q22. These improvements were due to revenue growth outpacing growth in fulfillment and shipping costs as inflationary pressure eases with reduction in shipping rates, fuel, and electricity prices. The margin expansion was partially offset by QoQ contraction in AWS to 24% from 24.3% in 4Q22 as customers opted for lower-tier products.

The Negative

– Further growth deceleration for AWS in 2Q23. AWS YoY growth for April was estimated to be ~5% lower than that of 1Q23 as enterprises continue efforts in optimising their spending and management expects this trend to persist at least through 2Q23, implying a further growth deceleration to ~11%. However, Amazon reiterated that its new customer pipeline remains robust and there is a strong ongoing set of workloads that is migrating to AWS. Management also indicated that its existing customers are extending their expiring contracts and will continue to engage with AWS.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

Wells Fargo & Company - NII decline hurt earnings

Wells Fargo & Company - NII decline hurt earnings Bank of America Corporation - Earnings hurt by NII and FICC

Bank of America Corporation - Earnings hurt by NII and FICC CapitaLand Investment Limited - Capital recycling picks up pace

CapitaLand Investment Limited - Capital recycling picks up pace Sheng Siong Group Ltd - Seasonal and base effect bump

Sheng Siong Group Ltd - Seasonal and base effect bump